A couple of days earlier, a lot of ASIC s pertaining to the mining of the Bitcoin SV blockchain showed up, boosting its hashrate. They aren’t exposing their identification, by running in an unseen method

The brand-new hashrate on the BSV chain is recognizable many thanks to the Bitcoin code, which tape-records the hash power committed to mining at every exposed block.

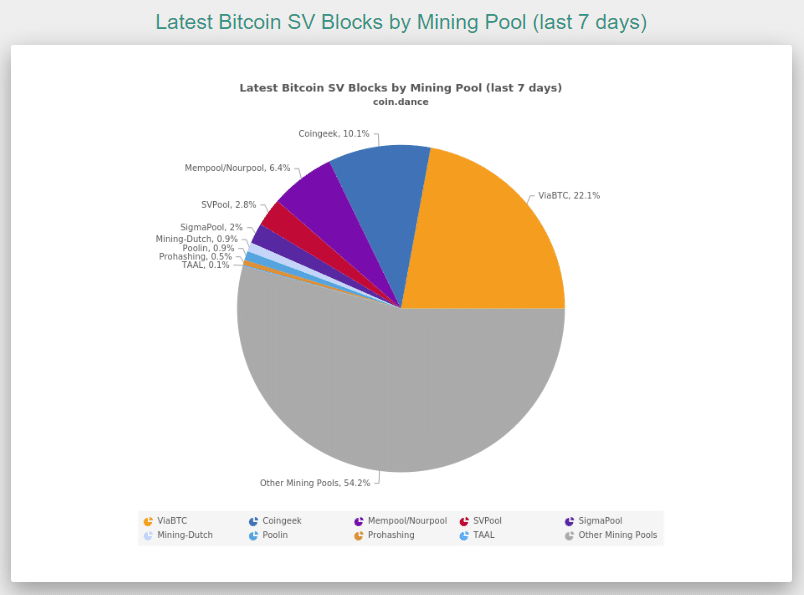

As can be seen with the Coin Dance solution, the computer power suggested as ” various other mining swimming pools” is more than 50%

The occasion occurred soon after BTC’s costs broke down What amazed the viewers is the truth that the blocks found by unidentified miners do not gather deal charges, so the electrical energy offered the calculation is just made up by the block incentive in BSV.

There are those that take this procedure gently encouraged that it is a joke, others that think about the threat of a feasible 51% strike, in case that the swimming pool is regulated by a couple of miners conspiring versus BSV.

Breaking: $ BSV being trolled tough “on-chain”

Unknown Miner/s gathering block benefits without tape-recording any kind of climate information or paid tweets

Has extra hash power than your whole BSV nation!

I scent an emergency situation fork in the stove, or a lawsuit lol

#bsv pic.twitter.com/FrmdBiZQUg— p00 rM3m0rY (@CourierBonded) March 23, 2020

There are those that rather like to see the procedure as a bank on BSV as well as the rise in its future worth, an indicator that would certainly validate the selection of unidentified miners to extract currently, prior to the halving of BSV that will certainly occur in 15 days.

Halving is coming close to for all SHA-256 cryptocurrencies, this is a really one-of-a-kind time after an amazing development of Bitcoin’s hashrate.

The rate has actually plunged because of the squander caused by Covid19 while the problem for BTC has actually enhanced many thanks to the boost of ASICs attached to the network completing for the incentive.

