- BlockFi: A Quick Summary

- Why Did BlockFi Go Bankrupt?

- BlockFi and SEC Fines: Latest Update

- The BlockFi Team

- Just How Much Money has BlockFi Raised?

- How Does BlockFi Make Money?

- Is BlockFi Safe? Is Your Money Safe on BlockFi?

- How do I obtain a BlockFi Account?

- How do I get in contact with BlockFi Customer Service?

- Is BlockFi guaranteed?

- Last Thoughts: Is BlockFi Legit?

BlockFi is a cryptocurrency-focused wealth generation platform that used a suite of items, such as the BlockFi charge card, a BlockFi custodial wallet, and a cryptocurrency interest account.

The business at first introduced with a cryptocurrency interest account item, using around 4.5% APY on BTC and as much as 9.5% on stablecoins. They put this offering on ice in February 2022. Paying $100 million in fines to the SEC and 32 states, BlockFi stopped all BlockFi Interest Account uses to bring its organization within the Investment Company Act of 1940.

BlockFi stated insolvency in November 2022 due to the disastrous fallout from the also-bankrupt FTX exchange: BlockFi had actually involved itself in a complex synergistic relationship with FTX previously in the year

Editor’s Note: This post was upgraded in December 2022 to show BlockFi’s insolvency and response to the occasions of 2022.

BlockFi: A Quick Summary

BlockFi is a privately-held NYC-based financing platform established in 2017.

BlockFi’s flagship item was the BlockFi Interest Account (BIA), which permitted users to make substance interest on cryptocurrencies such as BTC, ETH, LTC, USDC, USDT, GUSD, and PAXG.

Throughout the BIA’s operation from 2017 to 2022, stopped by the above-mentioned contract with the SEC, BlockFi kept cryptocurrency deposits protected and regularly produced yield for its depositors, slowly dropping its rates at the same time. It likewise introduced a multitude of brand-new items, consisting of the BlockFi charge card.

BlockFi gathered a credibility as one of the leading and most-trusted cryptocurrency interest accounts, especially, popular amongst those crazy about producing passive earnings

BlockFi deposits aren’t FDIC guaranteed These accounts weren’t expected to be thought about cost savings account they were financial investment accounts with a distinct dangers.

Why Did BlockFi Go Bankrupt?

BlockFi stopped briefly all client deposits into its interest-bearing account, it continued providing operations.

In May 2022, BlockFi lent $680 million to Alameda Research, FTX’s associated hedge fund.

Following subsequent the cryptocurrency crash, among BlockFi’s biggest debtors, Three Arrows Capital, collapsed– 3AC had actually taken an almost $200 million loss in the Luna ordeal.

BlockFi, in alarming straits, handled to acquire a $400 credit center from FTX in July 2022, which likewise consisted of a choice for FTX to buy the business in the future for as much as $240 million.

BlockFi quickly discovered itself in a complex incestuous relationship with being owed cash by Alameda Research (FTX’s affiliate hedge fund) and owing FTX $275 million from the July bailout.

BlockFi was likewise utilizing the FTX exchange to trade cryptocurrencies– and had $355 countless its crypto (i.e., user funds) secured when FTX applied for insolvency in November 2022.

In November 2022, BlockFi submitted insolvencydeclaring it owes cash to over 100,000 lenders; it likewise offered a part of its cryptocurrency possessions, going into insolvency with $256.5 million money on hand.

In addition to the over 100,000 users with funds secured BlockFi, a few of BlockFi’s biggest financial institutions consist of:

- West Realm Shires Inc., (the legal name for FTX United States): $275 million unsecured claim,

- the Securities and Exchange Commission (SEC): $30 million unsecured claim.

- Ankura Trust Company: a $730 million unsecured claim.

BlockFi and SEC Fines: Latest Update

The gripe with BlockFi’s Interest Account mainly focused on:

- The agreement is that the BIA’s are really securities, and the business had not registered them.

- An insufficient disclosure of threat in website and marketing copy

- BlockFi releasing securities along with holding more than 40% of its overall possessions in financial investment securities (such as loans of cryptocurrency properties to institutional debtors).

