Gradually, along with the cryptocurrency sector, stablecoins are expanding in stamina as well as appeal. Their development arises from the security they provide versus cryptocurrency volatility.

At the minute, USDT continues to be the biggest stablecoin by market cap, as USDC, Binance USD, as well as DAI comprise the leading 4.

Prominent stablecoins after FTX collapse

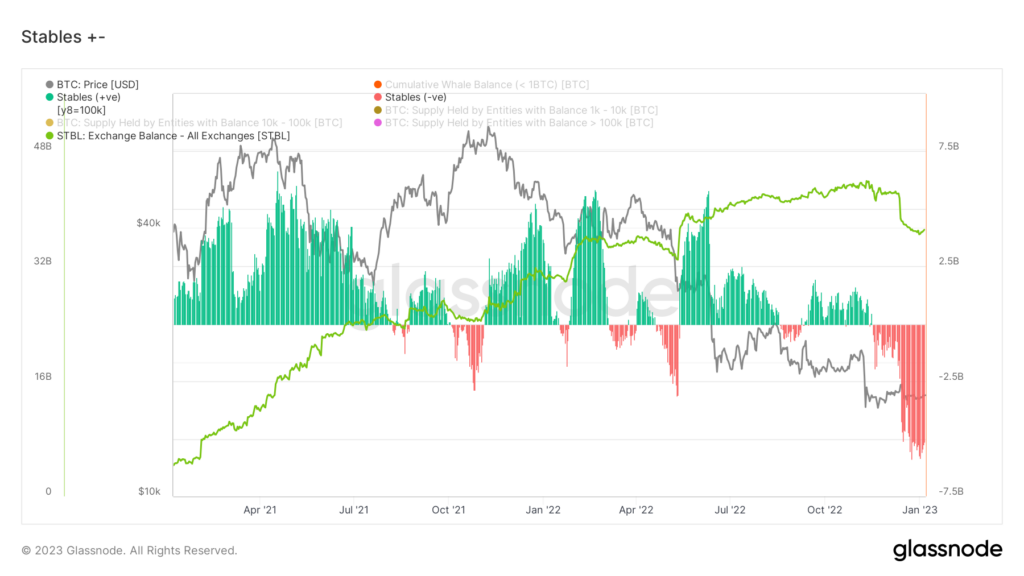

The totality of the stablecoin industry has a market cap of $138 billion, according to CoinMarketCap The large 4 stablecoins add greater than $130 billion to the number, controling the stablecoin market. Regardless of their development and also appeal, just a very little quantity of stablecoins get on cryptocurrency exchanges.

