Glassnode information examined by CryptoSlate reveals that the U.S.-based crypto exchange Gemini as well as its stablecoin Gemini Dollar ( GUSD) are beginning to shed fans as well as the neighborhood’s count on as metrics are up to lowest levels.

GUSD owners as well as exchange quantities

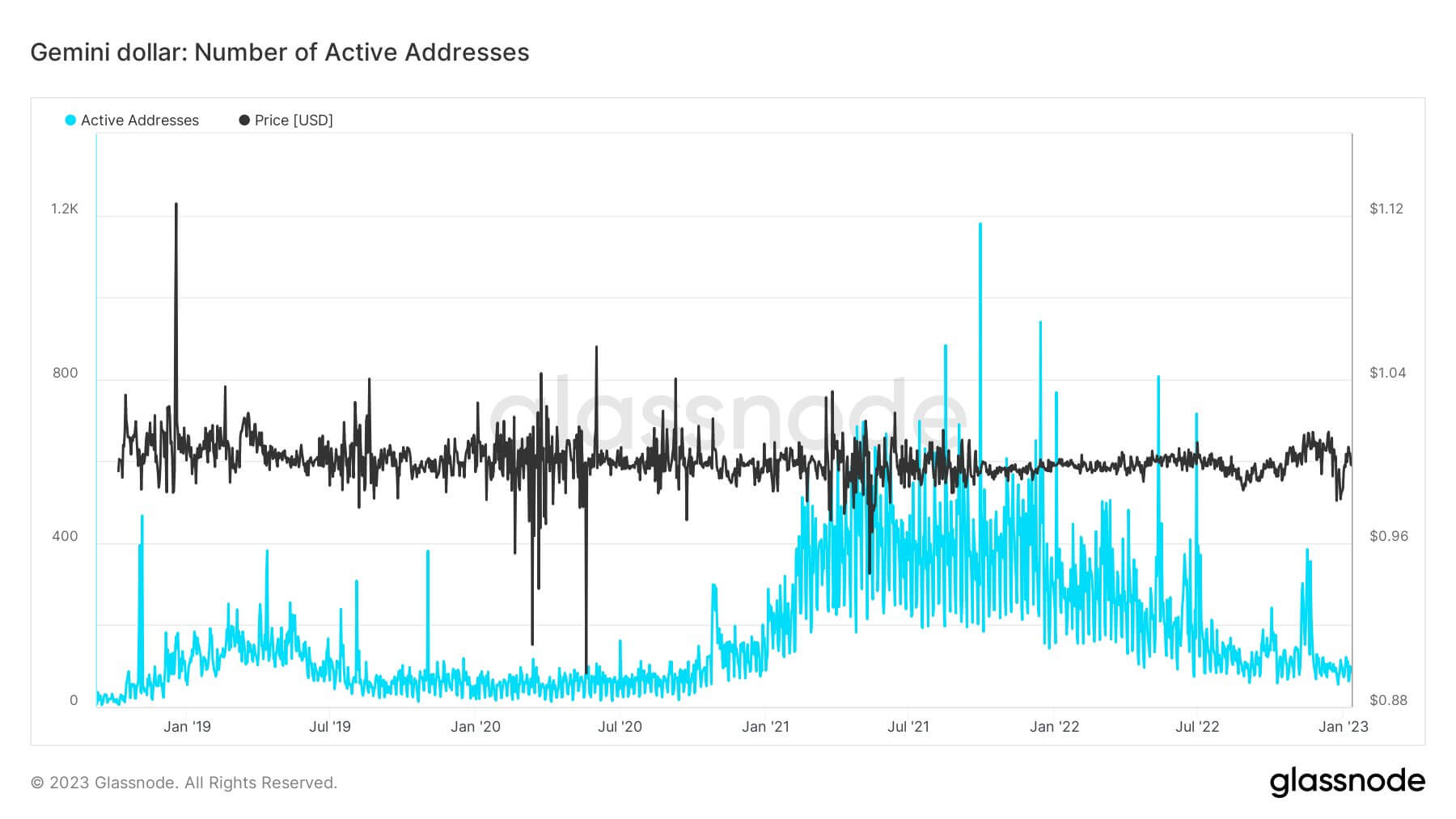

The variety of energetic addresses that hold GUSD has actually dropped back to its 2020 degrees. The graph listed below stands for the energetic budget number given that the start of the year 2019.

