- Function # 1: Interest Rates– BlockFi vs. Celsius APY

- How Do BlockFi and Celsius Make Money?

- Function # 2: Payouts and Withdrawals

- Function # 3: Security– Is BlockFi or Celsius Network Safer?

- Function # 4: Standout Features

- The Court of Public Opinion: BlockFi vs. Celsius Reddit

- Which is the Better Cryptocurrency Interest Account, BlockFi vs. Celsius?

- Last Thoughts: BlockFi vs. Celsius

When it pertains to assessing the very best cryptocurrency interest accounts, BlockFi vs Celsius Network tends to be the most popular head-to-head contrast.

Editor’s notes: In June 2022 Celsius Network froze all client withdrawals and transfers, and stated personal bankruptcy a month later on. We will upgrade this guide as the dust settles. Throughout the bulk of its operations, BlockFi was considered a top-tier item, a minimum of in the cryptocurrency market; it was thought about to be safe, and its executive group promised to keep user funds safe. By November 2022, BlockFi had no option however to obstruct all consumers from withdrawing their possessions due to its intricate monetary relationship with FTX and FTX affiliate hedge fund Alameda Research.

BlockFi and Celsius were the blue chips of cryptocurrency interest accounts. Both are at the leading edge of decentralizing * the Big Banks, possibly the most infamous of the cryptocurrency market’s bogeymen.

The following guide will check out BlockFi versus Celsius, their different functions, and eventually, which one is the much better cryptocurrency interest account.

At a loss corner, CelsiusThe NYC-based business is commonly considered a cryptocurrency financing and loaning leader. It has actually raised $93.8 M in equity capital, personal equity, and an ICO for its native token CEL. Celsius declares it’s”absolutely nothing like BlockFi“

In the blue corner, BlockFiThe New Jersey-based business raised $508.7 M in equity capital from over 30 financiers.

* Both BlockFi and Celsius are central business that utilize decentralized possessions, thus being Centralized Finance “CeFi,” instead of Decentralized Finance “DeFi.” Both business take custody of your cryptocurrency Cryptocurrency interest accounts should not be considered as cost savings accounts since they feature a special set of threats– neither your principal nor your interest is ensured.

How do BlockFi and Celsius stack up? Which platform is the very best value, dear reader? Where is your crypto the most safe?

Let’s check out.

You can check out a complete breakdown of each specific platform on our BlockFi evaluation Celsius evaluationinterviews (2018 and 2020with Celsius CEO, Alex Mashinsky, and a summary of the cryptocurrency interest account market.

Function # 1: Interest Rates– BlockFi vs. Celsius APY

Let’s begin with meat and get to the potatoes later on: just how much cash can BlockFi or Celsius make you?

Bitcoin:

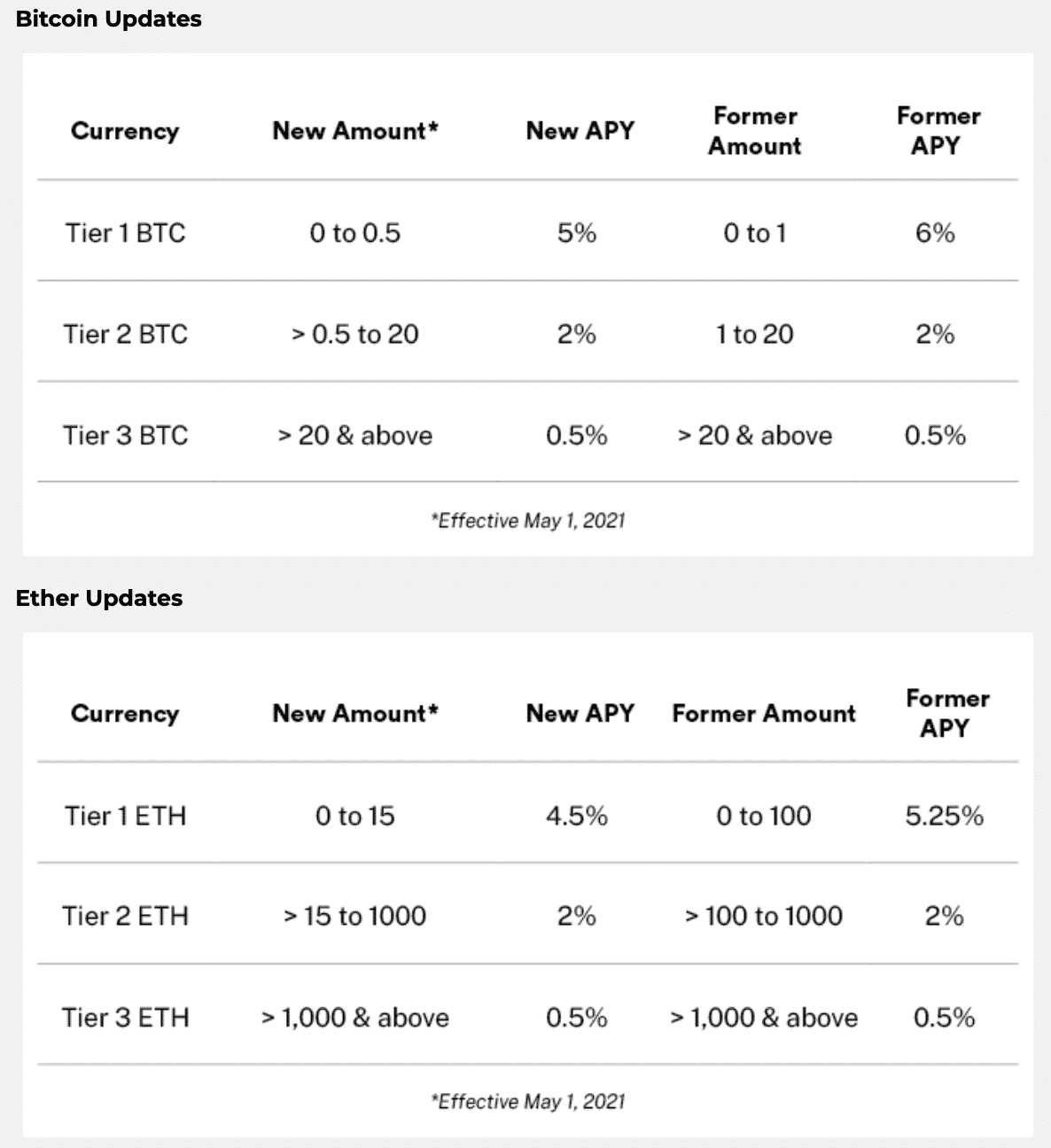

BlockFi uses 5% on your 0.5 bitcoin, 2% in between 0.5 and 20 BTC, and after that 0.5% on any quantity over that.

