Glassnode information assessed by CryptoSlate revealed an aberration in between extremely whales as well as retail, with the previous staying in hostile build-up setting entering into the brand-new year.

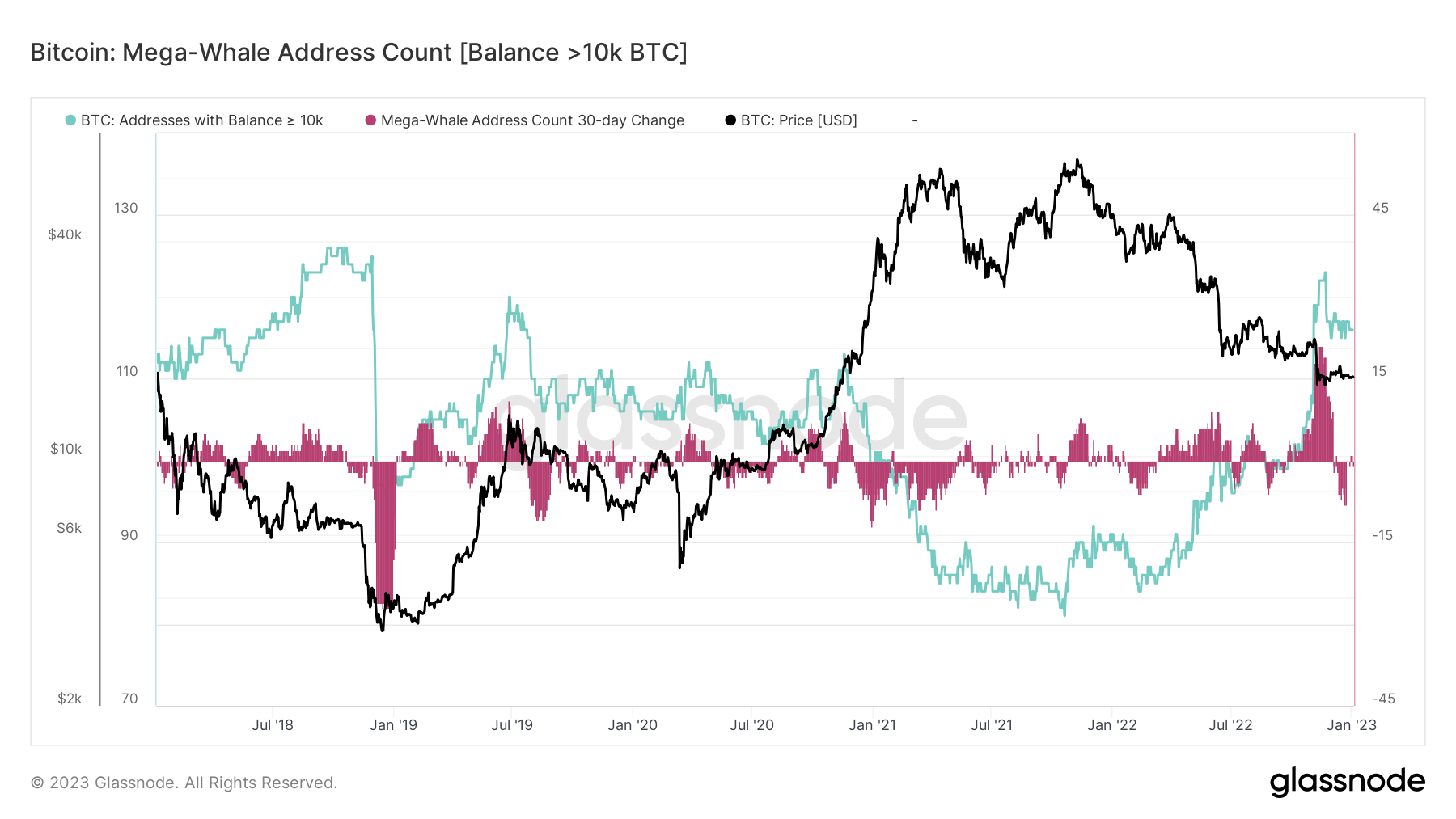

Bitcoin Accumulation Trend Score

The Accumulation Trend Score (ATS) considers the loved one dimension of entities that are proactively collecting or dispersing their Bitcoin holdings.

The ATS statistics makes use of a range in between 0 to 1. An analysis better to 0 suggests circulation or marketing. While a rating better to 1 reveals buildup or acquiring.

Analysis of the graph listed below revealed that significant build-up occurred throughout the FTX collapse about very early November 2022, also as the Bitcoin cost responded adversely to the information.

This recommends that financiers, all at once, saw worth in purchasing reduced rates.

The ATS has actually given that transformed a lot more neutral, with circulation predisposition, mirroring sticking around macro unpredictabilities entering into 2023.

