In 2019, the globe of semiconductors relocated from its previous 14- as well as 16- nanometre manufacturing procedures to TSMC’s brand-new 7-nanometre node, with massive consequences for the whole IT market, because of the opportunities supplied by the brand-new, progressively thick and also effective chips, which are as a result able to enhance the efficiency per watt of the different items

This shift has actually additionally included the crypto mining field, where the gigantic Bitmain has actually had the ability to prepare for, launching the initial ASICs with 7-nanometre chips for Bitcoin mining currently at the end of 2018

In reality, it remained in mid-2018 that TSMC, the leading Taiwanese chipmaker in the industry, began high quantity manufacturing for wafers based upon the very first 7-nanometre DUV (Deep UV Lithography) manufacturing procedure, permitting consumers such as Apple, Huawei, AMD, Qualcomm as well as also Bitmain to begin manufacturing tools based upon the brand-new chips, which are the topic of years of layout.

It is exactly the manufacturing procedures that have actually constantly been a crucial element in the advancement as well as development of the equipment of any kind of hi-tech gadget (from CPUs to mobile SoCs, GPUs, FPGAs, and so on), given that the development of manufacturing nodes has actually constantly enabled a boost in the thickness of transistors each location, keeping or reducing (relying on the regularity) the power intake contrasted to the previous nodes

Unfortunately, for many years the race to progressively innovative lithographs has actually endured a considerable stagnation, due partly to some problems in the manufacturing of equipment for these nodes, partially to the high expense as well as reduced returns provided by the very first examination chips generated in the initial wafers, which needed better improvements.

However, the present 7-nanometre manufacturing has actually currently dealt with various issues.

The beginning of TSMC’s overload

Competition problems

The shift from the previous 14- and also 16- nanometre manufacturing refines to the present 10- and also 7-nanometres has actually been the topic of various hold-ups and also troubles at significant factories.

For instance, Intel took 2 years much longer than anticipated to establish its 10- nanometre node, while remaining to fine-tune its 14- nanometre node so regarding maintain its items affordable in regards to efficiency while partly compromising performance.

Samsung, on the various other hand, as a result of some hold-ups began standardizing utilizing 7-nanometres just in late 2019, gathering a six-month hold-up contrasted to TSMC. Regardless of this, the firm instantly handled to utilize EUV ( Extreme UV Lithography) innovation for this node instead of the DUV embraced by TSMC. This needs to make sure a little much better manufacturing returns as well as efficiency many thanks to far better pattern of the 7-nanometre chip format, along with reduced manufacturing expenses because of the demand for less layers and also as a result masks.

Competing shop Global Foundries, on the various other hand, has actually essentially terminated its strategies to establish and also make 7-nanometre chips because of too much troubles as well as prices, according to the statement made in November of 2018.

The very first 7-nanometre chips of 2018

All these troubles and also hold-ups have actually brought about expanding need from the only shop with the ability of generating these chips with ample returns as well as quantities: TSMC. The Taiwanese chip manufacturer, as a matter of fact, began automation of the 7-nanometre contribute the summer season of 2018

The initial clients were definitely Apple (SoC A12) as well as Huawei (Kirin 980), complied with quickly by Qualcomm (Snapdragon 855), AMD (very first Zen 2 as well as Vega 20 examination chips), as well as the mining gigantic Bitmain (initial 7nm chip BM1391).

