Bitcoin (BTC) owners had it hard in 2022, yet it was an also harder year for BTC mining– mining supplies tipped over 80%, as well as extracting business personal bankruptcies strengthened the bearish market– however the most awful of miner capitulation might be over, according to CryptoSlate evaluation.

With BTC rate down 75% from its all-time high (ATH), the hash price also got to an all-time high as miners enhanced initiatives to make sure earnings in the power situation.

BTC Miner capitulation lowering

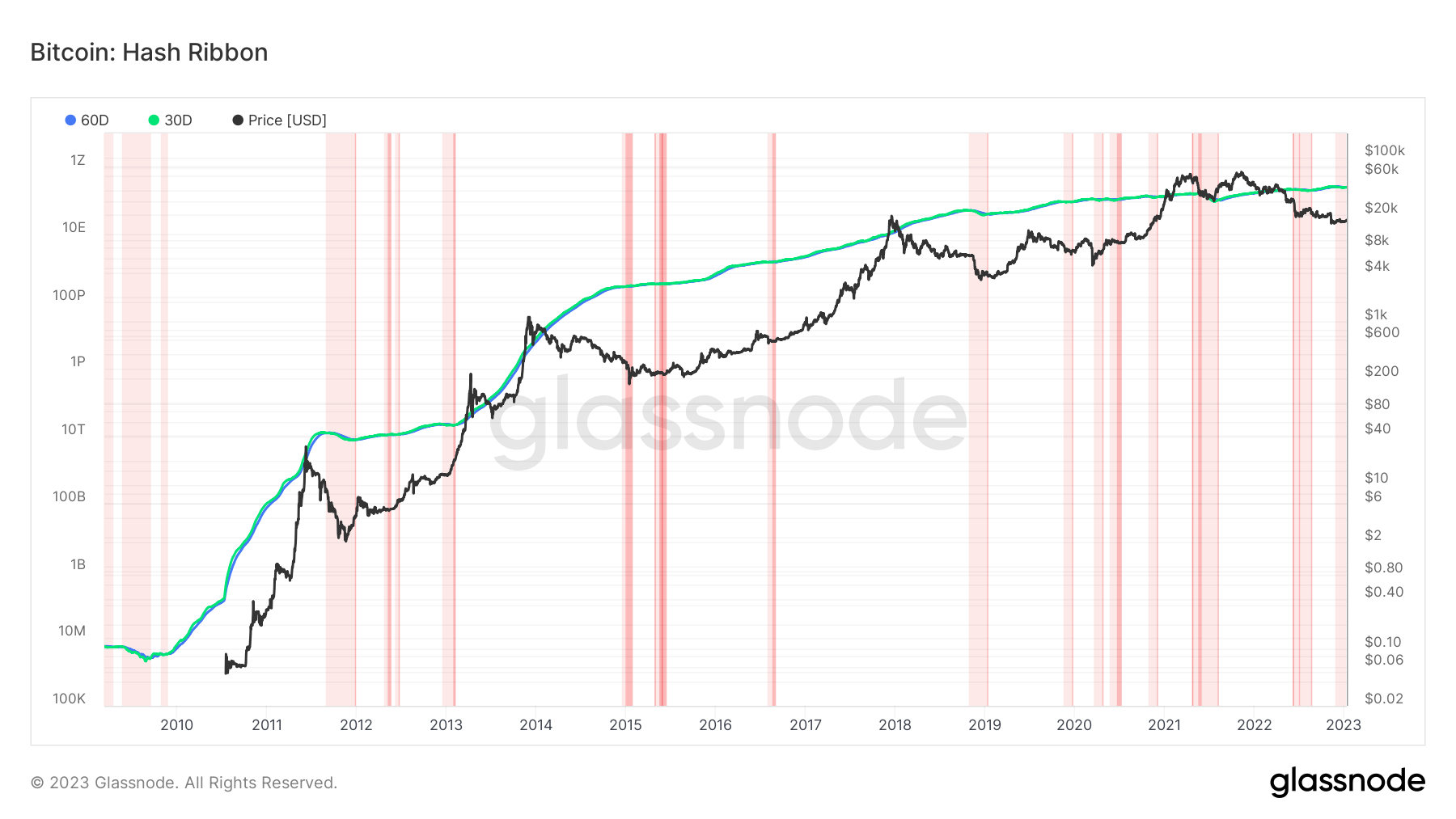

The Hash Ribbon sign graph over suggests that the most awful of miner capitulation mores than when the 30- day relocating standard (MA) goes across the 60- day MA– changing from light-red to dark-red locations.

