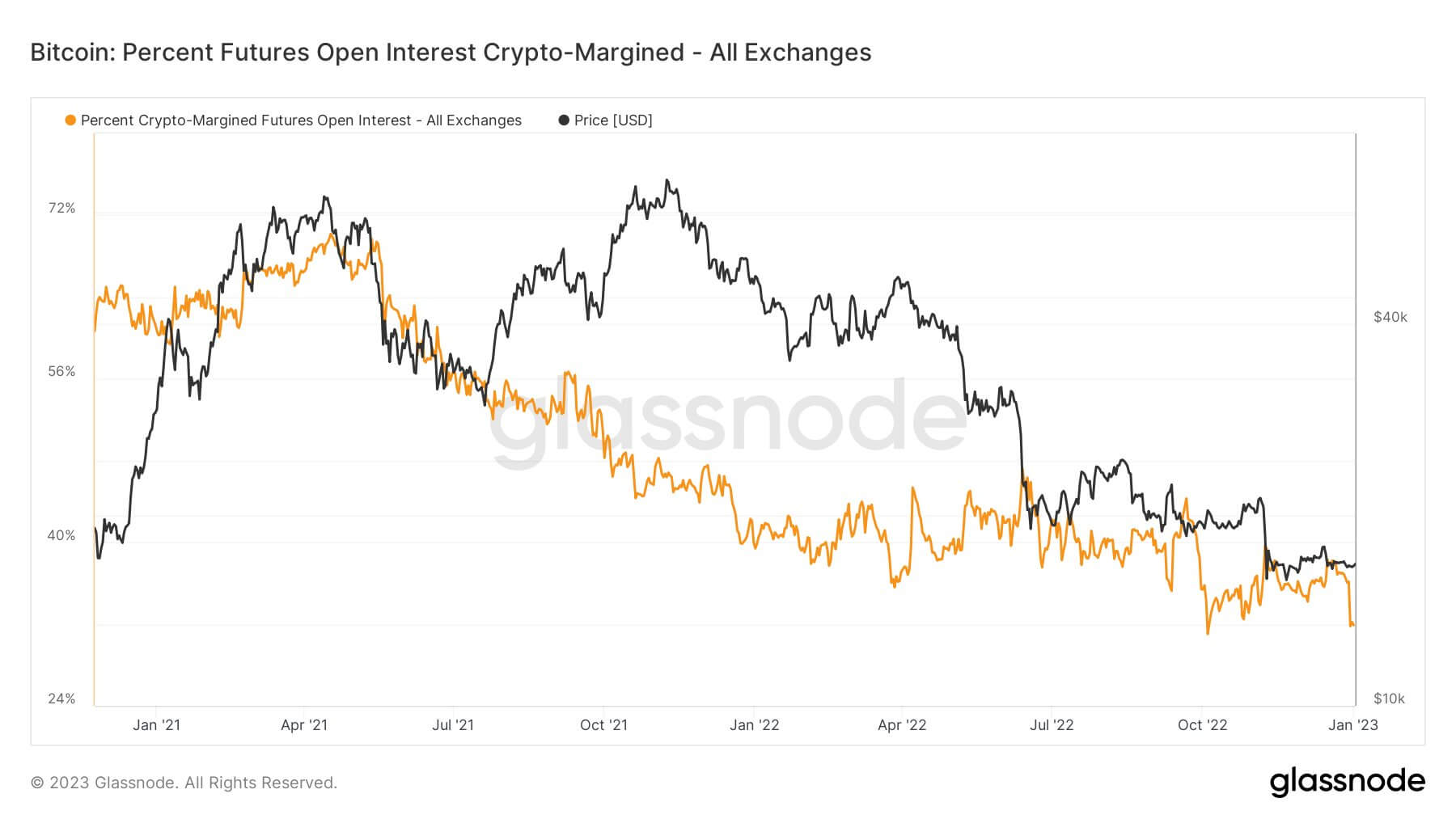

Bitcoin (BTC) started the year risk-off– as seen in the Futures Open Interest (OI) Crypto-Margined statistics presented listed below.

The decrease in BTC Futures OI percent seen from July 2021 right into 2022 depicted a recuperation right into a risk-on story throughout2022 Beginning at practically the most affordable factor in 2 years, threat is coming off the table quick as we start 2023.

Throughout 2021, over 60% of Futures agreements were utilizing BTC as the hidden possession– offering to the risk-on story as BTC is a lot more unpredictable contrasted to a stablecoin.

Meanwhile, in 2022, crypto-backed margin stayed reasonably level in the 35% to 40% array– less than 2021, yet symptomatic of security returning. A 15% modification to the drawback as we start 2023 shows that threat is coming off quickly right into the initial quarter.

Crypto-backed margin likewise dropped in a similar way on 4 previous celebrations:

- In May 2021 adhering to the China restriction on crypto

- Between November and also December 2021 following the all-time high (ATH)

- In April 2022 around the Luna collapse

- In October 2022 with the lead up to the FTX collapse going into a rough Q4 from a macro perspective.