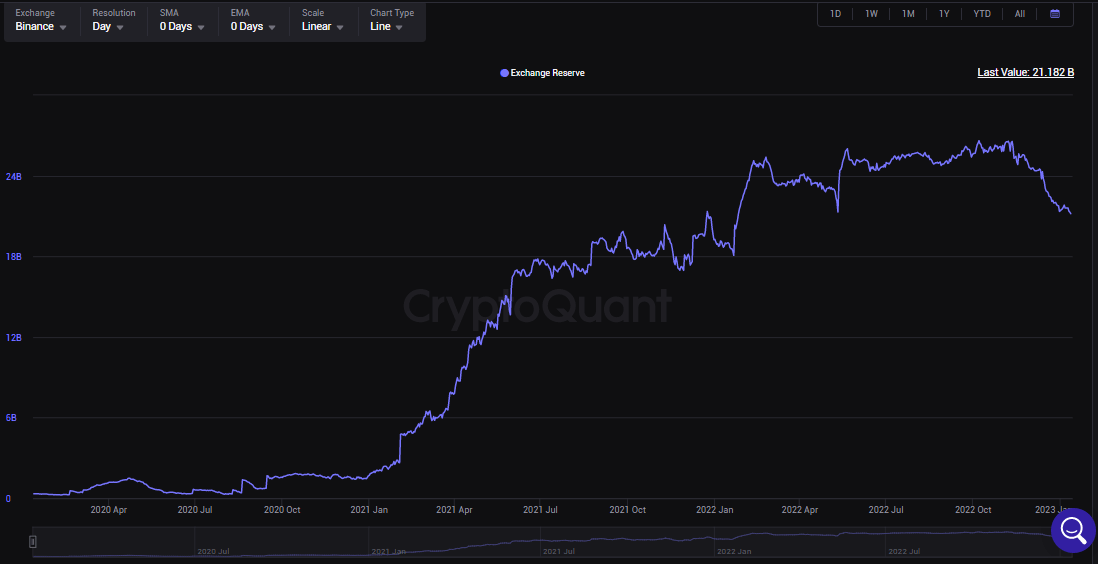

Presently, concerning 37 billion stablecoins are held aside of cryptocurrency exchanges. Binance is the highest possible factor to this number, with around $24 billion in stablecoins in its get. Coinbase has greater than $973 million, Huobi $709 million, Bitfinex $145 million, Gemini 98 million, and also Gate.io $78 million.

Due to market unpredictability and also reduced rely on central exchanges after the collapse of FTX, regarding 3.93 billion stablecoins have actually left exchanges in the last 30 days.