When this standard change takes place, a button from unfavorable to favorable rate energy is anticipated, which traditionally discloses great purchasing possibilities (changing from dark-red back to white).

It is symptomatic that the most awful of miner capitulation is virtually over as BTC transforms favorable as well as bursts out in the direction of $19,000, according to Glassnode information in the graph over evaluated by CryptoSlate.

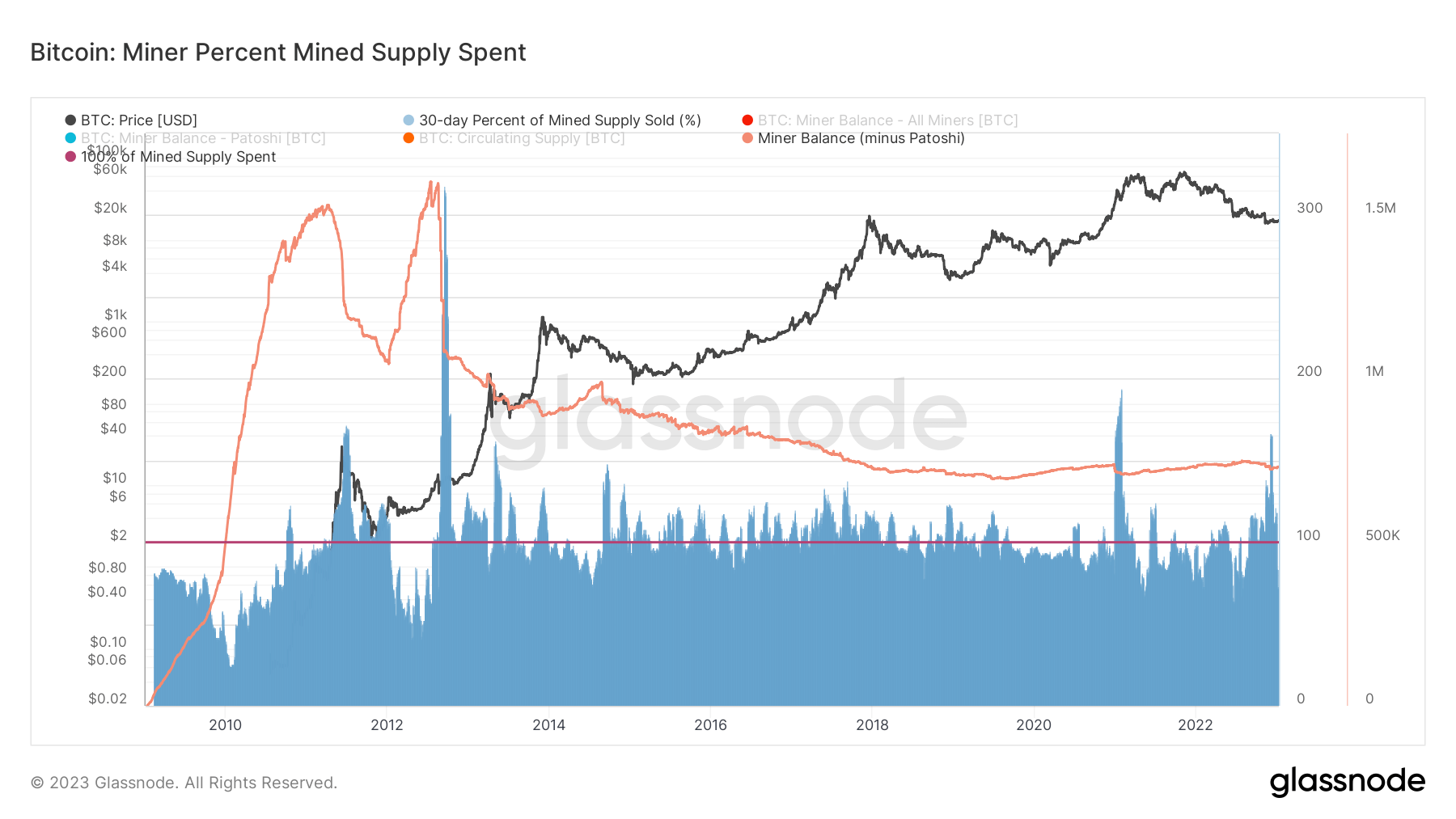

BTC miner supply offer stress easing off

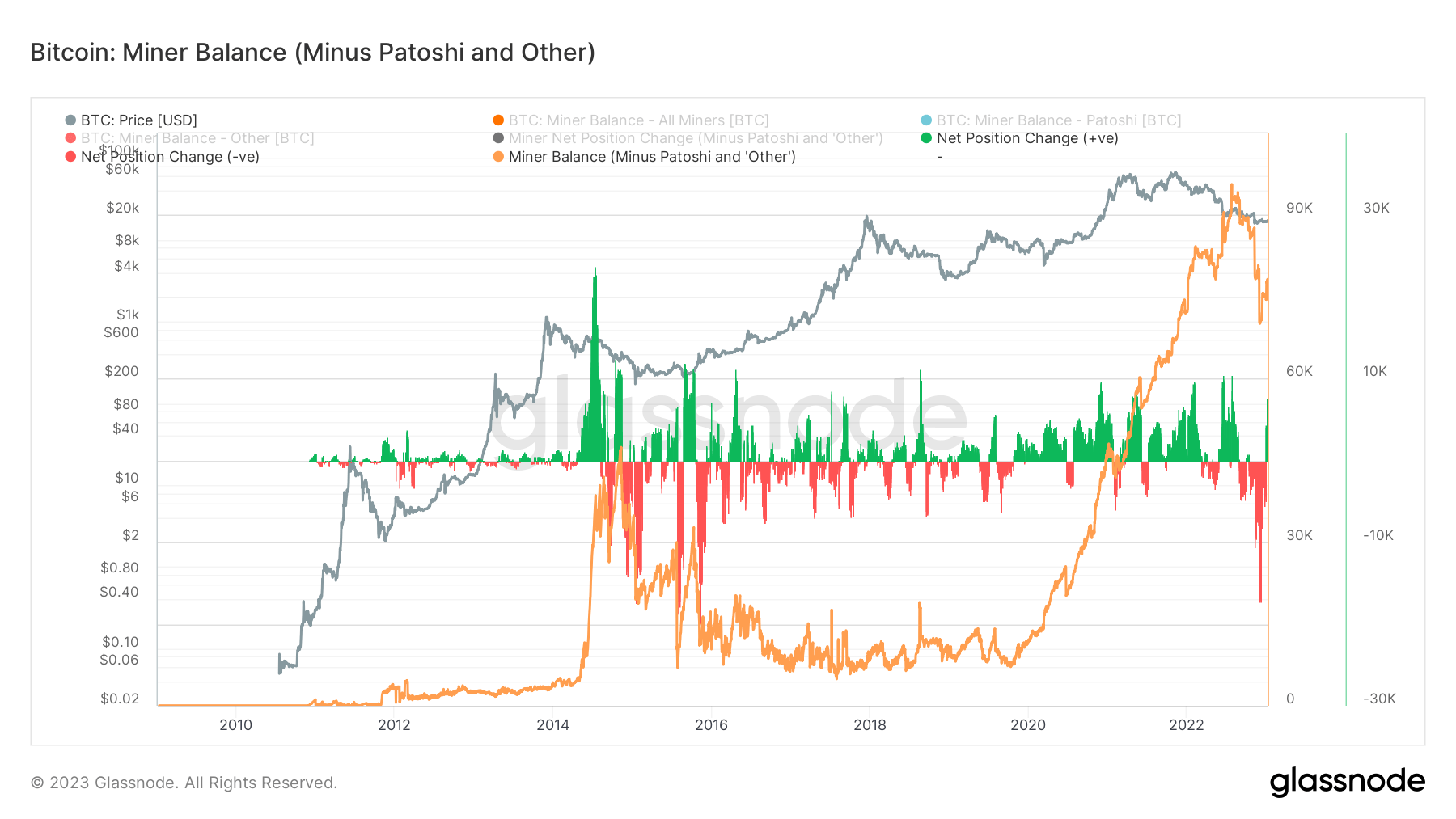

The complete supply of BTC presently kept in miner pocketbooks has actually struck about 1.8 million BTC after a drawdown of approximately 30,000 BTC. This does not straight suggest that the BTC was offered yet could, as a matter of fact, have actually been relocated to one more budget for long-lasting storage space.

