The year 2022 noted the beginning of a brand-new crypto winter months, with significant crypto business breaking down as well as electronic money rates plunging, consisting of Bitcoin.

In enhancement, rates of interest rises as well as basic financial negativeness are creating capitalists to stress.

The basics of Bitcoin continue to be solid in spite of every one of these. Let’s have a look at a few of the Bitcoin metrics for the year 2022:

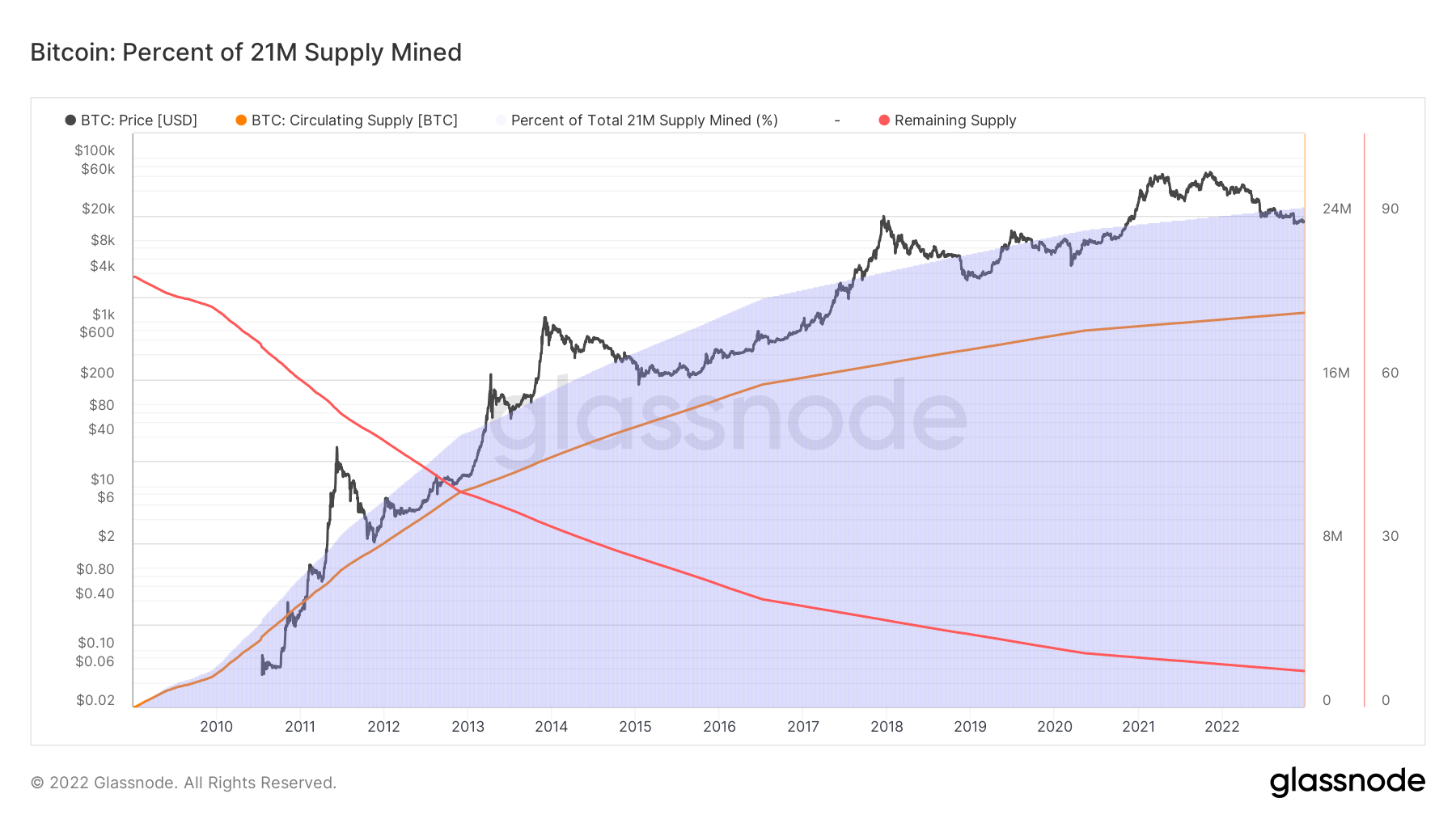

Bitcoin Circulating Supply

The flowing supply of Bitcoin presently stands at 19,257,175– 91.7% of the capped optimum supply of 21 million coins. Currently, there are 1,742,825 delegated be extracted prior to the limitation of 21 million bitcoins is gotten to.

