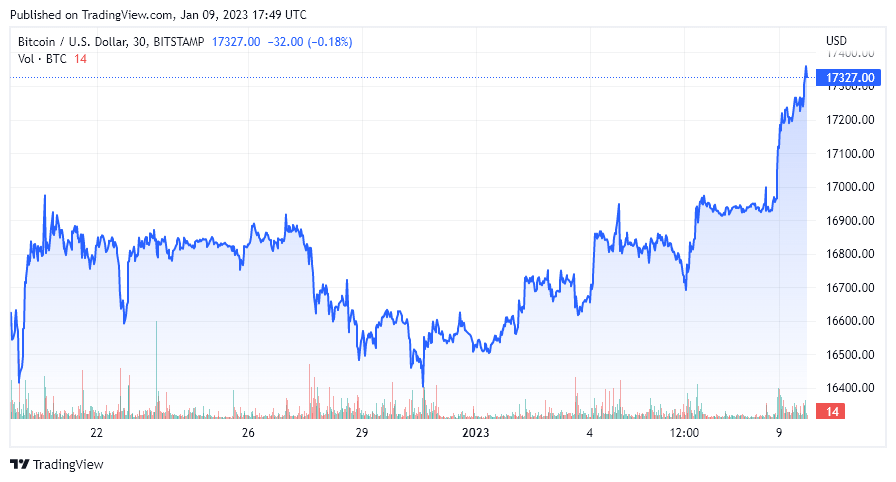

Crypto’s benchmark cryptocurrency, Bitcoin, has actually pressed past $17,000 for the very first time in 2023 after being array bound for a number of weeks in between $16,380 and also $16,975

Bitcoin has actually currently gotten on a favorable fad because the beginning of January when it opened up the year at $16,482 Bitcoin is up 3.72% over the last 7 days and also 2.33% in the previous 24 hrs, according to CryptoSlate information.

Why is Bitcoin pumping?

With an absence of considerable on-chain advancements within the Bitcoin ecological community, the rally shows up unlinked to any type of information pertaining to the network. Additionally, significant advancements within the crypto room at huge to which Bitcoin might respond have actually been limited.

However, as the dirt starts to choose the FTX information cycle, the usage situation for Bitcoin in self-custody is more powerful than ever before. An international monetary situation is impending with constantly high rising cost of living, no end in view for the battle in Ukraine, as well as expanding stress in between China and also the West. Additionally, the worry over which property course will certainly function as the most effective shop of worth in 2023 might be enhancing capitalists’ willpower in Bitcoin.

While Bitcoin functioned as a risk-on property throughout most of 2022, eyes currently relocate to whether Bitcoin will certainly duplicate its solid efficiency when the Ukraine battle began as we relocate additionally right into 2023.

The following Bitcoin cutting in half occasion is about 18 months away, so historic metrics recommend the booming market is not yet nearby. Lots of financiers have actually run away crypto after the troubled occasions of2022 The collapse of significant exchanges, tasks, hedge funds, as well as financing systems cleaned lots of capitalists while eliminating criminals from the area.

Forbes just recently reviewed prospective Bitcoin rate forecasts for 2023 with Alistair Milne, owner of Altana Digital Currency Fund, recommending it might get to as high as $300,000 by2024 Others had extra traditional quotes anticipating rates in between $30,000 and also $50,000, such as the Professor of Finance at Sussex University, Carol Alexander.

Eric Wall, the CIO of Arcane Assets, likewise mentioned all-time low remains in for Bitcoin, and also it will certainly currently race towards a $30,000 rate target in 2023.

Potential bear catch

The greatest elephant in the area, nonetheless, is the destiny of Digital Currency Group as well as, consequently, Genesis as well as the Grayscale Trust. A current CryptoSlate market record showcased the circumstance encountering DCG and also the prospective mayhem it might create on the crypto market need to it be compelled to sell off properties to stay clear of insolvency.

CryptoSlate is maintaining an eager eye on advancements at DCG as there have actually been no additional updates complying with the Winklevoss Twin‘s final notice pertaining to Genesis Earn funds. The Winklevoss bros established a due date of Jan. 8 for DCG to reply to an open letter, a day which has actually currently passed without a word.

The Forbes write-up discussed over likewise highlighted numerous standard money firms that anticipated Bitcoin would certainly drop listed below $10,000 this year. Most significantly, Eric Robertsen, the Global Head of Research for Standard Chartered, asked for $5,000 as “crypto companies and also exchanges locate themselves with not enough liquidity, bring about more insolvencies as well as a collapse in capitalist self-confidence in electronic possessions.”