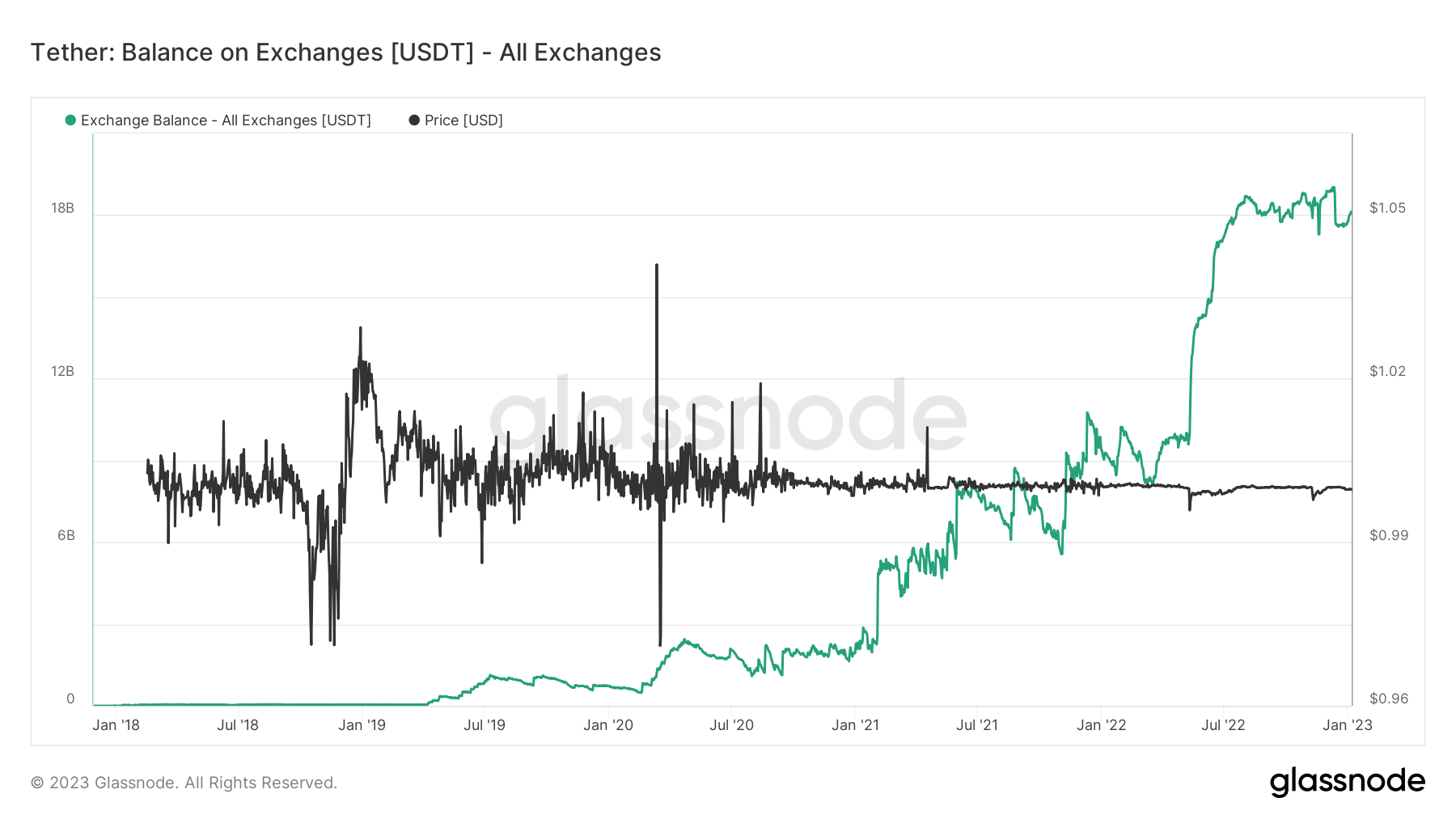

Despite the dominating crypto winter season, USDT has actually taken pleasure in even more of a secure existence in the book of cryptocurrency exchange. Considering That August 2022, USDT has actually greatly remained level at $18 billion in the get of cryptocurrency exchanges.