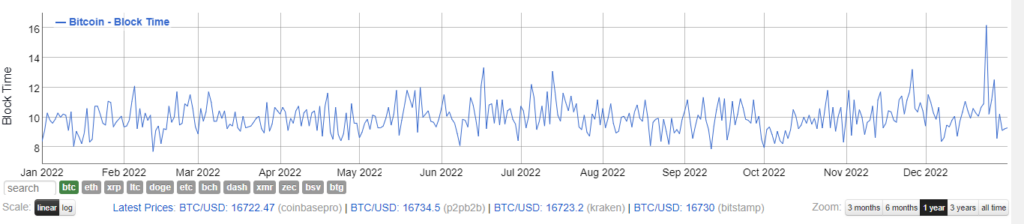

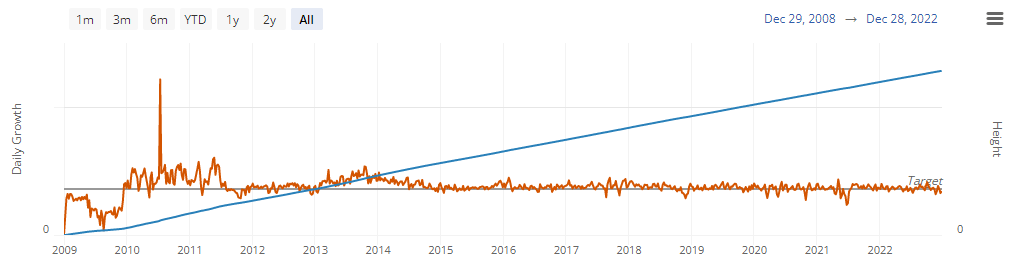

A standard of one bitcoin block is developed every 10 mins, so Bitcoin’s supply is enhancing roughly every 10 mins.

However, regardless of an extreme market recession, consisting of miner capitulation and also compelled liquidation, defi system hacks, Bitcoin has greatly kept regular 10- minute block times IN 2022.

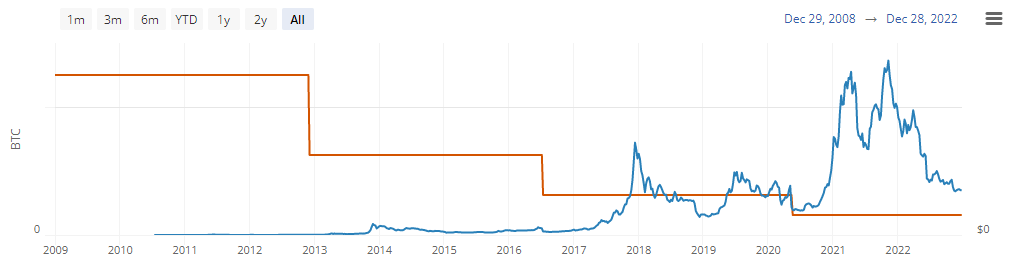

Bitcoin miner’s block incentive

Two elements comprise bitcoin block benefits: freshly produced coins as well as purchase charges. When they effectively confirm blocks on the network, the benefit is provided to miners.