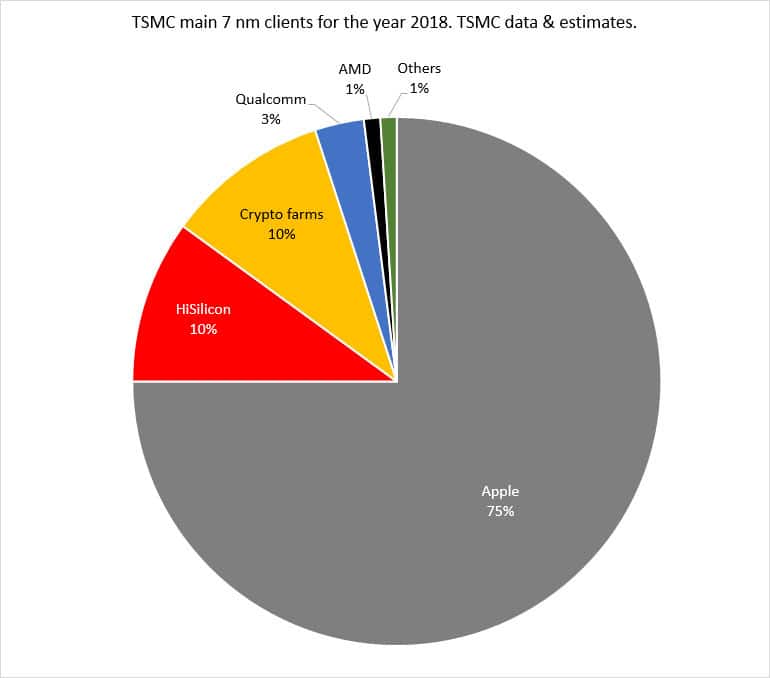

By observing the information reported at the end of 2018 by TSMC, it is feasible to see that concerning 10% of the 2018 manufacturing of 7-nanometre wafers was predestined solely to the crypto mining field Of this 10%, a lot of the orders were definitely carried out by Bitmain, considered that the business has actually launched on the marketplace the very first 7-nanometre ASIC Antminer S15 currently in December 2018.

Companies such as Innosilicon, Ebang and also Whatsminer, as a matter of fact, have actually made a decision to go with one of the most cost-effective 10- nanometre manufacturing procedure given by Samsung Just GMO has actually selected to count on TSMC’s 7-nanometres like Bitmain, yet the bad efficiency of its items has actually led it to tape-record a substantial loss in the crypto mining field, to the degree that the firm had actually made a decision to modify its setting in the cryptocurrency market

Among TSMC’s consumers, it was (like each year) Apple, which positioned 75% of the overall orders for 7-nanometre chips, adhered to by the Chinese Huawei (HiSilicon), Qualcomm and also lastly AMD.

The high need for contribute 2019 as well as the relocations of Bitmain

In 2019, the need for 7-nanometre chips has actually not quit, however, it has actually boosted substantially many thanks to the advertising and marketing of a number of 10s of numerous mobile phone devices based upon Qualcomm’s brand-new cpu: the Snapdragon855 It suffices to point out that producers like Xiaomi have in truth marketed virtually 5 million mobile phones based upon this contribute simply under 6 months (Mi 9 and also Mi 9T Pro specifically).

Then there is Samsung, which in the United States has actually marketed numerous million Samsung Galaxy S10 based upon the very same SoC(in Europe as well as China these gadgets utilize the Exynos 9820 rather).

In July, AMD marketed the brand-new AMD Ryzen 3000 cpus made with 7-nanometre chips, adhered to by the brand-new Navi GPUs additionally created with 7-nanometres. In August, the brand-new second-generation AMD Epyc web server cpus were likewise offered to OEMs and also huge business, once again making use of TSMC’s 7-nanometre manufacturing procedure. Many thanks to their high efficiency as well as superb price/performance proportion, AMD’s chips are actually marketing like hot cakes, to the degree that the business has actually had a variety of troubles in making sure appropriate schedule of its items

In the mobile phone field, Apple revealed in September its brand-new apples iphone based upon the A13, a brand-new SoC made with a sophisticated 7-nanometre manufacturing procedure (EUV) produced by TSMC, which needed to transform some old collection based upon the traditional 7 nm DUV to satisfy the high need for chips required by the Cupertino titan. Huawei really did not pull back either, revealing a couple of days later on the brand-new SoC Kirin 990 5G, likewise made with the 7-nanometer EUV.

On the crypto mining front, there was the increase of Bitcoin in springtime 2019, come with by the launching of the brand-new ASICs by Bitmain based upon the brand-new 7-nanometer chip BM1397, introduced last April This, catalysed by the expanding cost of Bitcoin till June, has actually fed the mining sector, to the factor that a number of makers of mining equipment have actually reported a too much need for gadgets, also 3 times the manufacturing ability

Precisely because of this Bitmain, in between completion of June as well as the start of July, gotten 30 thousand wafers of 7 nanometer chips from TSMC, chips whose distribution by the shop is anticipated around the month of October/November, in the nick of time to set up as well as supply the brand-new Antminer S17+ as well as T17+, introduced in current days.

