The most significant information in the cryptoverse for Jan. 11 saw Avalanche reveal a collaboration with AWS as Silvergate disclosed that it obtained a $4.3 billion bailout from a San Francisco Bank. Robinhood is delisting and also marketing its BSV, WazirX has actually released its proof-of-reserves report, as well as FTX has actually recuperated $5 billion. And also, research study on Bitcoin costs as well as their relationship to the Consumer Price Index (CPI).

CryptoSlate Top Stories

Avalanche gains 20% in hrs after Amazon collaboration news

Avalanche (AVAX) expanded by 20% in a couple of hrs after Ava Labs’ collaboration with Amazon Web Services went real-time.

The collaboration will certainly assist to range blockchain fostering throughout business, establishments, as well as federal governments, according to records With Ava Labs signing up with the AWS Partner Network (APN), it will certainly have the ability to release items on AWS with greater than 100,000 companions worldwide.

Silvergate obtained a $4.3 B bailout after FTX collapse

Silvergate Bank got $4.3 billion from the San Francisco-based Federal Home Loan Bank in 2015, complying with the collapse of crypto exchange FTX, according to the company’s Q4, 2022 flings

Silvergate’s company design concentrates on supplying financial solutions to crypto exchanges and also financiers. Around 90% of the financial institution’s down payments originate from crypto.

At the end of the 3rd quarter, Silvergate’s 10 most significant depositors, consisting of Coinbase, Paxos, Crypto.com, Gemini, Kraken, Bitstamp, as well as Circle, stood for concerning fifty percent of the financial institution’s down payments. As an outcome of the FTX collapse, Silvergate remained in an essential placement, as it held down payments for both FTX as well as Alameda Research.

Robinhood to market sell BSV after delisting Craig Wright’s Bitcoin variant

Users of the preferred supply as well as crypto trading application Robinhood are responding to the statement that the system will certainly delist Craig Wright’s Bitcoin SV ( BSV) on Jan. 25.

A Robinhood speaker even more informed CryptoSlate that any kind of BCV hung on the system by consumers after the target date will certainly be” cost market price as well as attributed to their Robinhood purchasing power.”

The modification comes as a component of Robinhood’s regular evaluation of its crypto items, implying BSV will certainly remain to be tradeable on the application up until the target date. It likewise highlighted that financiers living in Hawaii, Nevada, as well as New York have actually restricted capacities to trade BSV.

Bitcoin worth $120 M taken out from exchanges on Jan. 10

Around $120 million well worth of Bitcoin ( BTC) was taken out from crypto exchanges on Jan. 10, according to Glassnode’s information.

Roughly $50 numerous the withdrawals originated from Binance, while $30 million was drawn from Coinbase.

There have actually been a lot more BTC discharges than inflows on crypto exchanges considering that the start of2023 One of the most considerable BTC inflow was around $80 million, which took place on Jan. 4– nonetheless, exchanges saw discharges worth about $40 million on the very same day.

On various other days, the companies have actually primarily seen even more discharges than inflows.

WazirX releases evidence of gets of possessions worth $285 M

Indian-based crypto exchange WazirX has actually released its Proof-of-Reserves (PoR) record, which reveals it holds concerning $285 million well worth of crypto properties.

WazirX kept in mind that regarding 90% of individuals’ possessions (worth $25915 million) are kept in budgets at Binance, while the staying 10% ($2654 million) are saved in warm as well as cozy budgets.

WazirX kept in mind that it has adequate get funds to fulfill individuals’ withdrawal needs at any moment, as it has greater than 1:1 get holdings of individuals’ properties.

FTX lawyer reveals $5B in properties recuperated

FTX recouped over $5 billion included cash money, financial investment protections as well as fluid cryptocurrencies, according to Reuters.

” We have actually situated over $5 billion of cash money, fluid cryptocurrency as well as fluid financial investments safety and securities.”

Andy Dietderich– an FTX lawyer– offered the upgrade to the instance on Jan. 11, educating a personal bankruptcy court in Delaware at the beginning of the FTX Senate Banking hearing

Dietderich likewise stated that FTX intends to market non-strategic financial investments that had a publication worth of $4.6 billion, although the firm’s publications have actually been referred to as unstable.

Binance-Voyager bargain obtains preliminary court authorization in spite of SEC arguments

The U.S. insolvency court for the Southern District of New York supplied a preliminary greenlight for the Binance-Voyager offer on Jan. 10, Reuters reported

Judge Michael Wiles authorized the disclosure declarations that described the numerous facets of the bargain.

However, Judge Wiles asked the lawyers dealing with the offer to change the recommended order prior to he offers last authorization. The bargain will certainly be completed at a future court hearing. Till after that, the court asked Voyager to look for the ballots of all its financial institutions on the sale of its $1 billion properties to Binance.

Research Highlight

Research: Bitcoin stays under stress in advance of CPI information; Michael Burry makes stagflation phone call

Analysts anticipate a year-over-year rise of 6.5% in the U.S. Consumer Price Index (CPI) for December 2022– with the Bureau of Labor Statistics’ main information launching Jan. 12– yet 2023 can bring some upside as financier Michael Burry anticipates CPI to relocate lower this year however alerted that any kind of succeeding pivot on rate of interest to boost financial task would certainly set off a 2nd inflationary spike.