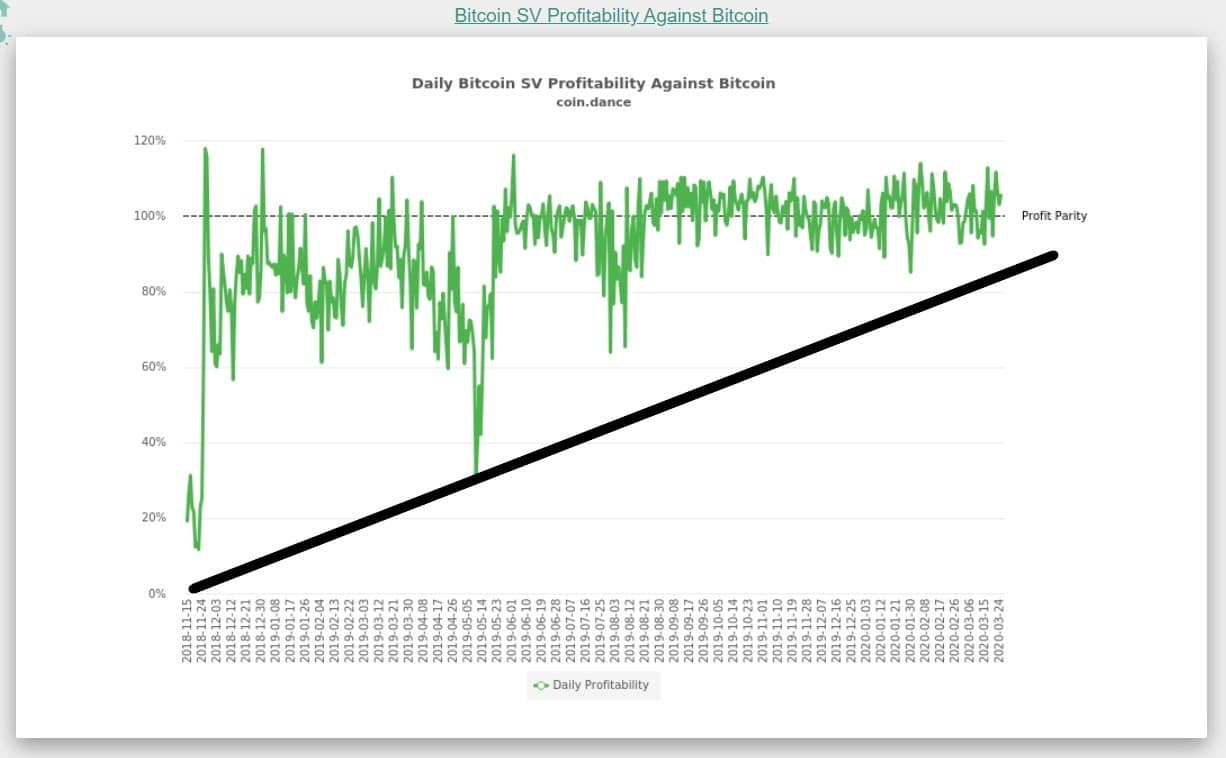

This indicates that the earnings of mining has actually lowered for BTC, which holds a huge piece of the SHA-256 hashrate offered on the marketplace.

Since the birth of BSV, leaving apart the problems of decentralization, the licenses of Nchain, Craig Wright as well as all the crypto-drama, a plain productivity computation sees BSV progressively intriguing in the short-term regarding earnings is worried.

Just like BCH as well as BTC, every 210,000 obstructs BSV miners experience a decrease in the mining benefit which goes down from 12.5 BSV to 6.25 per block.

Currently, miners adding to the remainder of the BSV hashrate consist of Taal, Coingeek, Viabtc, Prohashing, Mining-dutch, Mempool, Svpool, Sigmapool and also Poolin.

The network will certainly experience a decrease in the block benefit in 15 days. Long prior to BTC which still has 46 days left up until the halving. This distinction is because of the very first fork that saw BCH divided from BTC.

Despite continuous conflicts, Bitcoin SV has actually acquired greater than 178% in the in 2014

Some individuals assert that the cost has actually been adjusted, although background educates that on Bitcoin, whatever variation it is, it commonly occurs to hear this sort of case.

The BSV chain has actually constantly been bordered by debate, since the fork, the majority of the chain’s deal information originates from a Twitter-like application called Twetch and also an atmospheric system that tapes atmospheric information. Coin Metrics reported last July that 96% of BSV deals were originated from the WhaterSV application. In the last 24 hrs, the BSV chain has actually refined 599,851 purchases with an ordinary block dimension of around 1,795 MEGABYTES.

BTC miners deal with a quickly coming close to future where the marketplace rate of the coin might not increase sufficient to cover expenses.

While economic markets encounter a feasible worldwide economic crisis, capitalists have actually not yet hurried to get BTC.

If cpus remain to sustain the Bitcoin BTC network, they will certainly need to execute two times as numerous estimations with an equivalent rise in power intake to gain the exact same quantity of Bitcoin they are obtaining today.

This would certainly be balanced out if a number of them closed down in favour of a retargeting of the trouble, which would certainly raise the likelihood of extracting a block.

The halving will certainly compel numerous to switch over to brand-new specialized high-performance equipment due to the fact that older generation versions like Antminer S9 are ending up being expensive to run.

While some cpus will certainly be terminated as well as the hashrate will briefly reduce, brand-new gamers will promptly take their area.

Many smaller sized business might discontinue procedures and also wind up offering their devices to bigger drivers that are much better prepared to maximize expenses via economic situations of range.

.