The existing scarcity of 7-nanometre TSMC chips

The continual build-up of orders from AMD and also Apple, many thanks to unanticipated success for their items, complied with likewise by the constant orders from Qualcomm, Huawei as well as several various other smaller sized business, consisting of Bitmain and also just recently Canaan, has actually compelled TSMC to considerably prolong the shipment time for their items

Just last month, actually, the factory introduced that as a result of the high need for 7-nanometre chips (both DUV as well as EUV), complied with by a significant need for 10- as well as 14- nanometre chips, it was compelled to enhance preparation(the moment needed to create the chips when appointed), from the previous 2 months to the existing 6 months An instead crucial variant, which as a result requires producers to prepare brand-new items really thoroughly, provided the long durations that can change the competition and also as a result the earnings of a provided gadget

In the coming months, for that reason, the scenario might come to be really fragile, considered that all the manufacturing ports of the chipmaker are complete as well as, offered the preparation scenario, possibly will still be for the majority of 2020

The feasible impacts of the lack for crypto mining

The lack of 7-nanometre chips might have essential effects in all those fields where timing is typically important. Amongst them, stick out the globe of GPUs, the globe of mobile SoC and also naturally likewise of crypto mining, specifically of ASICs, partially due to the upcoming Bitcoin halving

It’s no coincidence that Bitmain as well as Canaan lately introduced the brand-new ASICs for Bitcoin mining, as there are currently simply under 7 months to BTC halving.

Both producers anticipate to provide the brand-new items by the end of the year, therefore leaving a time home window of concerning 4/5 months to the miners to build up as much BTC as feasible because the halving, so regarding increase the ROI. It’s tough to anticipate what will certainly take place following A lot will certainly depend upon the cost of Bitcoin after cutting in half.

If the rate is high sufficient, the Bitcoin mining race could proceed, if rather, the very same happens what occurred with Litecoin, there could be a decrease of the BTC hashrate, creating a lot of the miners to move to various other money(BCH?) while waiting on a recuperation of the BTC cost.

In any type of instance, the entire crypto mining market can be greatly adversely influenced by the scarcity( Innosilicon is currently experiencing troubles for instance) if the orders of the wafers made by the different suppliers show to be inadequate to the need for crypto mining items In this instance, there can be a substantial rise in ASIC costs for mining, brought on by the deficiency of items readily available on the marketplace.

This scenario has actually currently taken place numerous times in the past In 2017, video clip cards essentially went off the rails, with costs that have even more than tripled. Or, returning to today day, throughout the summer season there were usually troubles in acquiring the brand-new Antminer, offered the too much need.

If the currently high need for items were to be gone along with by the annoying absence of chips, the cost of ASICs might quickly replicate, three-way or boost a lot more, although a lot will certainly depend upon the cost of Bitcoin, which has actually constantly been a critical consider establishing the success of mining.

Potential results additionally for the mining of Monero

On November 30 th, Monero will certainly apply a fork to switch over to the brand-new Proof of Work RandomX, a CPU pleasant PoW This brand-new Proof of Work device will certainly once again get rid of ASICs and also FPGAs from the mining of the cryptocurrency. Not just that, given that the return in video clip card mining will certainly go down significantly, originally just the CPUs will certainly stay ideal for crypto mining

In current weeks, the very first RandomX-compatible mining devices have actually been provided, enabling individuals to straight examine mining efficiency with Monero’s future PoW.

From the very first examinations accomplished, amongst all the cpus checked, an intriguing efficiency benefit arised for the brand-new AMD Ryzen CPU s, particularly for the 3rd generation of CPUs based upon the ZEN 2 style improved the 7-nanometre TSMC chips These certain CPU versions, actually, brag huge amounts of initially, 2nd and also 3rd degree caches, almost two times as high as the initial as well as 2nd generation of AMD Ryzen as well as the existing services used by Intel.