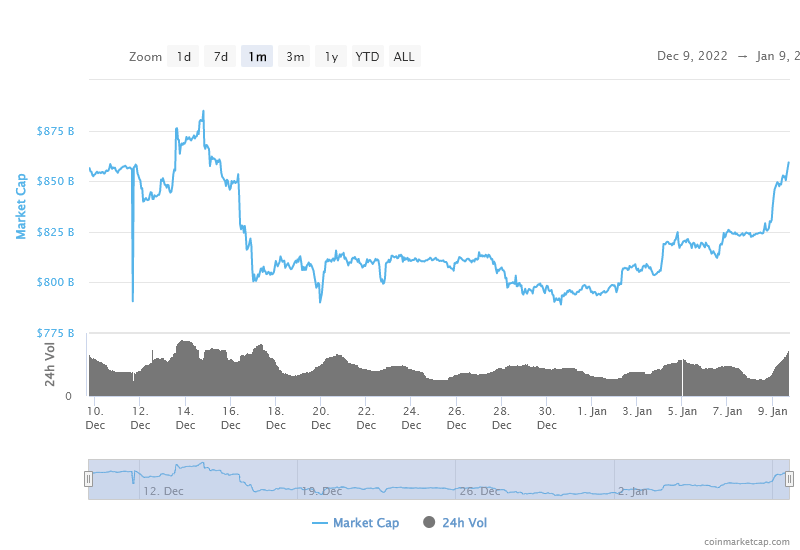

Yet, as the graph listed below suggests, the total crypto market cap has actually been rallying considering that2023 Over the previous 9 days, over $50 billion has actually been infused right into the crypto markets. As we invited in the brand-new year, the complete market cap was $795 billion yet has actually considering that struck $859 billion, according to CoinMarketCap.

The worldwide crypto market cap with Bitcoin got rid of stood at $477 billion on Jan. 1. It has actually progressively expanded to $525 billion, a boost of $58 billion. Therefore, while Bitcoin is executing well in 2023, the wider crypto market is outmatching the front runner crypto network. Just $18 billion has actually been infused right into Bitcoin, a plain 4.7% boost in market cap contrasted to the remainder of the overall market (minus Bitcoin), which increased by 10%.

Nothing has actually altered concerning Bitcoin’s principles, and also 2023 is readied to be a year where either the FIAT system resolves the rising cost of living trouble, or the occasions of 2008 return to attack reserve banks harder than ever before.

The FIAT issue

A globe where the FIAT system gets on its last legs is a globe where Bitcoin has the possible to preponderate. Time will certainly inform whether the U.S. Federal Reserve, Bank of England, European Central Bank, as well as Bank of Japan can reclaim financial control.

While Bitcoin has actually stayed level prior to beginning to climb in worth, the Dollar has actually been downward given that late September. The graph listed below programs the peak toughness of the Dollar being gotten to on Sept. 22,2022 Ever since, it has actually tipped over 10%, about the very same decrease seen on the Bitcoin graph for the exact same duration.

Bitcoin’s volatility has actually gone to several of the most affordable degrees in its background in between November and also January, moving 12% in both instructions throughout the duration.

Today’s cost activity in Bitcoin mirrors the Dollar’s bad efficiency over the last 24 hrs. Given that Jan. 6, the DXY has actually decreased by 2.49%, while Bitcoin has actually climbed by 2.9%. Certainly, neither of these steps is extraordinary. Needs to the DXY proceed to drop throughout 2023, it can offer Bitcoin the stamina it requires to return to degrees last seen prior to the negative stars created a market-wide sell-off throughout 2022.

Bitcoin is plainly placing itself as a trip from FIAT in a globe where international money are possibly in major risk. Certainly, there are several relocating components, some traditionally associated as well as some not, yet 2023 is unquestionably readied to be an intriguing experiment in exactly how Bitcoin executes in the middle of more international financial unpredictability.

At the time of press, Bitcoin is placed # 1 by market cap and also the BTC rate is up 2.39% over the past 24 hrs. BTC has a market capitalization of $33395 billion with a 24- hr trading quantity of $1801 billion Learn even more’

Market recap

At the time of press, the international cryptocurrency market is valued at $85535 billion with a 24- hr quantity of $4614 billion Bitcoin supremacy is presently at 3905% Learn even more’