The variety of pocketbooks began to enhance at the end of 2020 and also got to nearly 1200 in the direction of completion of2021 Ever since, energetic addresses that hold GUSD dropped by 91.6% as well as pulled away back to 100 in January 2023.

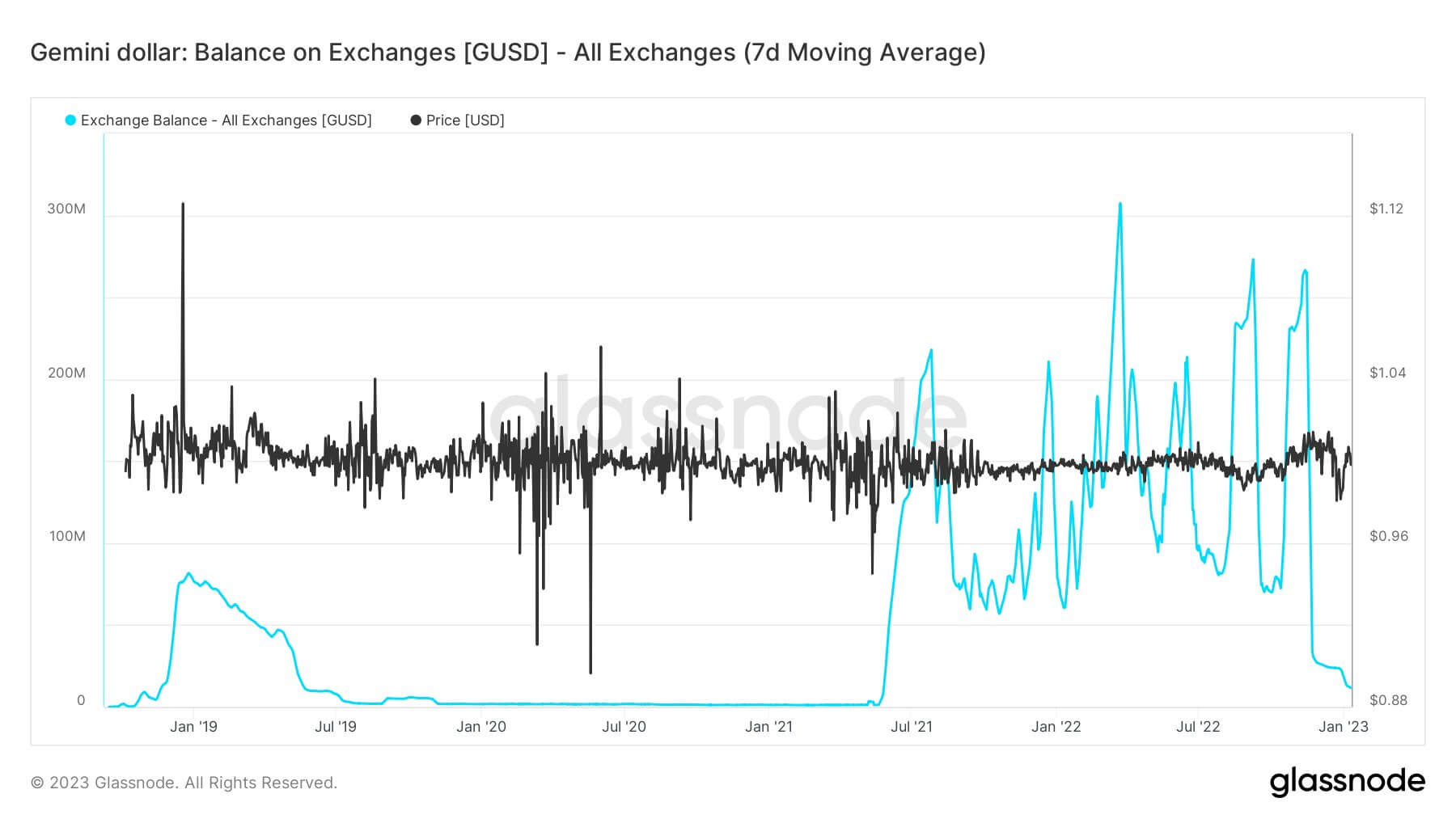

BUSD equilibrium on exchanges likewise tape-recorded a substantial reduction. The graph listed below shows the BUSD equilibrium hung on exchanges given that the start of 2019.

The BUSD quantity on exchanges began to expand greatly in July 2021 and also breached 300 million in May 2022, right before the FTX collapse.

However, the BUSD quantity began to tape-record ups as well as downs after the FTX catastrophe and also lastly videotaped a 96% reduction in January 2023, dropping from around 260 million to simply over 10 million.

What occurred?

The name Gemini has actually gotten on the headings given that the Terra-Luna collapse. As quickly as the winter season market began, Gemini gave up 10% of its team in June 2022, which noted the exchange’s very first discharge choice. In July 2022, Gemini went for the 2nd round of discharges as well as allow 15% of its team go. In both choices, the exchange directed at the marketplace chaos and also duplicated that it needed to handle prices. At the time, nonetheless, most crypto business were giving up team, so Gemini really did not truly stand out.

Gemini Earn

The genuine chain of occasions that harm the neighborhood’s rely on Gemini began on Nov. 16, 2022, when Gemini’s Earn program halted withdrawals as a result of market chaos. Attending to the individuals, the exchange claimed it would certainly attempt to satisfy clients’ withdrawal demands asap.