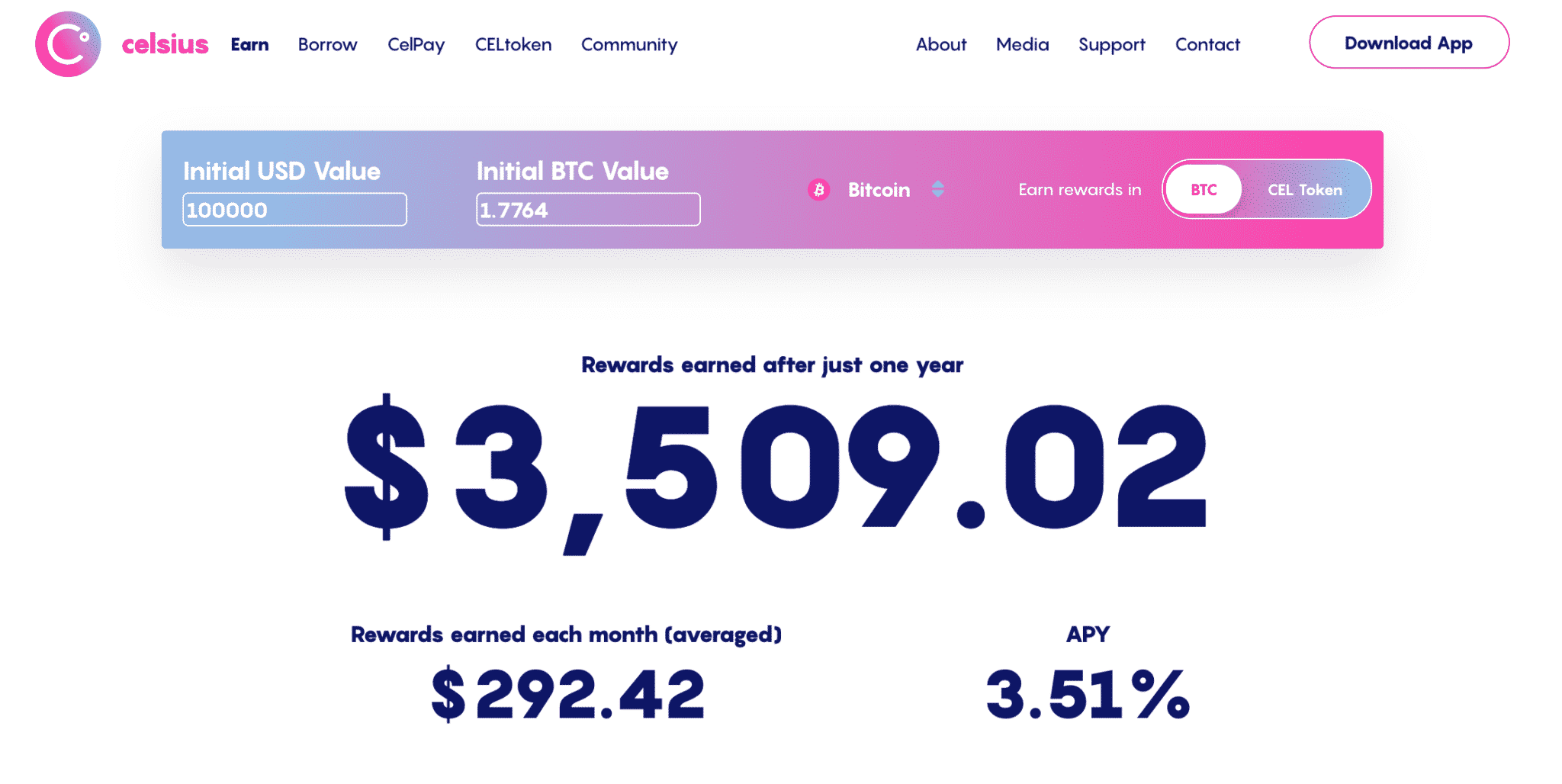

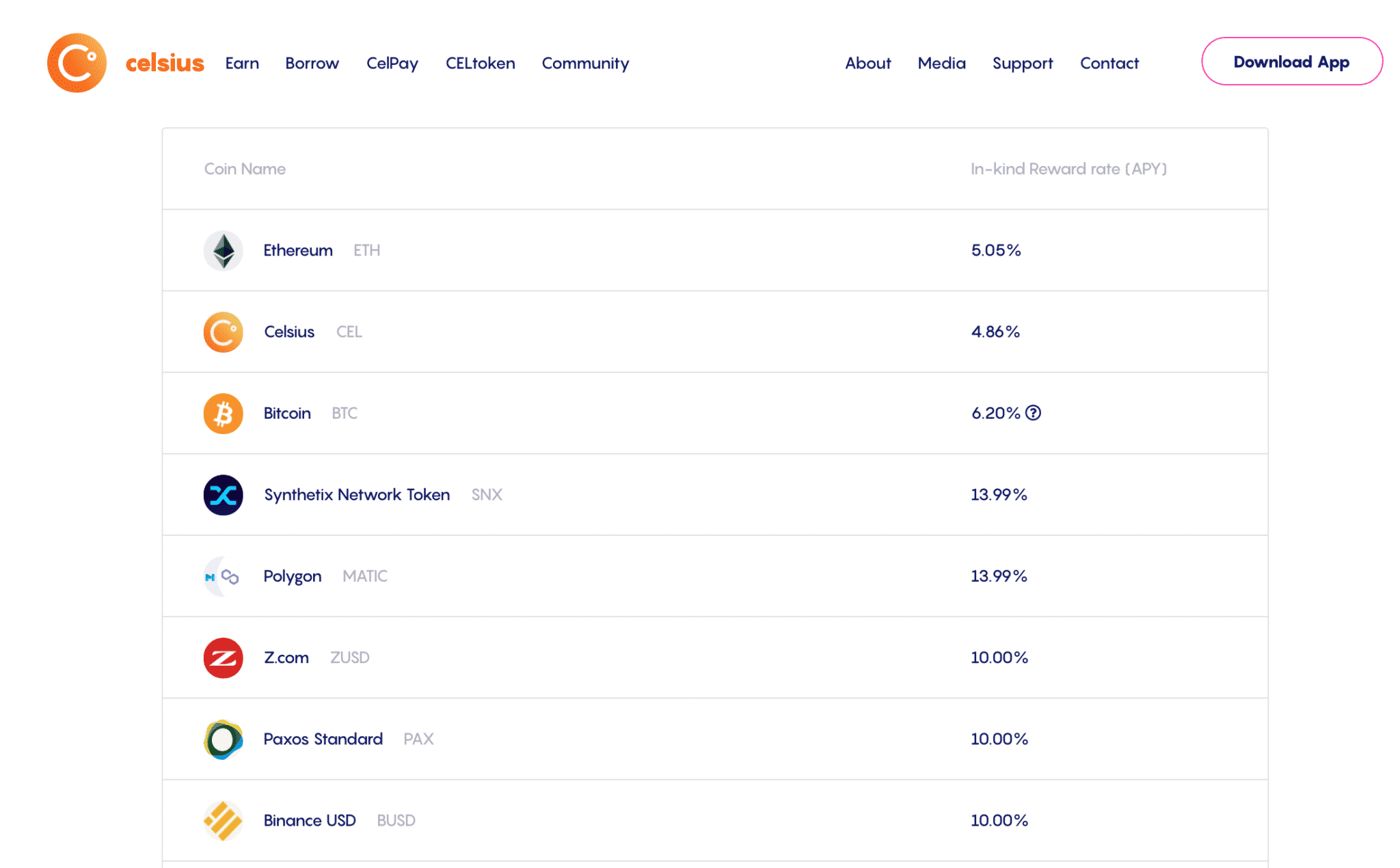

Celsius provides 6.2% for the very first 2 BTC, and after that 3.51%.

Ethereum:

BlockFi uses 4.5% on your 15 Ethereum, 2% in between 15 and 1000 ETH, and after that 0.5% on any quantity over that.

Celsius provides 5.5% for any quantity of Ethereum.

Stablecoins:

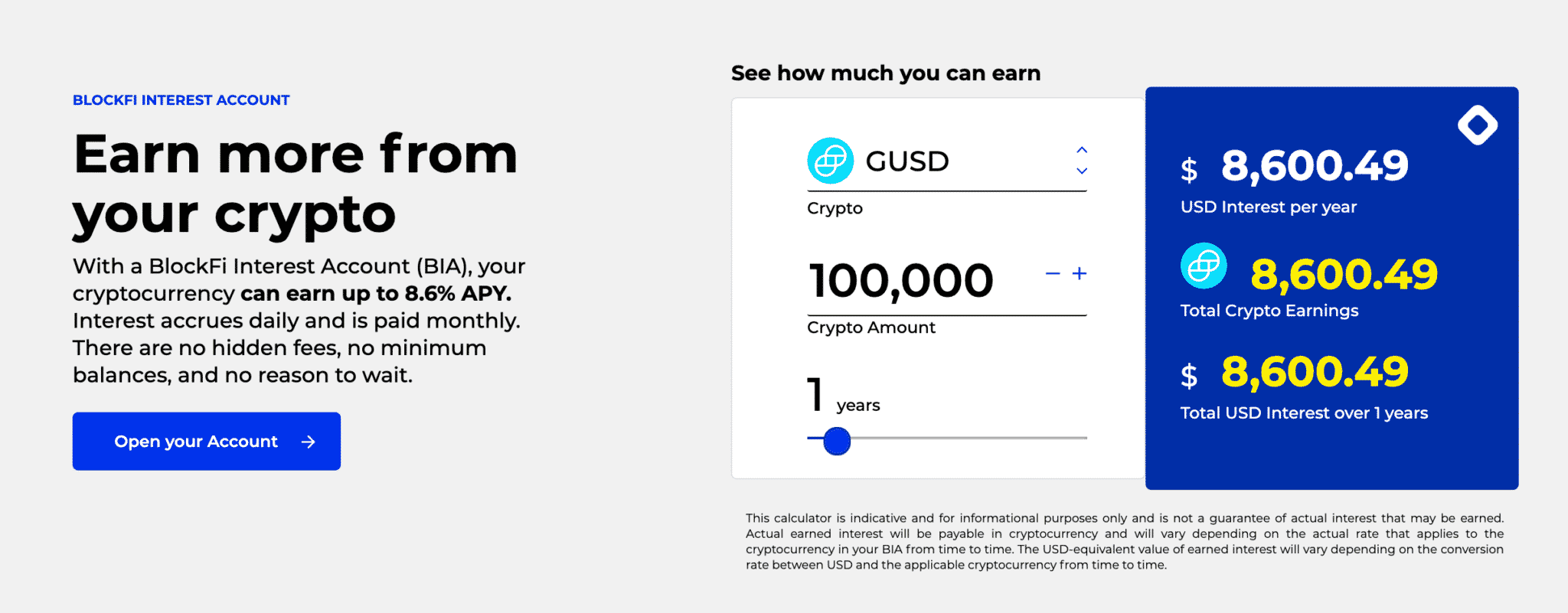

BlockFi uses a flat 8.6% on popular stablecoins like USDC and GUSD, and 9.3% on USDT.

Celsius uses a flat 8.88% on all stablecoins.

How Do BlockFi and Celsius Make Money?

Neither platform has yet to reveal a complete transparent breakdown of its loaning techniques, with their reasoning being to prevent the universal hazard of rivals leeching off their techniques.

BlockFi tends to be relatively conservative in threat management and credit evaluations of institutional customers, such as Fidelity Digital Assets, a subsidiary of Fidelity Investments with more than $8.7 trillion properties under administration.

In a 2019 Celsius articleCEO Alex Mashinsky alerted BlockFi consumers that BlockFi might utilize equity capital funds to sustain its rates of interest; if the VC cash dried up, so would the prospective rate of interest. These words of cautioning brought a lot more weight in 2019 when BlockFi had actually just raised a portion of its overall financing of $508M today.

Celsius provides to cryptocurrency exchanges and hedge funds aiming to obtain funds, and it disperses 80% of earnings straight to holders of its native token, CEL.

Celsius varies in that it appears to be dipping its toes into DeFiwhich is a naturally riskier (and more rewarding) technique than merely taking control of the borrowing/lending functions of a bank.

Some DeFi jobs can return 30% to 100%+ annually, however there have actually been a number of circumstances of DeFi jobs going awry, either through developmental breakdowns, carpet pulls, or hacks.

The idea of a CeFi platform like Celsius going into DeFi is fascinating and possibly too chewy for the restraints of a contrast piece The skinny– DeFi is dangerous and fairly more complex than providing on a central platform if Celsius can make greater portions (80% of which are shown CEL holders) while reducing loss (and completely re-enumerating any stable-penny or satoshi loss), it’s going to be effectively placed to use greater rates.

Do you desire us to explore this point deeper? Shoot us a tweet @realCoinCentral!

Which matters more, how the cryptocurrency interest account hotdog is made, or how it tastes? We’ll leave it to you to identify which is more crucial, however our 2 satoshis is to think about all the threats included when moving cash and do your own research study.

The winner:

Eventually, if BlockFi is naturally less dangerous than Celsius if it is genuinely following a more conservative loaning and yield-seeking technique. BlockFi’s BTC and ETH depositors might discover some disappointment in the regular rate caps and limitations– the business has actually lowered both two times in 2021 due to altering market characteristics

Celsius provides greater rates for bigger quantities and a broader choice of cryptocurrencies. International users can even snag an extra 2% on stablecoins if they utilize the “Earn in CEL” choice.

Expect we were to separate the principle of fund security totally from rates. Because case, Celsius takes the cake over BlockFi, winning by approximately about 2% greater interest for each digital possession.

Not to state Celsius is much riskier than BlockFi. Still, BlockFi has actually clearly safeguarded its rate cuts by promoting for its much safer fund management techniques, whereas Celsius has actually discussed its checking out DeFi techniques. Both are insolvent.