BlockFi’s moms and dad business settled, accepting pay a $50 million charge to the SEC, stop its deals and sales of the unregistered BlockFi Interest Account, and effort to bring its organization within the arrangements of the Investment Company Act within 60 days. BlockFi presently owes the SEC $30 million.

BlockFi paid an extra $50 million in fines to 32 states.

BlockFi likewise revealed it plans to sign up the deal and sale of a brand-new financing item under the Securities Act of 1933. The brand-new item has actually not yet been signed up nor divulged

The complete news release from the SEC can be discovered here

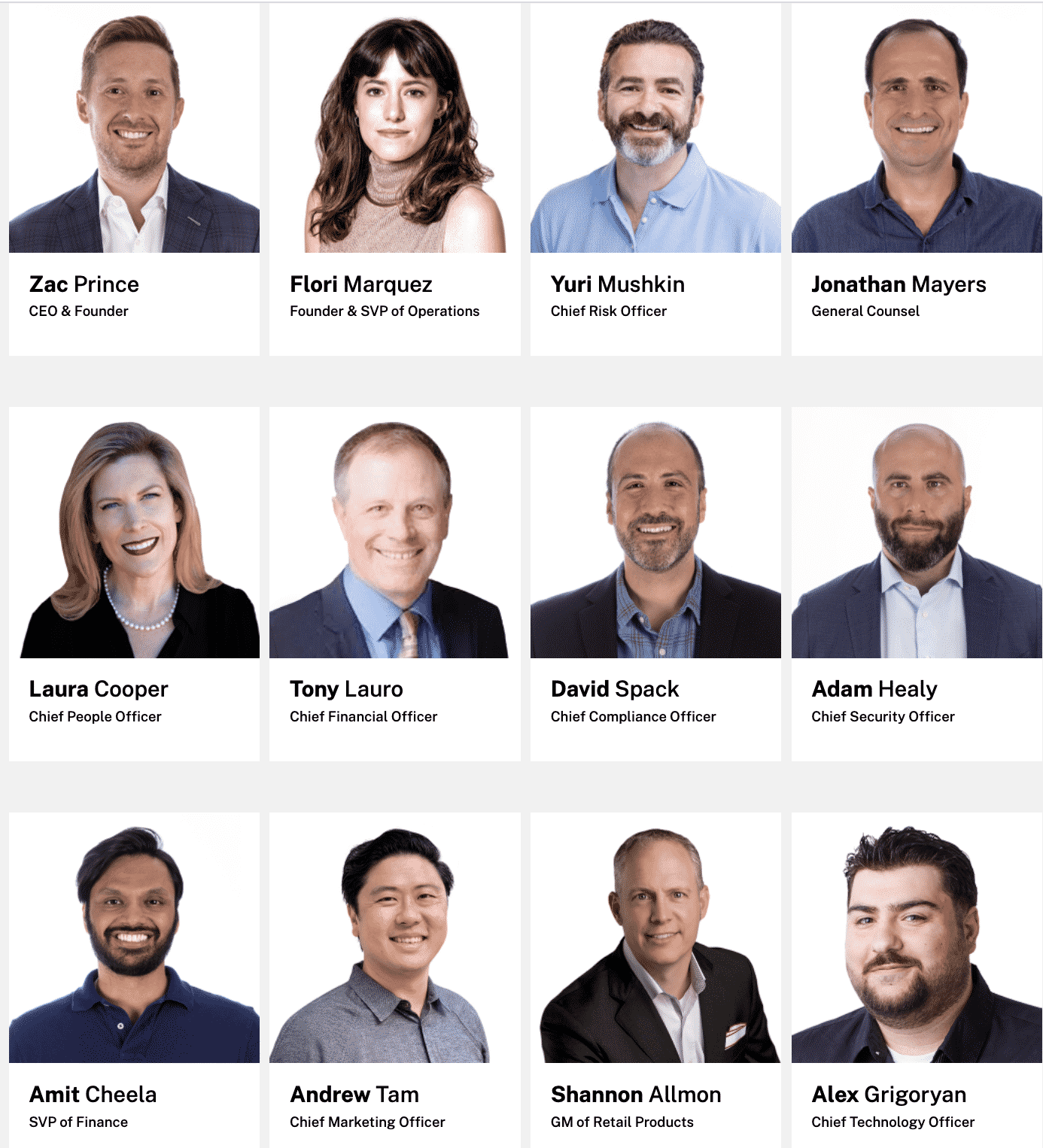

The BlockFi Team

BlockFi’s management group has years of experience in the conventional monetary services and banking world. The business declares to take a conservative method to guideline that will place it for sustainable long-lasting development and growth.

Creator & & CEO, Zac Prince has management experience at several effective tech business. Prior to beginning BlockFi, he led organization advancement groups at Orchard Platform, a broker-dealer and RIA in the online loaning sector, and Zibby, an online customer lending institution.

Co-Founder & & VP of Operations Flori Marquez has experience handling alternative financing items. She assisted construct and scale a $125MM portfolio for Bond Street (obtained by Goldman Sachs) as Head of Portfolio Management. She handled all operations, consisting of point of origination, default, and lawsuits.