Gemini Earn is a program that enables private capitalists to offer their crypto possessions to institutional debtors for a specific quantity of passion. To help with these solutions, Gemini partnered with third-party crypto lending institutions, consisting of Genesis, which put on hold withdrawals for its very own clients on Nov. 16, the very same day as Gemini Earn. Genesis stated it is experiencing unusual quantities of withdrawal demands which go beyond the firm’s liquidity. It likewise included that its moms and dad firm, Digital Currency Group(DCG), is likewise doing every little thing in its power to ravel the scenario.

The conversations in between DCG, Genesis, as well as Gemini, consisting of DCG’s CEO Barry Silbert as well as Gemini CEOs Cameron as well as Tyler Winklevoss, have actually been proceeding ever since, and also the stress has actually been climbing up daily. On Dec. 5, Gemini created an ad-hoc board ahead up with a service to the liquidity dilemma.

On Jan. 2, Cameron Winklevoss created an open letter resolved to Silbert and also declared that Gemini Earn’s liquidity dilemma is triggered by Genesis, as well as Genesis is having issues due to the fact that Sibert owes his subsidiary $1.675 billion. Cameron Winklevoss offered Silbert time up until Jan. 8 to offset his financial debt as well as consequently fix Gemini’s liquidity situation. Silbert replied to the open letter right after it was released, claiming that neither he neither DCG has any type of financial obligation to Genesis.

Gemini Earn individuals submitted a course adjudication match versus Genesis as well as DCG on Jan. 3, declaring that Genesis breached its arrangement with Gemini Earn individuals. On Jan. 4, Genesis CEO launched a declaration stating that the company is concentrated on resolving the issue, yet it requires even more time.

The issue continued to be unresolved, as well as Gemini introduced that it is formally ceasing its Earn program on Jan. 11,2023 The exchange included that returning its individuals’ funds is presently the highest possible concern while additionally advising that Genesis was accountable for settling all properties to customers.