Function # 2: Payouts and Withdrawals

BlockFi paid monthly, while Celsius paid weekly.

BlockFi permits one totally free cryptocurrency withdrawal each month, Celsius has endless totally free cryptocurrency withdrawals.

The winner Celsius pays more frequently and does not have any withdrawal limitations.

Function # 3: Security– Is BlockFi or Celsius Network Safer?

Celsius utilizes BitGo’s multi-signature wallets to protect user funds. BitGo has a $100M insurance coverage spread over all its customers.

BlockFi utilizes Gemini and BitGo as its main custodians. Both Gemini and BitGo have personal insurance coverage on their deposits.

We must keep in mind that neither platform is totally secured by insurance coverage. BlockFi, for instance, exposed it has more than 265,000 retail customers– $100M in insurance coverage would cover each account as much as $380.

Even more, neither BlockFi nor Celsius are covered by FDIC insurance coverage.

Celsius meant releasing personal insurance coverage for its users, and we’ll upgrade as quickly as it is launched.

There is likewise talk of third-party personal insurance coverage suppliers covering cryptocurrency interest represent about 2.6% of the return, however we’ve yet to try out any of these platforms.

The winner Tomato, tomato (pronounce them in a different way in your head, please.)

Both BlockFi and Celsius utilize comparable security preventative measures, and both are exposed to the very same dangers and dangers of any business holding cryptocurrency. Considering that neither platform has actually been hacked for user funds, we’ve yet to see how either business would re-enumerate its users must one happen.

If Celsius can provide personal insurance coverage for its users within its platform, it would win the edge.

Function # 4: Standout Features

Celsius is mobile-only, which might be frustrating for our readers who choose handling their cryptocurrency accounts on a desktop. BlockFi has both a mobile and web app.

Celsius’s native token CEL benefits CEL holders with a proportional share of 80% of their earnings. International users can likewise acquire an APY increase of around 2%, however this choice isn’t offered for U.S. users, who should “Earn in Kind.”

