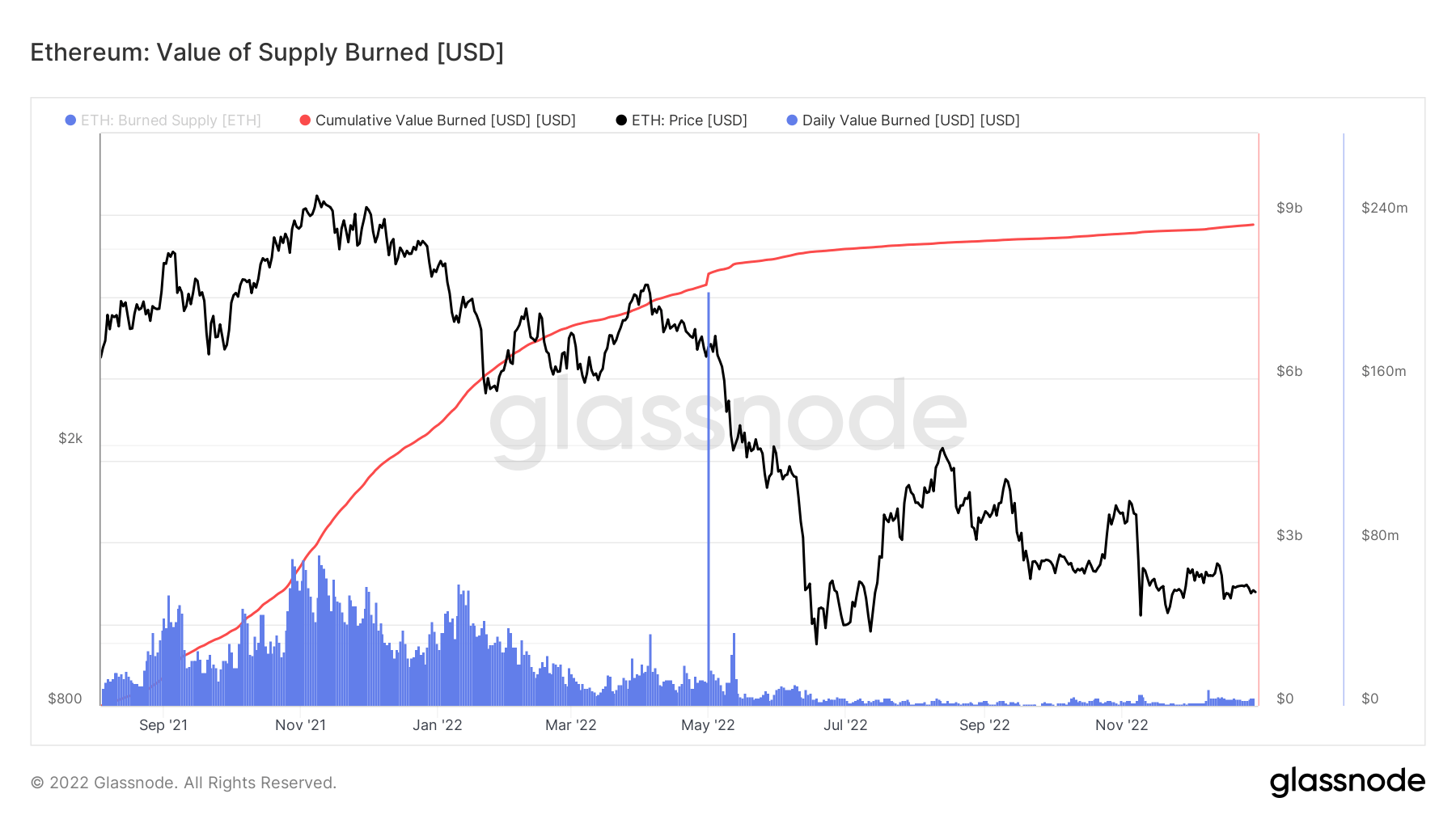

The 2nd biggest cryptocurrency by market cap, Ethereum(ETH), applied a token melt device on Aug. 5, 2021, via the Ethereum Improvement Proposal (EIP) 1559 upgrade. Ever since, virtually $9 billion well worth of symbols have actually been shed cumulatively, information from Glassnode suggests.

