Unspent Transaction Outputs (UTXOs) are typically described as the essential foundation of Bitcoin As the Bitcoin network is improved a bookkeeping design based upon unspent results, they can be utilized to gauge the total state as well as development of the network.

Changes in the collective worth worked out via UTXOs, their number, and also the portion of them in revenue or loss can show where the network stands and also where it’s heading.

What are UTXOs?

Put candidly, an unspent purchase result is the quantity of BTC that continues to be after every deal. Every single time a Bitcoin deal happens, existing inputs are erased and also brand-new results are produced. Results that aren’t invested instantly end up being UTXOs linked to the sender.

For instance, if an address with an equilibrium of 1 BTC intends to send out a purchase of 0.4 BTC, the purchase will certainly separate the equilibrium right into 2 different outcomes: the 0.4 BTC paid to the receiver, as well as the 0.6 BTC that’s left. The 0.6 BTC is “unspent,” went back to the sender, and also ends up being a UTXO that can be made use of as an input in later purchases.

Almost all Bitcoin purchases wind up making use of unspent deal outcomes. Just purchases making use of a solitary unified information byte– i.e. deals in increments of numbers– do not produce UTXOs. These deals are uncommon sufficient that they can be overlooked when looking at unspent outcome information.

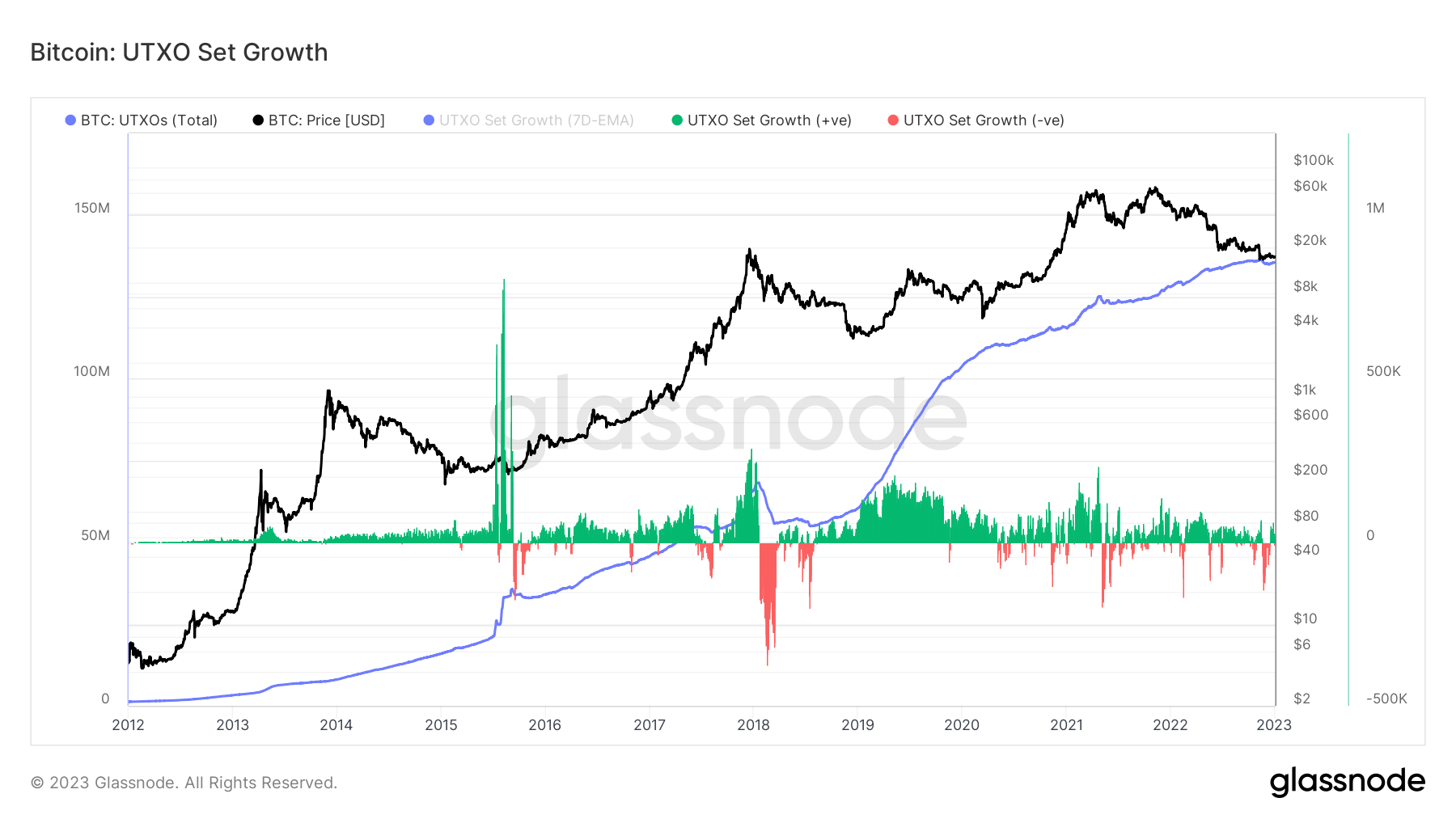

CryptoSlate’s evaluation of Bitcoin UTXOs revealed that there has actually been continual development in the complete variety of UTXOs given that2018 The climbing variety of unspent outcomes resisted every circumstances of cost volatility as well as remains to expand with the recurring bearishness. Favorable development in the UTXO collection shows boosted network use, while adverse worths reveal a tightening in network use.