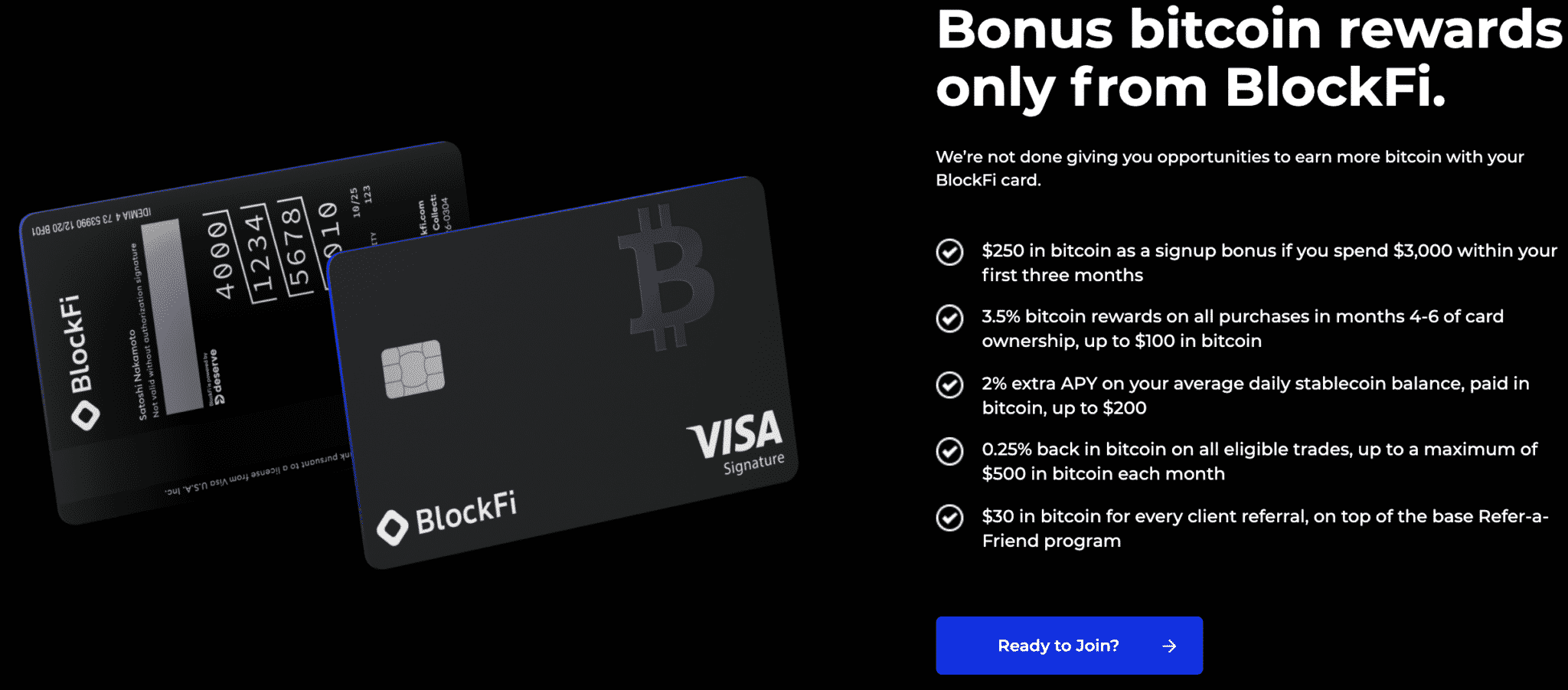

BlockFi is gradually growing its community beyond simply cryptocurrency loaning and loaning. Its most noteworthy standout function is its approaching BlockFi Credit Cardwhich gets users 1.5% back in bitcoin on all purchases.

Celsius uses competitive rates of interest for a much larger range of propertiesconsisting of current pioneers like Synthetix, Polygon, Polkadot, Aave, and Compound.

The Court of Public Opinion: BlockFi vs. Celsius Reddit

Both BlockFi and Celsius have ardent advocate bases, and beyond platform maximalism and tribalistic propensities, the contrast in between the 2 cryptocurrency account platforms is civil.

One popular Blockfi vs. Celsius Reddit thread on r/BlockFi records the discourse well: numerous users lean towards Celsius for its greater rate of interestothers choose BlockFi’s more conservative financing and financial investment approaches. A strong bulk supporter for utilizing both platforms.

Editor’s note: In June 2022, Celsius Network froze all client withdrawals and transfers, and stated insolvency a month later on. We will upgrade this guide as the dust settles

Which is the Better Cryptocurrency Interest Account, BlockFi vs. Celsius?

Celsius has a strong benefit over BlockFi in concerns to rate of interest, payments, and withdrawals.

Celsius provides greater rates for its stablecoin interest account throughout the board, has much better tiers and rates for Bitcoin and Ethereum.

The business is figured out to equalize financing and to supply constant yield and a safe shop of worth for the next numerous countless individuals. It disperses 80% of its earnings to its CEL token holders and has actually cultivated an active neighborhood of Celsius fans (over 16,000 on Telegram.)

The scales start to tip to BlockFi’s favor when we consider its endeavor capital war chests and more conservative investing method. Both business are lined up with the finest interests of their stakeholders, BlockFi has over 30 noteworthy and respectable financiers it should remain liable to. Presently in its Series D and most likely on a fast course to IPO, BlockFi should be very conscious of a range of user-oriented metrics.

The winner You (once again) if you play your cards right.

Last Thoughts: BlockFi vs. Celsius

Editor’s note: In June 2022 Celsius Network froze all consumer withdrawals and transfers, and stated insolvency a month later on. We will upgrade this guide as the dust settles. By November 2022, BlockFi had no option however to obstruct all consumers from withdrawing their properties due to its intricate monetary relationship with FTX and FTX affiliate hedge fund Alameda Research.

Disclaimer, this isn’t financial investment suggestions, and all cryptocurrency interest accounts are dangerous.BlockFi and Celsius both had a few of the greatest sign-up bonus offers in the cryptocurrency account area and declared to safeguard user funds most importantly, yet both and insolvent with users not able to access their funds.

Never Ever Miss Another Opportunity! Get hand picked news & & details from our Crypto Experts so you can make informed, notified choices that straight impact your crypto revenues Register for CoinCentral complimentary newsletter now.