An overall of around 2.8 million ETH symbols have actually been gotten rid of from the supply considering that the melt device was set up, according to information from ultrasound.money

In the above graph from Glassnode, blue mirrors the everyday ETH supply melted at the area rate, while red mean the advancing worth of ETH melted in time. An evaluation of the Glassnode information by CryptoSlate recommends that Ethereum’s everyday shed price has actually lowered considerably and also virtually gone stale given that the collapse of Terra-Luna in May 2022.

During the bull run of 2021, $20 million to $75 million well worth of ETH was being ruined daily. This has actually been up to just around $2 million to $4 million well worth of ETH melted daily in December2022 According to ultrasound.money, 1,89630 ETH, worth around $2.2 million was melted over the previous day.

It is to be kept in mind that the loss in the day-to-day shed price of Ethereum is a straight representation of the autumn in Ethereum task in the middle of the present bearish market.

Understanding the importance of ETH shed

Buring of symbols describes sending out symbols to an address where the symbols end up being irretrievable. Referred to as damaging symbols, melting symbols decreases the property’s distributing supply and also agreements total supply over time. The burning device intended to control Ethereum’s gas costs– the costs spent for performing purchases on Ethereum.

Prior to the shed system, Ethereum individuals needed to presume the charges they needed to pay to have their deals consisted of in the blockchain. This created high volatility in Ethereum gas charges, particularly throughout times of high network blockage.

With countless individuals whining concerning high gas charges, the Ethereum network included the token shed device. Based on the EIP 1559 upgrade, customers are called for to pay a base charge and also an idea. This amounts individuals paying a base cost for distribution and also a pointer to shipment execs for supplying on or prior to time. While the network burns all base charges, the pointer is awarded to miners.