Data from Glassnode revealed that the overall collection of Bitcoin UTXOs reached its all-time high in the very first days of January, counting over 136 million UTXOs.

The relentless development in the UTXO collection reveals that the network has actually been expanding in spite of the bearish market. Crypto wintertimes have actually traditionally been durations of going stale network development, as affordable price and also unpredictability press several individuals out of the network. On the various other hand, booming market have actually traditionally activated durations of rapid network development, as a rise in speculators drives the total network use up.

UTXOs can likewise aid establish future market energy.

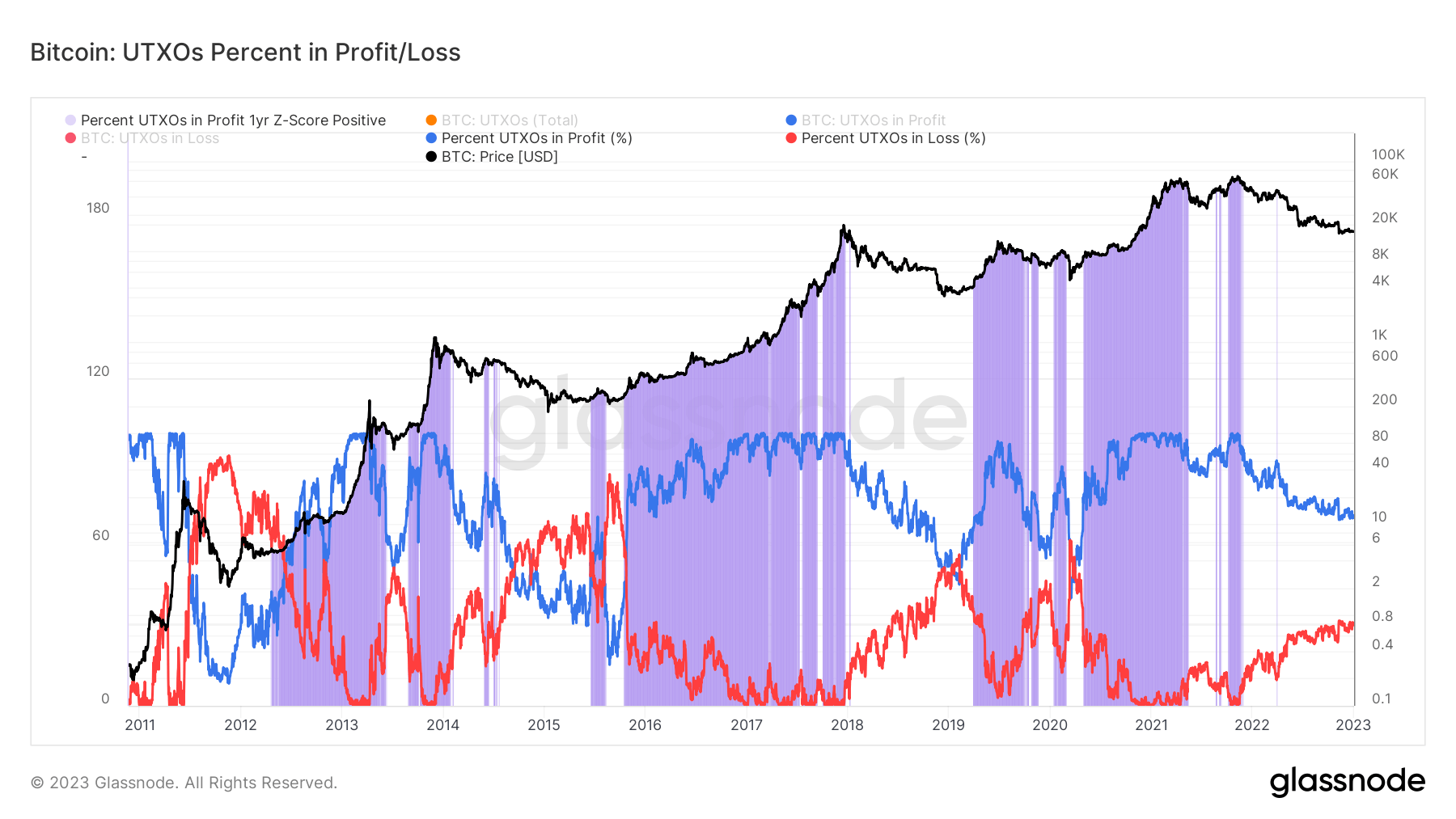

Looking at the rate stamp appointed at the time of the production of each UTXO as well as contrasting it to BTC’s present rate programs which outcomes remain in revenue and also which remain in loss.

As of Jan. 3, around 100 countless UTXOs remain in earnings. This suggests that 70% of all unspent deal results ever before produced have actually negotiated with BTC listed below its present cost. An above-average matter of in-profit outcomes has actually traditionally been connected with favorable market energy

However, it’s still prematurely to inform when the favorable cost activity could take place. The 1-year rolling Z-Score of UTXOs in earnings has actually last declared at the end of 2021, recommending that the bearish market may proceed well right into 2023.