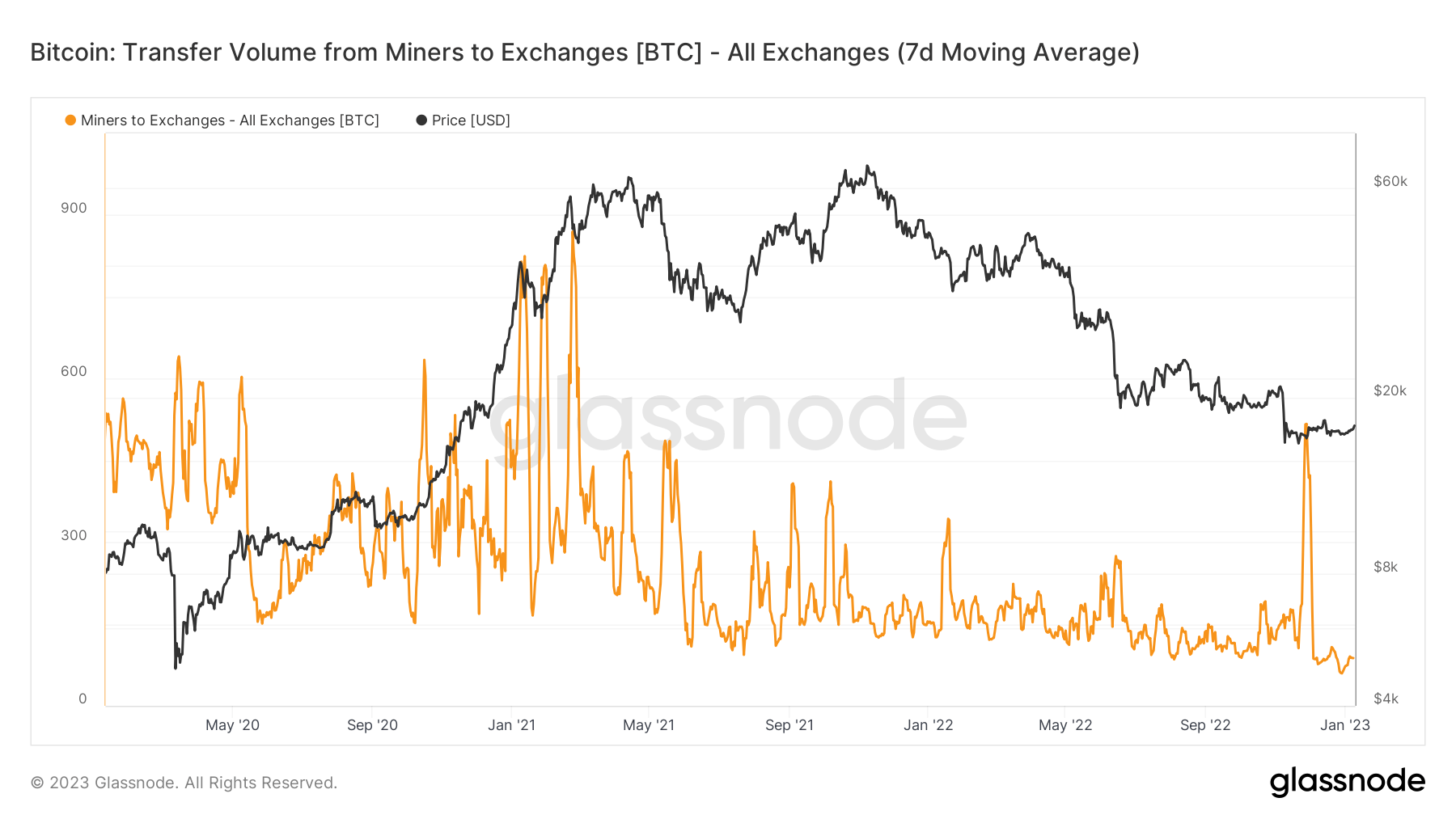

Meanwhile, miner costs has actually dramatically lowered as transfer quantity from miners to exchanges drops considerably, as received the graph below.

Miner market stress has actually reached its least expensive in the last 3 years as much less than 100 BTC is being marketed on a seven-day MA. When contrasted to the ferocious drawdown in 2022– where miners were investing even more BTC than was being extracted– all graphes show marketing stress is readied to switch over to get stress.