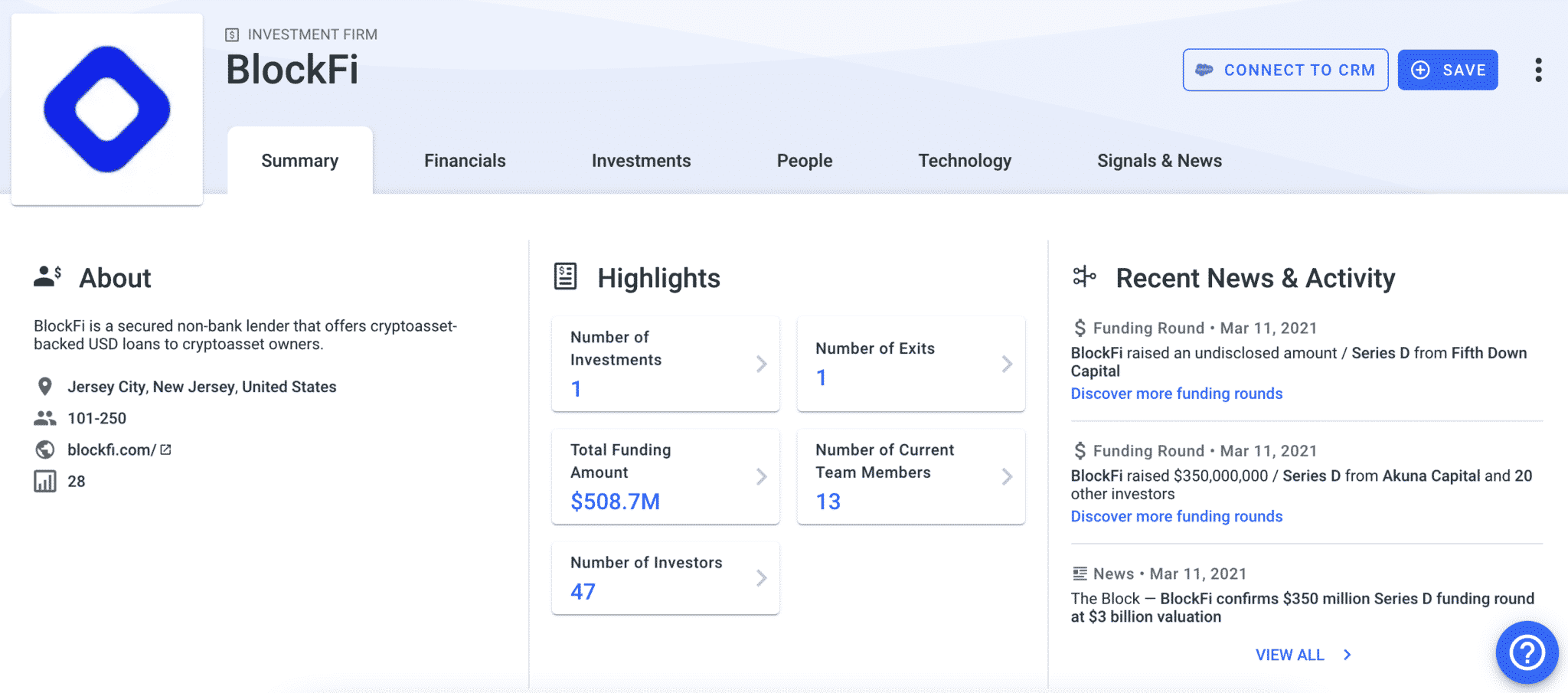

Just How Much Money has BlockFi Raised?

BlockFi has actually raised a overall of $508.7 M, valuing the young business at $3 billion BlockFi’s income has actually grown 10x over the previous year, putting it on track to reach $100M in income over the next year. With over $1.5 B in properties on the platform, and a 0% loss rate throughout its financing portfolio, BlockFi has actually made a strong case for developing itself as a dominant entity in the overarching emerging FinTech area.

BlockFi raised its lion’s share of financing in a $350M Series D, led by brand-new financiers such as Bain Capital Ventures, Pomp Investments, Tiger Global, and partners of DST Global. In a news release, BlockFi noted it prepares to utilize the inflow of capital to check out more development in its item suite, speed up brand-new market growth, and possibly money brand-new acquisition chances.

BlockFi raised $50 million in its Series C led by Morgan Creek Digital, with getting involved financiers such as Valar Ventures, Winklevoss Capital, Kenetic Capital, CMT Digital, Castle Island Ventures, SCB 10X, HashKey, Avon Ventures, Purple Arch Ventures, Michael Antonov, NBA gamer Matthew Dellavedova, and 2 university endowments.

Prior to its current Series C, BlockFi raised $18.3 million in Series A financing led by the Peter Thiel-backed Valar Ventures with involvement from Winklevoss Capital, Galaxy Digital, ConsenSys Ventures, Akuna Capital, Avon Ventures, Susquehanna, CMT Digital, Morgan Creek, and PJC.

BlockFi has actually likewise raised earlier rounds by SoFi and Purple Arch Ventures.

The group keeps in mind that they expect raising extra capital in the future to assist in ongoing item advancement and fast development.

Since March 2021, the platform has more than 265,000 retail and 200,000 institutional customers, with reported month-to-month income of $50m in 2021, compared to $1.5 m regular monthly profits in 2020.

