Glassnode information assessed by CryptoSlate revealed considerably higher open rate of interest asks for Bitcoin and also Ethereum.

Calls and also places describe the trading, specifically, of choices. These acquired items offer owners the right, yet not the commitment, to purchase or offer the hidden possession at some future factor for an established rate.

This fixed cost is additionally called the strike cost; together with the place rate, it identifies the choice’s “moneyness.”

Calls, where the strike cost is less than the place rate, are “in the cash,” as investors can purchase the choice for much less than the marketplace cost as well as offer promptly. Places where the strike rate is greater than the area cost are “in the cash,” as investors can market the alternative over the market rate.

Being “out of the cash” happens when phone calls have a strike rate over the marketplace rate or places have a strike cost less than the marketplace rate.

The spread of phone calls as well as places throughout various strike rates offers a basic scale of market belief while additionally offering info on investors’ assumptions for future rates.

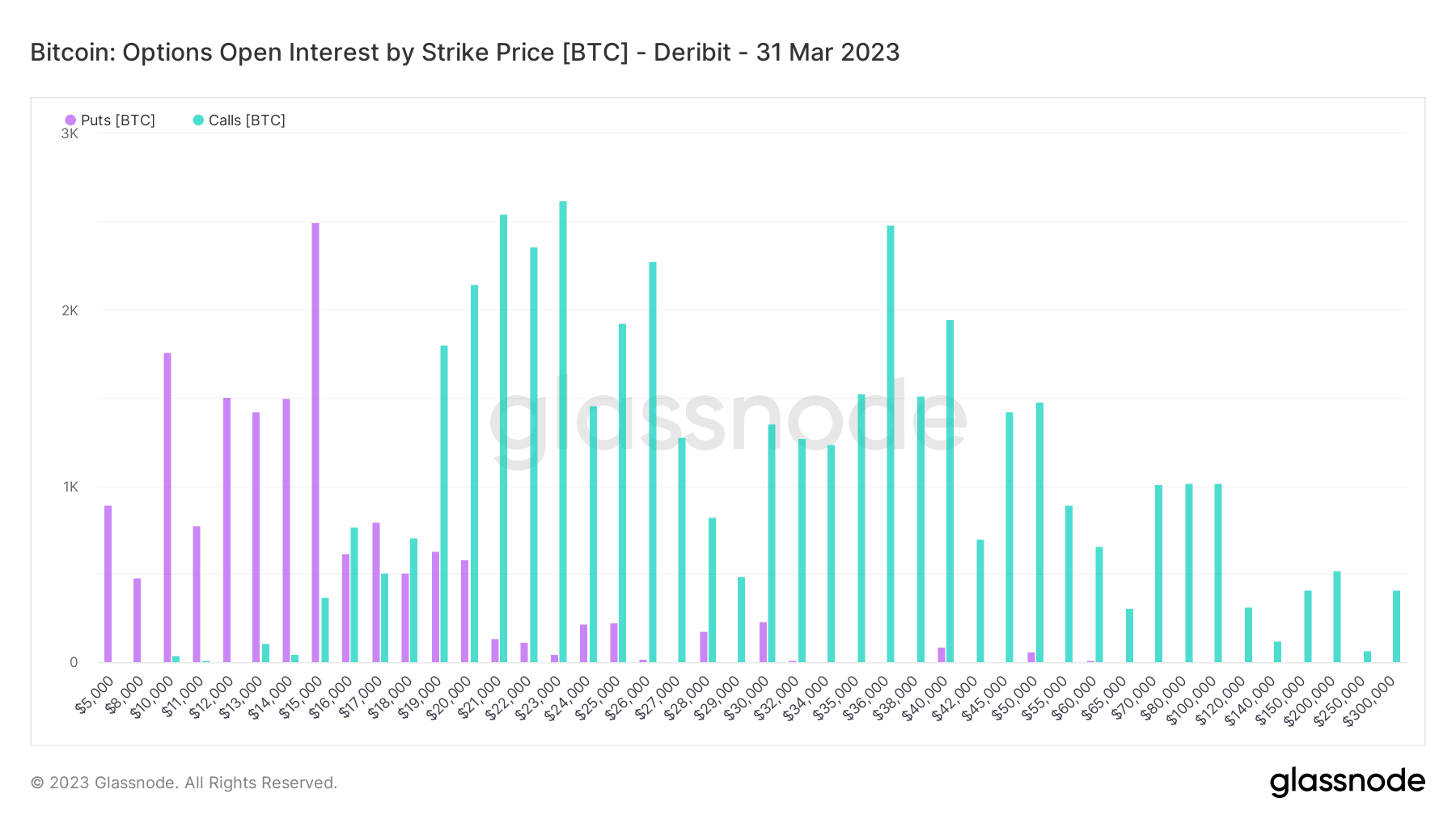

Bitcoin Open Interest

Q1 2023 Bitcoin Open Interest by Strike Price revealed dramatically even more telephone calls than places, recommending increasing favorable belief amongst alternatives investors.