The variety of freshly produced coins is managed by a cutting in half occasion that happens about every 4 years. The Bitcoin cutting in half occasion minimizes the supply of brand-new bitcoins by fifty percent and also intends to make sure that all 21 million bitcoins have actually been extracted.

Despite relocating all their BTC to various addresses, the recently produced Bitcoin presently stands at 900/ day this halving, as well as the benefit for each and every block is $6.3 BTC.

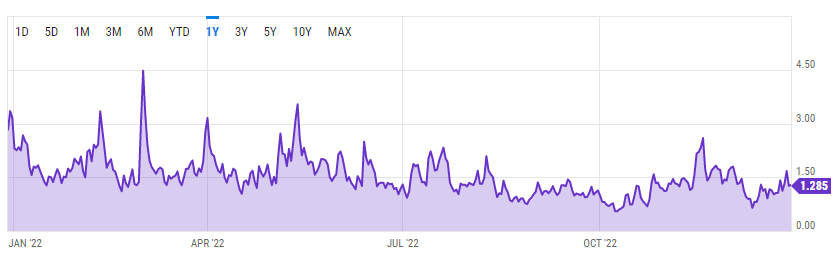

While block benefits are steady as well as foreseeable, deal charges can vary relying on several variables, such as network task as well as purchase dimension.

Bitcoin’s Average Transaction Fee was $0.834 on Dec.31, a reduction from in 2015’s high of 2.829– a modification of 70.5%.

This loss is mainly because of boosting network trouble, hefty computational need, and also bad market efficiency.

Block elevation

The block elevation stood at 573.296 k since December31 The blocks developed daily stayed consistent in spite of the miner’s earnings touching brand-new lows.

Every blockchain contains a collection of consecutive blocks, with the initial block described as the genesis block. The genesis block is thought about to be in block elevation no. As a basic regulation, the blockchain’s complete elevation amounts to the elevation of one of the most current block.

As the block elevation proceeds, Bitcoin still has greater than 99% uptime, presently resting at 99987%