November 2022’s real CPI was available in at 7.1%, much less than the anticipated 7.3% price. The better-than-expected outcome caused an enter crypto rates throughout the statement, with Bitcoin uploading a prompt spike to $18,000 at the time.

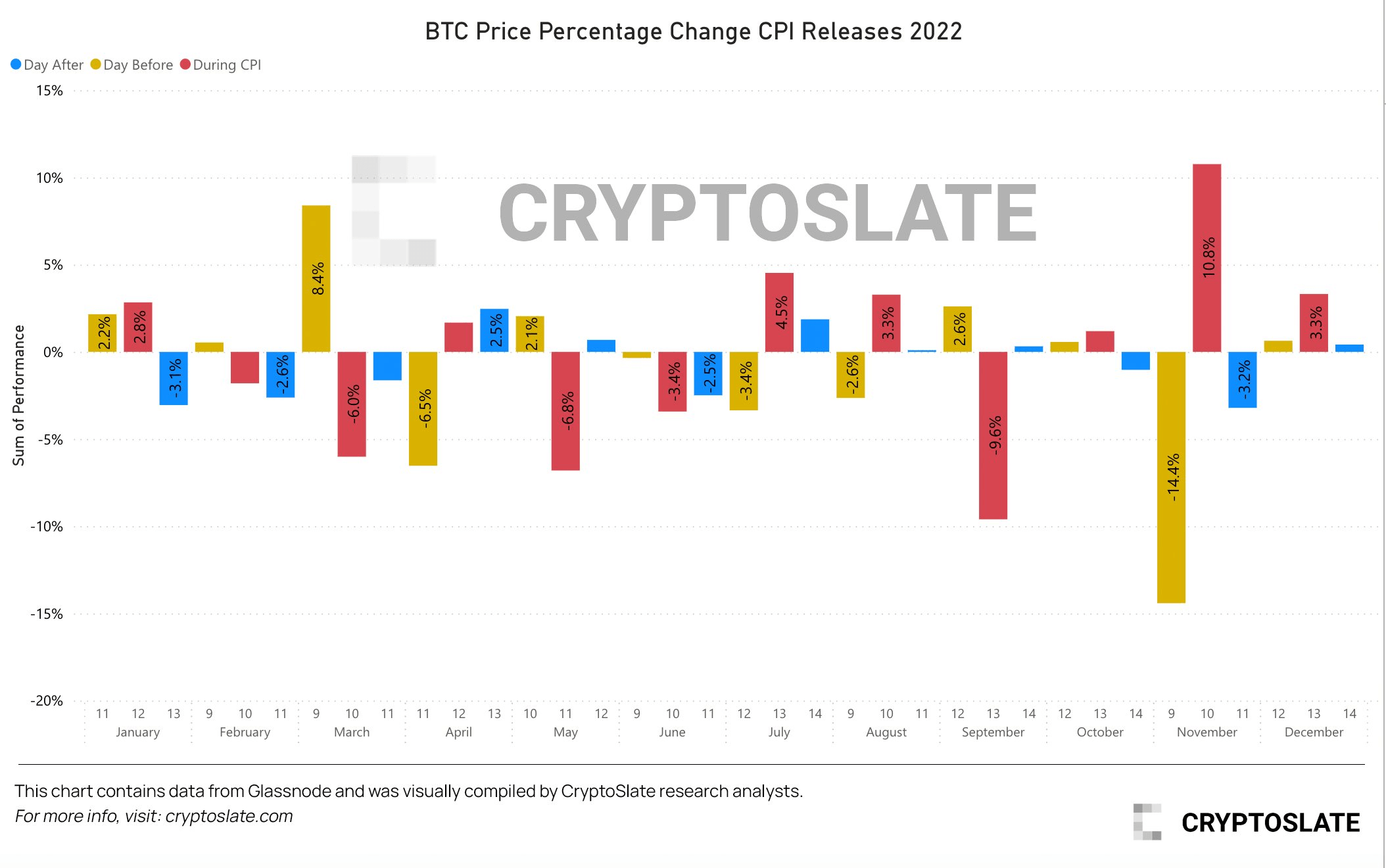

Throughout this bearishness, CPI information and also rate of interest news have actually been substantial stimulants to crypto cost volatility in the past, after, as well as throughout statements. To what degree?

The graph listed below programs roughly half favorable as well as half negative impacts on the Bitcoin rate prior to the CPI news; this was additionally the situation throughout the statement.

By comparison, the day after the statement often tended to produce mainly unfavorable cost results, probably as financiers have actually had time to take in the fact of raised customer rates and also the succeeding extension of rates of interest walkings.

Crypto Market

In the last 24 hrs, Bitcoin (BTC) climbed 0.49% to trade at $17,54589, while Ethereum (ETH) was up 0.1% at $1,34212

Biggest Gainers (24 h)

- SingularityNET (AGIX): 3904%

- Ergo (ERO): 27.02%

- Voyager Token (VOY): 24.71%

Biggest Losers (24 h)

- Gala (GALA): -1182%

- Lido DAO Token: -1023%

- Bitcoin SV (BSV): -9.8%