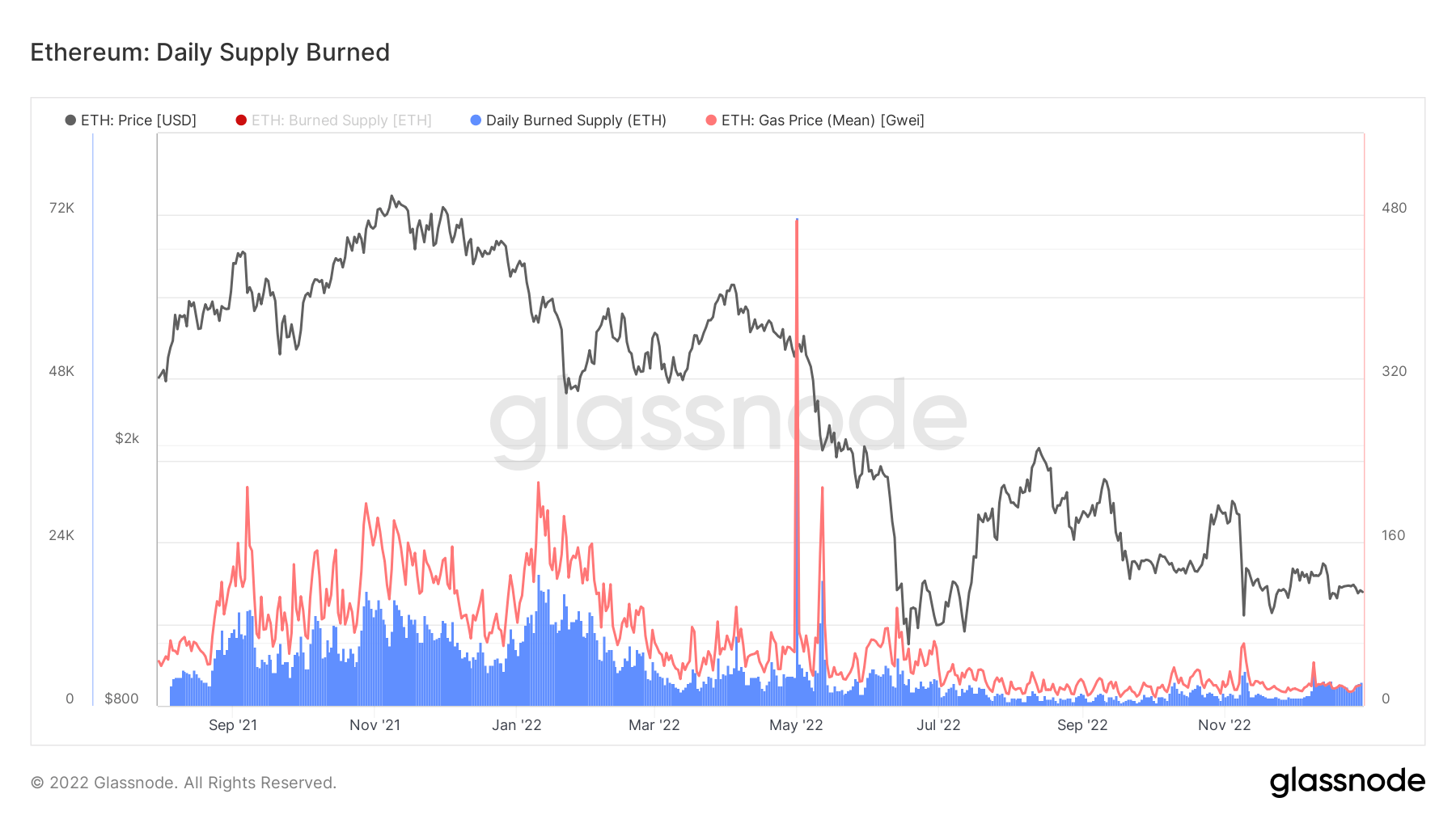

A deep study the everyday ETH supply melted and also gas charges information from Glassnode suggests that the mean gas charge has actually dropped substantially to around 15-20 Gwei from around 100 Gwei before the execution of EIP1559 The ordinary gas charge varied from 100 to 200 Gwei in between January and also April 2021, while it fired up past 200 Gwei throughout network blockage.

In various other words, Ethereum’s ordinary gas costs reduced by about 80% given that the application of the burning device.

The typical Ethereum gas charge was 20.55 Gwei on Dec. 30, according to Etherscan information Information from ultrasound.money suggests that the ordinary Ethereum gas costs stood at 16.2 Gwei over the past 30 days.

In enhancement to managing gas rates, the ETH burning device was presented to place deflationary stress on the token. To put it simply, the melt device lowers the supply of ETH which can trigger the rate of ETH to boost gradually. This is since the cost of any kind of property is impacted by the need as well as supply legislation, which mentions that a decline in supply triggers the rate to enhance.

At the time of composing, Ethereum’s rising cost of living price or its internet issuance price stood at 0.013% annually, based on ultrasound.money information. If Ethereum had actually not switched over to a proof-of-stake (POS) agreement system, its issuance price would certainly have stood at 3.588% annually. With the button to POS, Ethereum’s rising cost of living price has actually dropped much listed below that of Bitcoin(BTC), which provides brand-new coins at the price of 1.716% each year.

As per ultrasound.money quotes, around 1.9 million ETH symbols are anticipated to be shed each year, while just 622,000 ETH symbols are anticipated to be provided yearly.

Ethereum’s cost is presently battling amidst the crypto winter season– ETH was trading at $1,19652 at the time of creating, down 67.88% for the year. With the token shed system, ETH is anticipated to come to be deflationary, which can lead to a rise in its worth in the lengthy term.