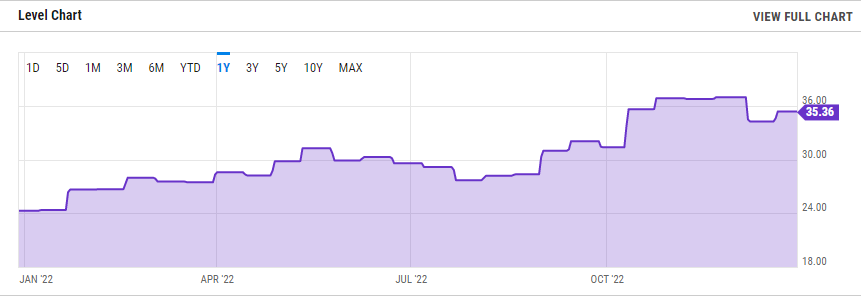

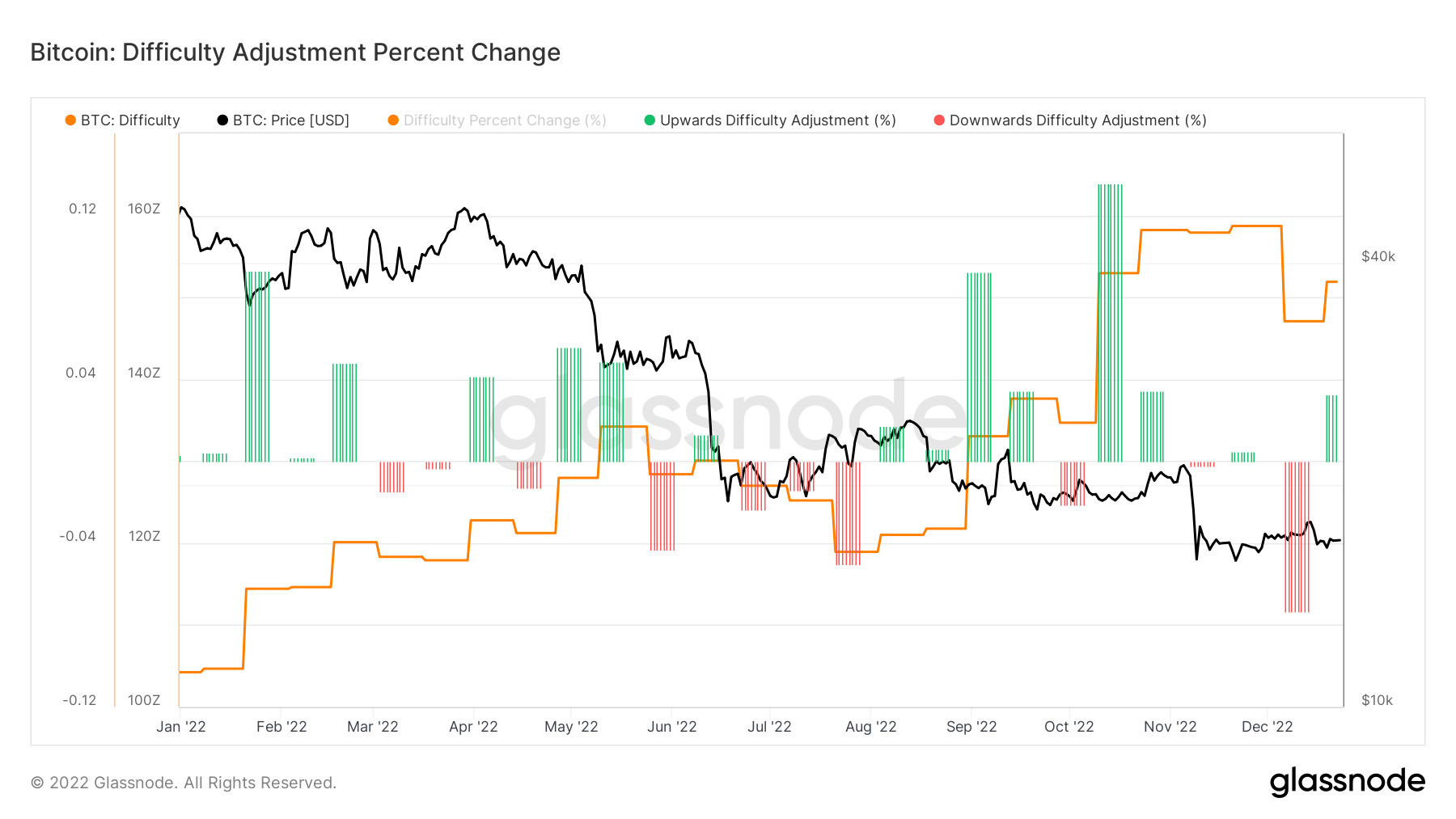

Bitcoin mining trouble

As of December 31, 2022, Bitcoin mining problem stood at 35.36 trillion, up from 24.27 trillion one year back.

This number stands for the quantity of calculating power put on extracting this certain cryptocurrency every 14 days based upon the quantity of hashing power contending for benefits on the network.

A better mining trouble suggests that even more miners are attempting to get this cryptocurrency. Hashing describes the quantity of handling power that PCs make use of to construct the blockchain: the even more blocks of confirmed deals are refined, the even more bitcoin is extracted. Regardless of an unpredictable market as well as a snowstorm last month, mining problem readjusted every 2016 block.

At the time of press, Bitcoin is placed # 1 by market cap as well as the BTC cost is up 0.46% over the past 24 hrs. BTC has a market capitalization of $33391 billion with a 24- hr trading quantity of $1617 billion Learn even more’

Market recap

At the time of press, the worldwide cryptocurrency market is valued at $85528 billion with a 24- hr quantity of $3858 billion Bitcoin supremacy is presently at 3905% Learn even more’