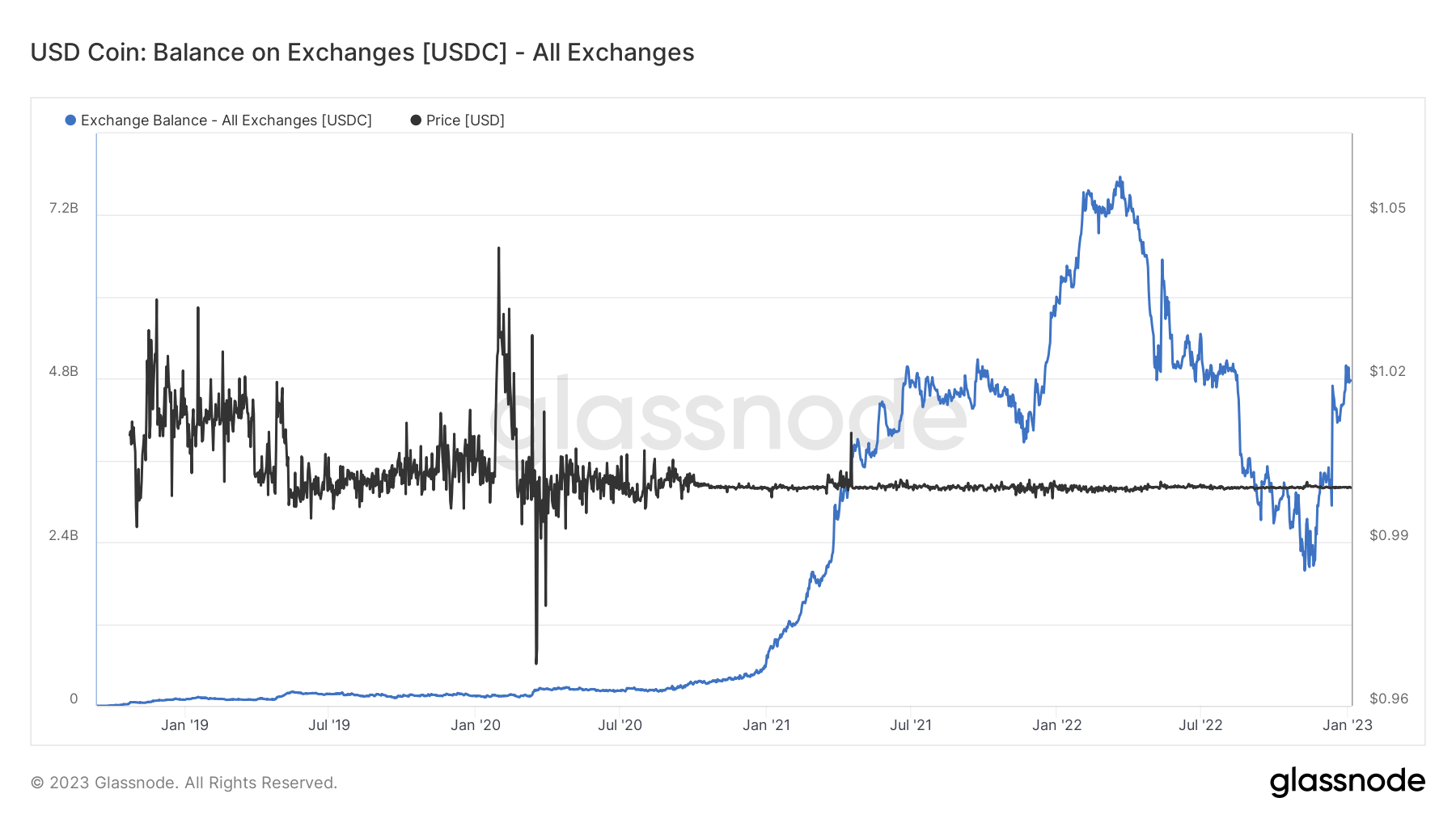

USDC, on the various other hand, has actually appreciated some development while attempting to suppress USDT’s prominence in the stablecoin market. Given that the collapse of FTX in very early November 2022, the quantity of USDC in the book of cryptocurrency exchanges increased to $5 billion.