Bitcoin is preferred in the $15,000– $20,000 variety, where the phone calls and also places are roughly also. This is anticipated considered that, considering that the FTX collapse, BTC has actually traded within this basic rate band.

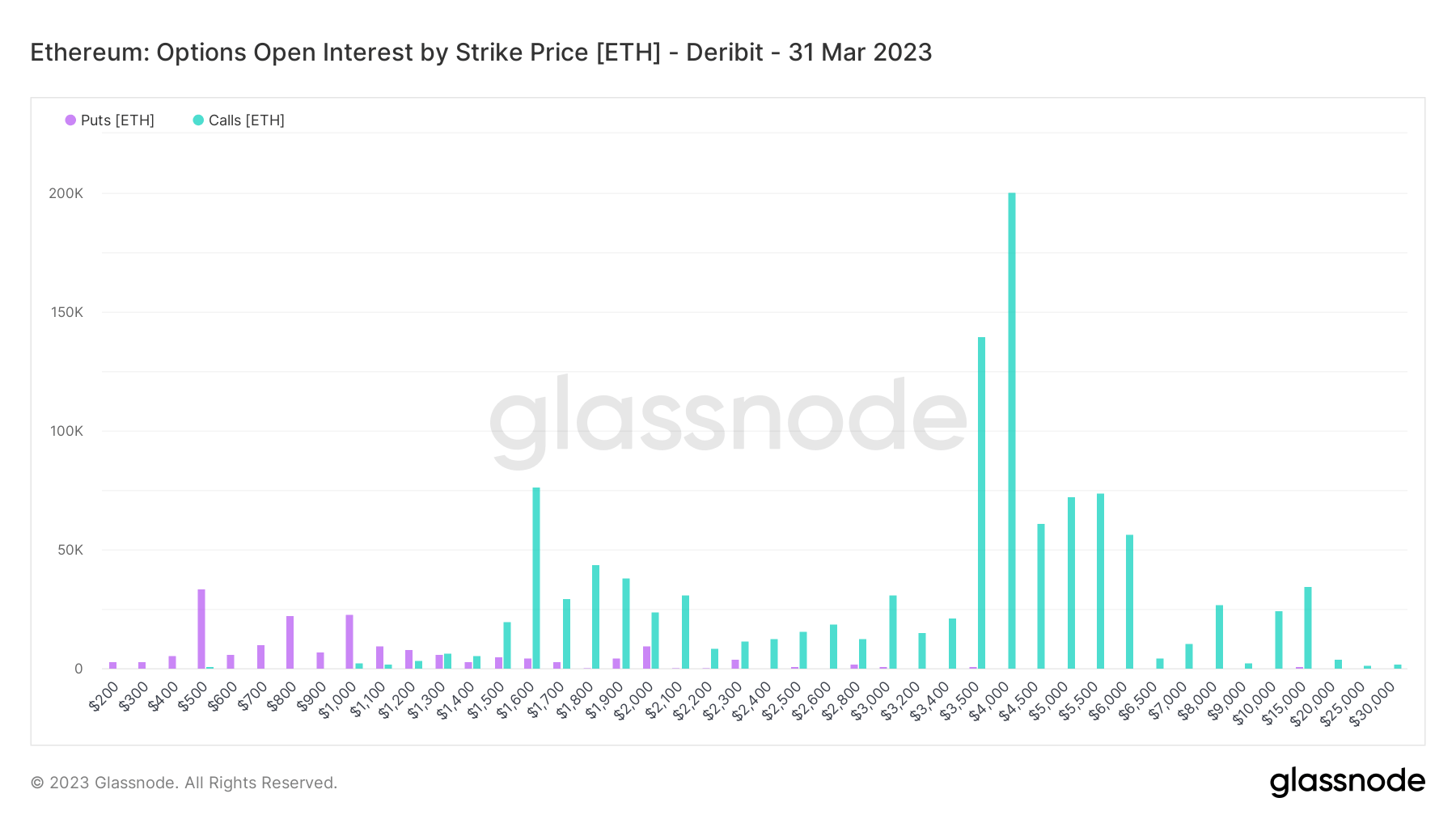

Ethereum Open Interest

Q1 2023 Ethereum Open Interest by Strike Price revealed the unique prominence of phone calls, contributing to the favorable belief story.

Ethereum is normally taken into consideration to have a greater beta than Bitcoin. In a risk-off setting, this might not be the instance.

It was kept in mind that one of the most vital telephone calls were for $3,500 as well as $4,000, at 150,000 as well as 200,000, specifically.

As the very first week of 2023 wanes, unpredictability stays the overriding motif. Additional macro headwinds can include in crypto torpidity, combating choices investors’ assumptions.