Currently, one of the most doing version is certainly the Ryzen 9 3900 x, geared up with 12 cores and also 24 strings at a base clock of 3.8 GHz. This CPU can get to a hashrate near 11500-12000 H/s, with a power intake of around 150 watts The cost is not the least expensive, as it is hard to discover the Ryzen 3900 x at much less than 600 euros

The version with the greatest price/performance proportion is certainly the Ryzen 5 3600, an option with 6 cores and also 12 strings running at a base clock of 3.6 GHz It can obtain a hashrate up to practically 6300 Hash/s, all with a power usage of regarding 80-90 watts for the CPU alone as well as a rate listed below 190 euros

The success of Ryzen 3000 and also the lack

At the minute, many thanks to the high efficiency for cost used by these CPUs in all industries (not just in mining), the sales taped by AMD have actually verified to be more than anticipated, bring about numerous troubles in discovering the very best carrying out designs, specifically the 3900 X as well as the future 3950 X, 2 services that are likewise popular in mining on RandomX.

With the movement of Monero’s miners from GPUs to CPUs, several will certainly go with the growth of systems based upon the brand-new AMD Ryzen 3000 cpus (along with the future Threadripper 3000), taking the chance of to more concession the currently high need for these items

As pointed out over for ASICs, the mix in between the passion of the miners and also the substantial passion of AMD clients(offered the superb efficiency of these CPUs) incorporated with the scarcity of 7-nanometre chips on which they are based, can have severe effects on the rates of these items, which currently today are basically impossible at market price (referral is made to 3900 X) offered the high need

It will, consequently, be essential to review well what will certainly take place at the end of November as well as throughout the month of December on the Monero network, yet currently in current weeks a number of additional money (ARQ, DERO, LUX) are changing to PoW RandomX, hence additional boosting rate of interest in these CPUs.

The future of semiconductors

Samsung concerns the help with the manufacturing of 7-nanometre EUV chips

Among all the adverse information of the recentlies on the planet of semiconductors, throughout the summertime period, Samsung began the automation of 7-nanometre EUV chips, therefore signing up with the only producer existing to day, specifically TSMC.

However, given that Samsung is not just a shop for 3rd party consumers however additionally a producer of several items based upon its chips, it is highly likely that the South Korean titan will at first provide concern to its items, specifically to the brand-new SoC Exynos 9825 made use of on the newly revealed mobile phone Galaxy Note10 Not just that, the South Korean producer is definitely currently servicing the future Exynos 9830, anticipated on the future Galaxy S11, which will certainly debut throughout February 2020.

In any type of instance, the firm appears to have actually offered a suitable manufacturing capability for 7-nanometre EUV chips throughout the very early months of 2020 Among the initial consumers to have actually currently appointed their manufacturing is Nvidia, which will certainly introduce the brand-new 7-nanometre Ampere video clip cards throughout 2020.

In the crypto mining area, it is likely that Innosilicon(currently a consumer of Samsung), can capitalize on the 7-nanometres EUV to make a DIE Shrink of its ASICs presently made at Samsung however with 10- nanometres This can occur currently in the very first component of 2020, although much will certainly depend upon the returns as well as manufacturing ports assigned by Samsung itself.

Towards 5-nanometres in late 2020

Immediately after the 7 nanometers EUV (likewise called 7nm+) TSMC has actually currently revealed its intent to begin the manufacturing of 5-nanometre chips EUV, supplying a decrease of the location with the very same short-term equivalent to 40% as well as a boost of 15% in efficiency while preserving the very same intake.

The initial 5-nanometre chips will certainly be created in quantities by mid-2020, although threat manufacturing will certainly begin in the very first couple of months of the year. As constantly, the initial consumer will certainly be Apple, with the cpus of the future apple iphone 2020.

We will barely see the very first ASICs with this manufacturing procedure prior to the start of 2021, as a result of the expenses of the initial manufacturings, lasting just by firms with huge manufacturing quantities. Perhaps Bitmain will certainly suggest an ASIC with 5-nanometre chips at the start of 2021(allegedly Antminer S19 or S21), yet, as constantly, a lot will certainly depend upon the rate of Bitcoin, which, likewise thinking about the halving of 2020, will certainly need to be economical for the high style and also growth expenses for future 5-nanometre chips

.