![Bitcoin: Futures Open INterest crypto-Margined [BTC] - Source: Glassnode.com](https://cryptoslate.com/wp-content/uploads/2023/01/crypto-margin.png)

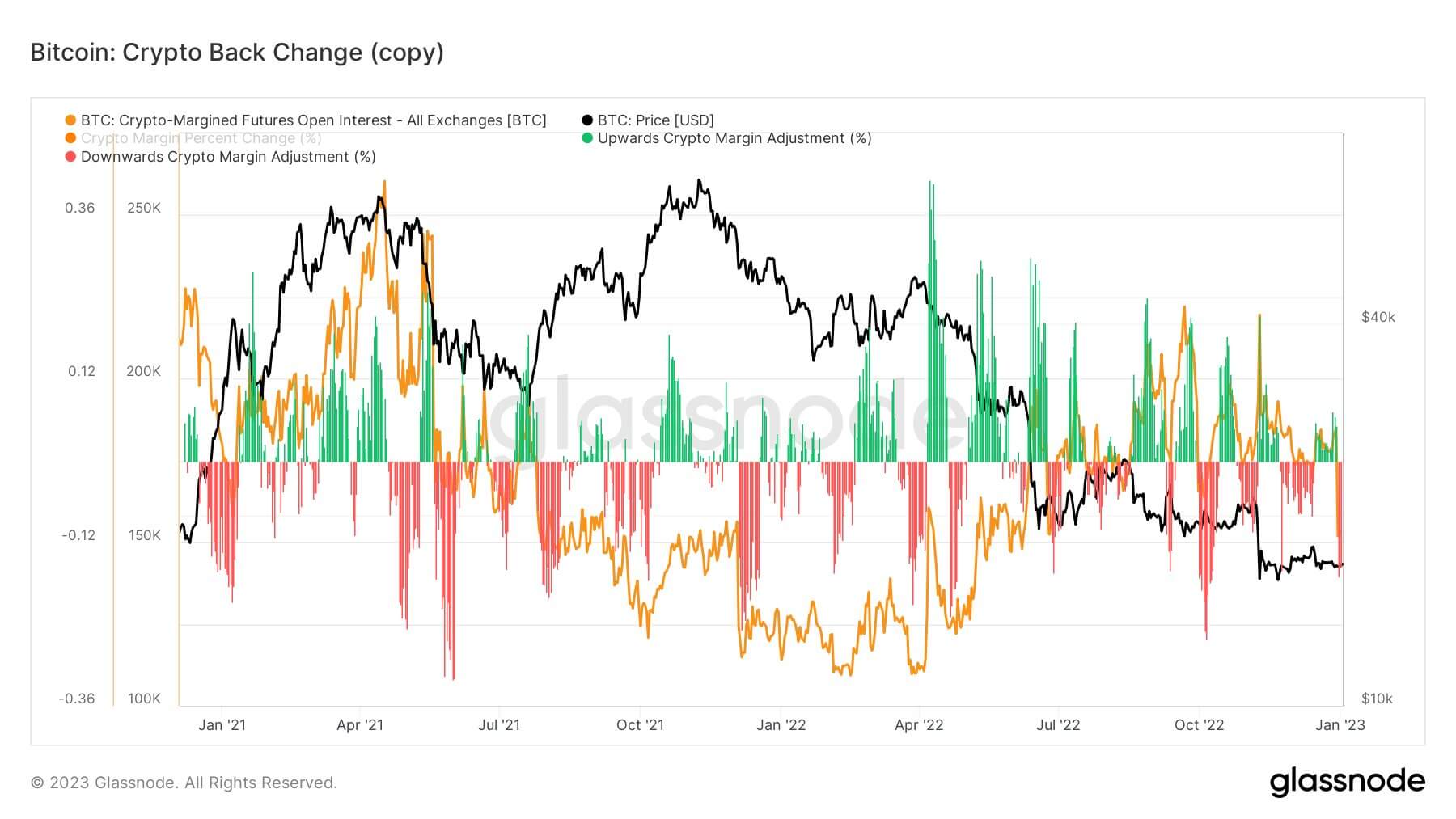

Approximately 150,000 BTC stays in Futures OI– its least expensive degrees considering that April 2022– as the risk-off pattern decrease remains to arise.

To better disclose the unique button far from BTC to risk-off and also cash money, the ‘Cash-Margined’ statistics programs a continuous slope because April 2021 to a present degree of 327,000 BTC– backed by money as the hidden possession.

![Bitcoin: Futures Open Interest Cash-Margined [BTC] - Source: Glassnode](https://cryptoslate.com/wp-content/uploads/2023/01/glassnode-studio_bitcoin-futures-open-interest-cash-margined-btc-all-exchanges.png)

Disclaimer: The degrees presented just stand for exchanges covered in Glassnode information.