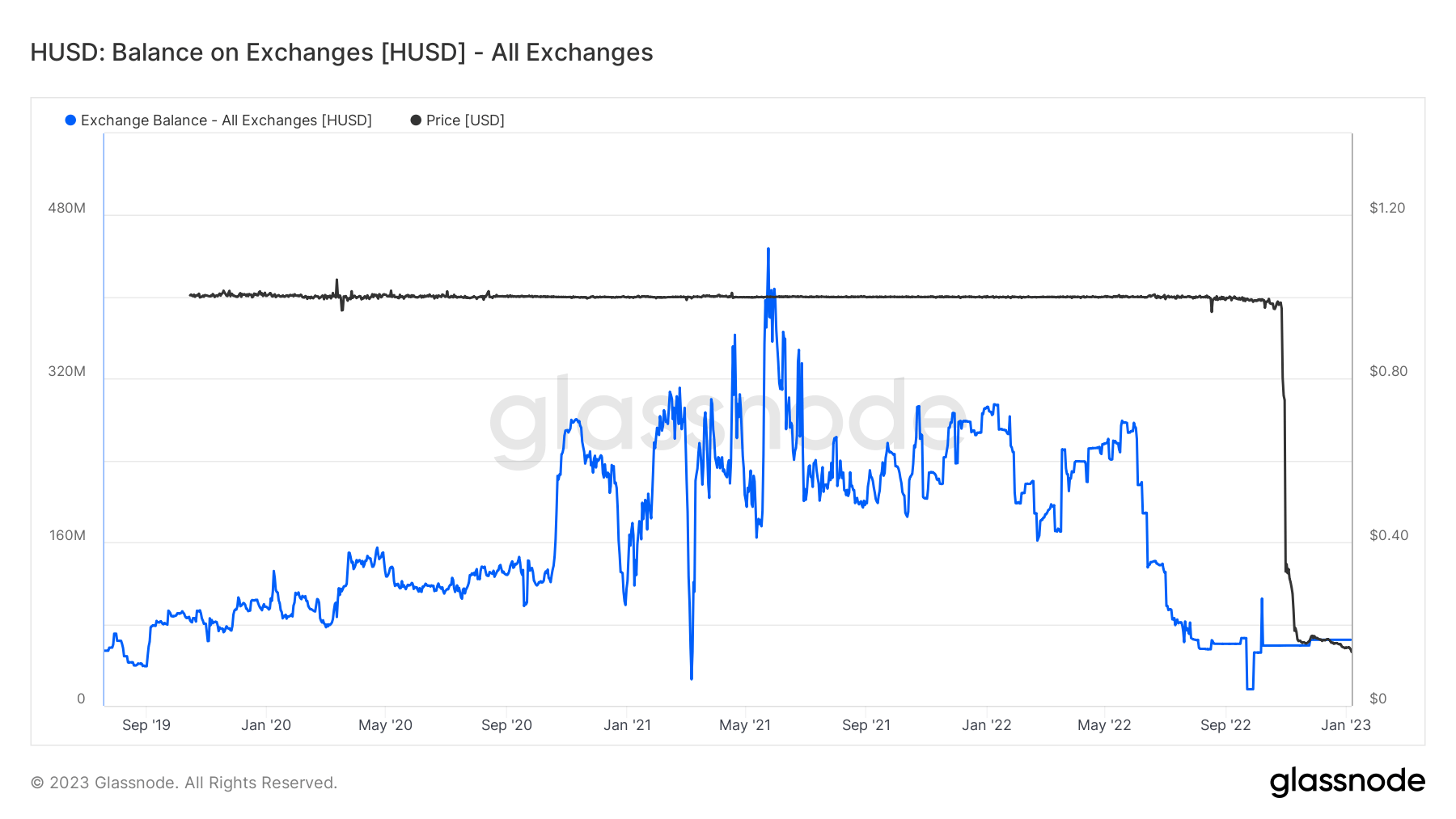

However, the strength the stablecoin market has actually been appreciating considering that the collapse of Terra Algorithm stablecoin UST is rather under danger. Adhering to the statement of Huobi Global to delist the HUSD stablecoin, the token has actually endured a large decrease.

Shortly after the statement, the stablecoin dropped 72% off its buck secure, and also currently HUSD is trading at 13 cents. In a sharp dip, the quantity of HUSD in cryptocurrency exchange gets will exceed its lowest level of $65 million.

Stablecoin get in central exchanges

Following the collapse of FTX, financiers started to question the integrity of Centralized exchanges. As of January 12, Binance taped concerning $5.202 billion discharge of stablecoin considering that the collapse of FTX.

Likewise, within 2 months after the death of FTX, Coinbase Pro saw a web discharge of $690 million, Huobi $277 million, Bitfinex $125 million, Gemini $398 million, and also Gate.io $42 million.

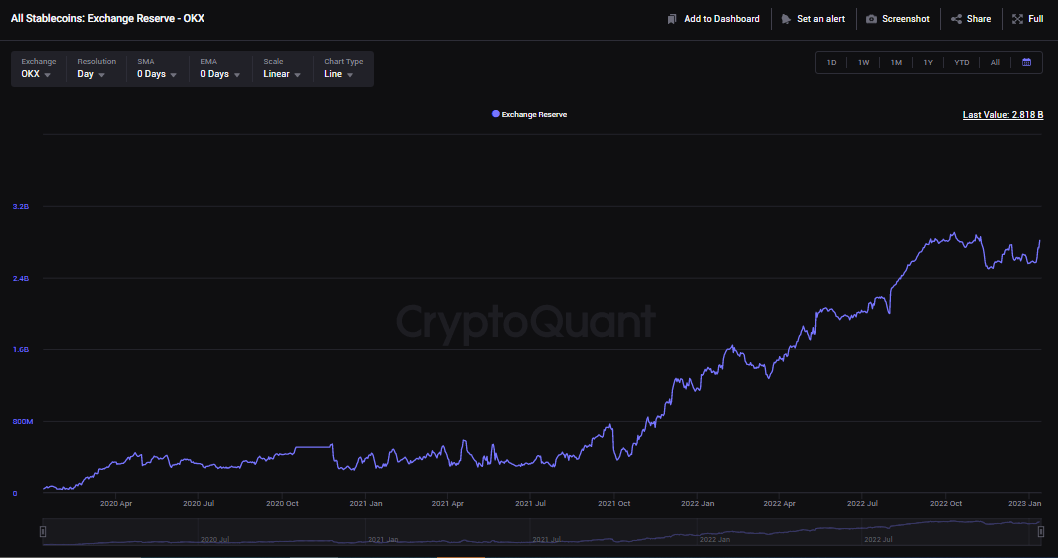

OKX, on the silver lining, really did not tape a deficiency; rather, the cryptocurrency exchange took pleasure in a $43 million web inflow.

Within this duration, cryptocurrency exchanges experienced concerning $6.2 billion web discharge of stablecoin, with Binance enduring one of the most, according to Cryptoquant The discharge can not be taken into consideration substantial because Binance held regarding $399 billion well worth of stablecoin, according to its evidence of get record from Nov. 10.

Exchanges like Binance and also Crypto.com launched proof-of-reserves with Mazars in November to develop individuals’ count on. Nevertheless, the companies later on dealt with reaction from the area as some suggested that the record did not expose the complete book of the exchanges.

In a rough repercussion, Binance, within a day, observed a substantial withdrawal of stablecoins that totaled up to regarding $2.1 billion.

It’s noticeable from the graphes that customers still have depend on concerns with central exchanges considering that stablecoin books remain to drop.