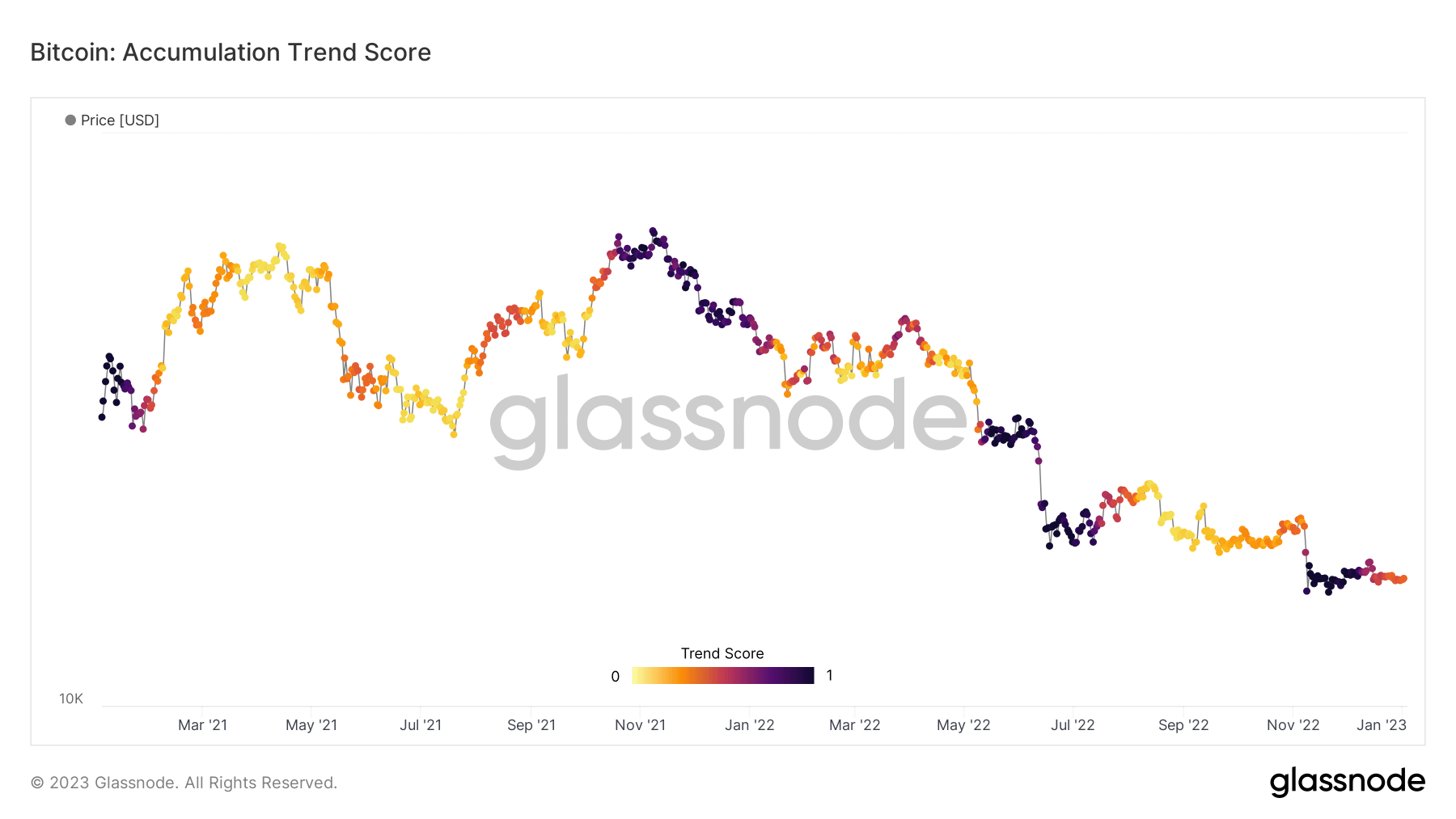

Cohort evaluation

Cohort evaluation offers a visual depiction of build-up and also circulation throughout 6 accomplices, varying from minnows with much less than one BTC to incredibly whales holding greater than 10,000 BTC.

As the FTX legend was exploding, all friends were building up boldy. This constant fad finished around mid-December 2022 when whales (entities holding in between 1,000 as well as 9,999 BTC) started greatly dispersing.

The modification in whale view spread throughout various other associate teams, which likewise started dispersing, yet not to the very same level as the whales. On the other hand, throughout this duration to the here and now, incredibly whales continued to be internet collectors to a solid level.

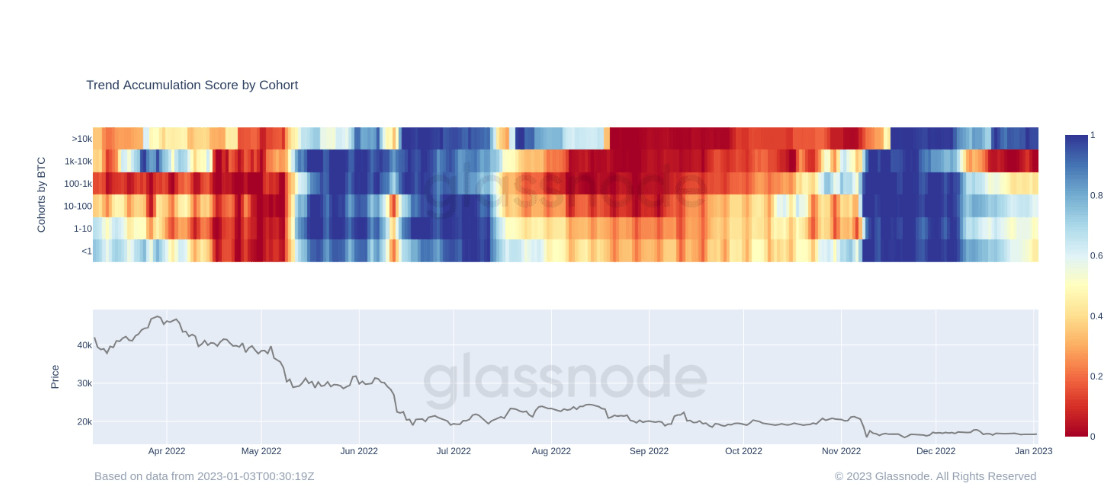

Mega-Whale Address Count

Analysis of the Bitcoin Mega-Whale Address Count Balance revealed entities with greater than 10,000 BTC went beyond 120 addresses at the tail end of in 2014. This included a 30- day adjustment of over 20 extra addresses, noting the fastest development price considering that 2018.

Coupled with the above graphes outlining hostile extremely whale buildup, it’s reasonable in conclusion wise cash capitalists were acquiring the dip.