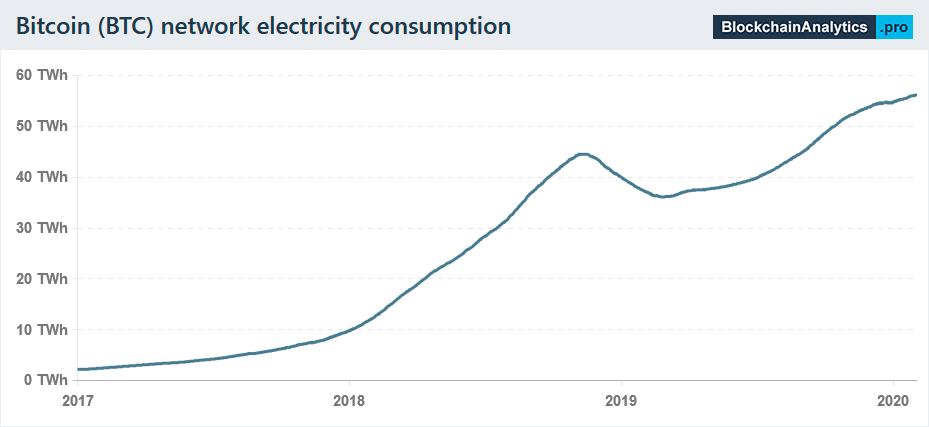

According to research study by BlockchainAnalytics.pro, Bitcoin’s power intake in 2019 went beyond that of the entire of New Zealand

Blockchain Analytics approximates that 2019 finished with an ordinary yearly power intake of concerning 43 TWh, which is somewhat greater than New Zealand’s yearly need, as well as a little much less than that of Portugal (49 TWh), Romania (50 TWh) as well as the Czech Republic (59 TWh).

This number is likewise revealing solid development contrasted to previous years In 2018 usage was much less than 29 TWh, even more or much less the very same as in Nigeria, while in 2017 it was just around 5 TWh, the very same as in Jamaica.

Moreover, according to traditional quotes, in 2020 Bitcoin’s power usage will certainly surpass 70 TWh, approximately the like that of Chile, which has 18 million residents.

Just by forecasting the existing information, the yearly usage would certainly be 56.3 TWh, nearly like that of the Czech Republic, nonetheless, this number promises to expand in the coming months.

The presumptions on which these quotes are based are extremely traditional, which implies that these numbers are likewise conventional: it is feasible that the real usage might be also greater.

The reality is that Bitcoin is coming to be progressively preferred and also better, and also seeing that the price of mining relies on the cost (as well as not the other way around) its constant rise in worth time after time certainly brings about greater expenditures for miners, brought on by greater electrical energy intake.

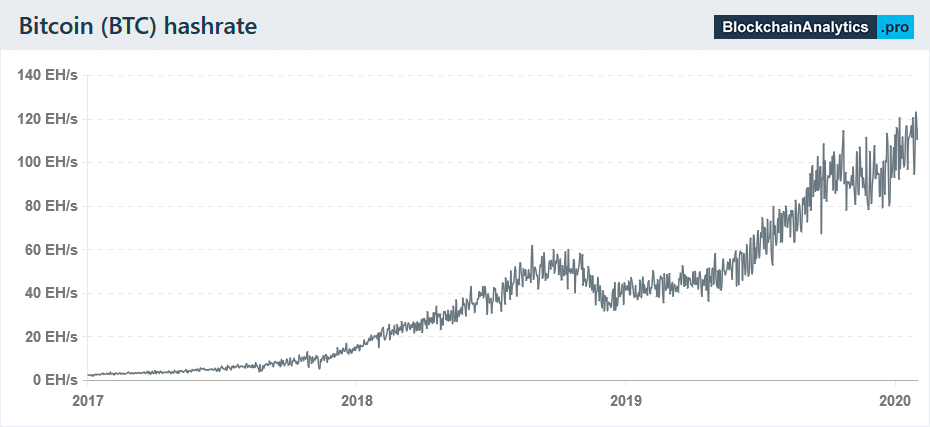

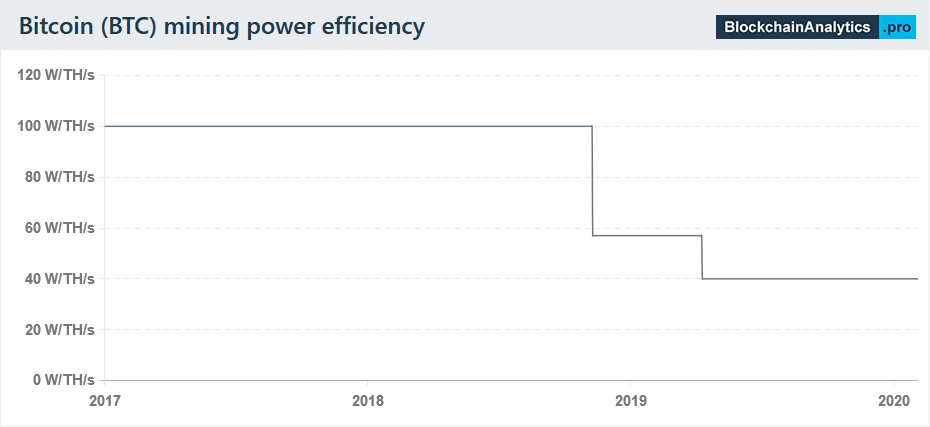

In enhancement to this, there is a constant development in hashrate, which schedules primarily to the boosted effectiveness of the ASICs.

For instance, in the currently remote 2016, Bitmain released the Antminer S9, which eaten 100 watts to generate a terahash per 2nd (100 W/TH/s).

In 2018 the Antminer S15 was launched, which minimized power intake to 57 W/TH/s, while the existing Antminer S17 eats just 40 W/TH/s. This results in a rise in hashrate, as the TH/s that can be created rises with the intake.

Although theoretically, this rise in effectiveness might decrease electrical energy intake, in truth, the boost in Bitcoin’s yearly typical worth certainly results in a rise in power intake, considered that the costs power of the miners boosts consequently, enabling them to acquire even more power to take in.

In truth, the intake development contour relocate line with the rise in hashrate, although it stays to be seen what will certainly occur with the halving in May 2020 which will certainly reduce miners’ benefits in fifty percent.

However, it ought to be kept in mind, for instance, that after the last halving, in July 2016, the decrease in hashrate was very little and also just momentary, and also by August it had actually currently gone back to pre-halving degrees. it is challenging to picture that the following halving might in fact considerably decrease Bitcoin’s power usage

.