Out of all the crypto acquired items, continuous futures have actually become a recommended tool for market supposition. Bitcoin investors make use of the tool en masse for threat hedging as well as catching financing price costs.

Perpetual futures, or continuous swaps as they’re often described, are futures agreements without expiry day. Those holding continuous agreements have the ability to acquire or offer the hidden property at an undefined factor in the future. The rate of the agreement continues to be the like the hidden possession’s place price on the agreement’s opening day.

To maintain the agreement’s rate near to the area rate as time passes, exchanges execute a system called a crypto financing price. The financing price is a tiny percent of a setting’s worth that have to be paid or obtained from a counterparty at normal periods, normally every couple of hrs.

A favorable financing price reveals that the cost of the continuous agreement is more than the area price, showing greater need. When the need is high, get agreements (longs) pay financing charges to the sell agreements (shorts), incentivizing opposing placements and also bringing the agreement’s cost better to the place price.

When the financing price is unfavorable, offer agreements pay the financing charge to the lengthy agreements, once again pressing the agreement’s rate more detailed to the area price.

Given the dimension of both the ending and also the continuous futures market, contrasting both can reveal the more comprehensive market view when it pertains to future cost activities.

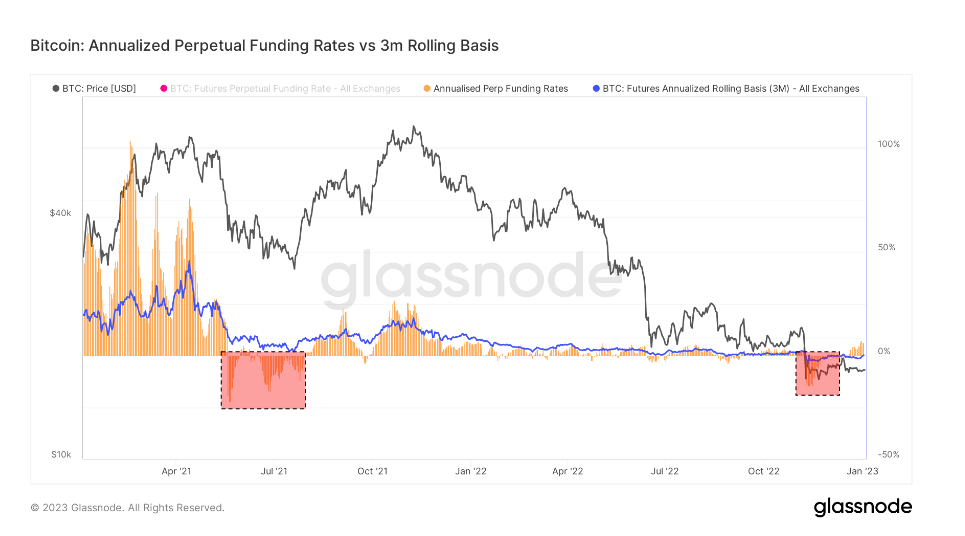

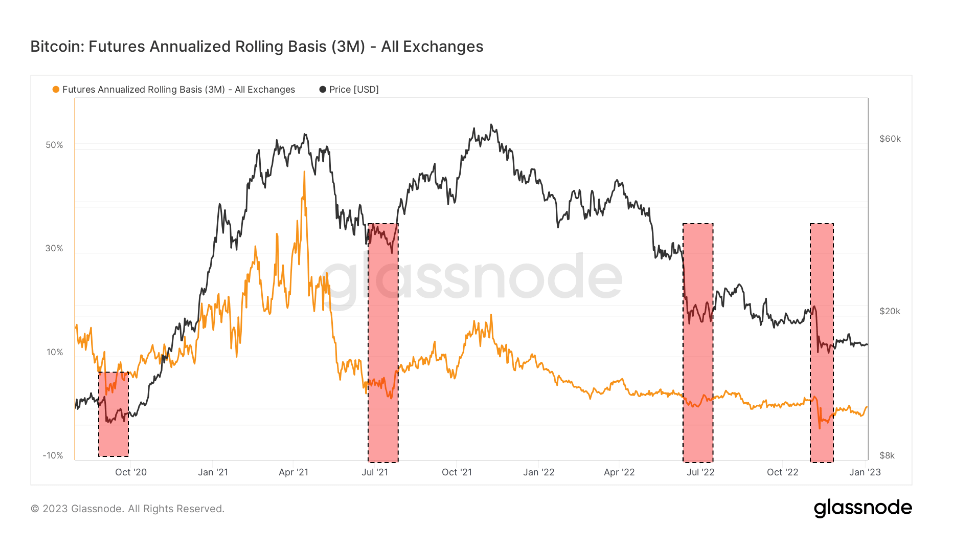

Bitcoin’s annualized 3-month futures basis contrasts the annualized prices of return offered in a cash-and-carry profession in between 3-month running out futures and also continuous financing prices.

CryptoSlate evaluation of this statistics programs that the continuous futures’ basis is considerably a lot more unpredictable than that of running out futures. The inconsistency in between both is an outcome of raised need for take advantage of in the marketplace. Investors appear to be searching for an economic tool that tracks area market value indexes much more very closely, as well as continuous futures match their requirements flawlessly.

Periods where the continuous futures’ basis professions less than the 3-month running out futures basis have actually traditionally happened after sharp cost decreases. Big derisking occasions such as booming market modifications or long term bearish downturns are typically complied with by a reduction in the continuous future basis.

On the various other hand, having the continuous futures basis profession more than the 3-month running out futures basis reveal high need for utilize in the marketplace. This produces an excess of sell-side agreements that bring about value depressions, as investors act quickly to arbitrage down the high financing prices.

Looking at the graph over programs that both Bitcoin running out futures as well as continuous swaps were selling a state of backwardation throughout the FTX collapse.

Backwardation is a state in which the cost of a futures agreement is less than the place cost of its hidden possession. It happens when the need for a possession obtains more than the need for agreements growing in the coming months.

As such, backwardation is a rather unusual view in the by-products market. Throughout the collapse of FTX, ending futures were trading at an annualized basis of -0.3%, while continuous swaps were trading on an annualized basis of -2.5%.

The only comparable durations of backwardation were seen in September 2020, the summer season of 2021 complying with the China mining restriction, and also July2020 These were durations of severe volatility as well as were controlled by shorts. Every one of these durations of backwardation saw the marketplace hedged in the direction of the drawback as well as getting ready for more depressions.

However, every duration of backwardation was complied with by a rate rally. Higher rate activity started in October 2020 as well as came to a head in April2021 July 2021 was invested at a loss as well as was adhered to by a rally that proceeded well right into December2021 The Terra collapse in June 2022 saw a rally in late summertime that lasted till completion of September.

The upright cost decrease brought on by the FTX collapse induced backwardation that looks strangely comparable to the formerly tape-recorded durations. If historic patterns were to repeat, the marketplace might see favorable rate activity in the coming months.

At the time of press, Bitcoin is rated # 1 by market cap and also the BTC rate is up 1.06% over the past 24 hrs. BTC has a market capitalization of $32589 billion with a 24- hr trading quantity of $1284 billion Learn even more’

Market recap

At the time of press, the international cryptocurrency market is valued at $82322 billion with a 24- hr quantity of $2636 billion Bitcoin prominence is presently at 3959% Learn even more’