How Does BlockFi Make Money?

BlockFi has a couple of income streams.

Its previous Interest Account was a spread service that earns money by obtaining capital at a particular rate (the rates of interest it pays to users) and provides it a greater rate (the rate of interest it uses for BTC/ETH/GUSD loans) A BlockFi article notes that the business mostly deals with institutional counter-parties to use them liquidity. These debtors include:

- Traders and mutual fund looking for arbitrage trading chances in a fragmented market. They obtain cryptocurrency to close mispricing spaces in between exchanges or dispersed markets. Margin traders will obtain to sustain their trading methods.

- Over-the-counter (OTC) market makers that link purchasers and sellers that choose not to negotiate over public exchanges, frequently at a high mark-up. These celebrations require to keep cryptocurrency stock on hand to fulfill need. Considering that owning the cryptocurrency is really capital extensive and bears the dangers of rate volatility, OTC market makers will obtain from loan providers such as BlockFi to facilitate their requirements.

- Other companies that require a stock of cryptocurrency to offer their customers with liquidity. This classification consists of companies such as cryptocurrency ATMs that keep most of their cryptocurrency possessions in freezer and require some level of liquidity to work daily.

Today, BlockFi still earns money on the spread of possessions exchanged on its platform, interest paid on its loans, and numerous plans with its charge card account.

Throughout the bulk of its operations, BlockFi was considered as a top-tier item, a minimum of in the cryptocurrency market; it was thought about to be safe, and its executive group promised to keep user funds safe.

As rubber fulfilled the roadway, BlockFi had no option however to obstruct all consumers from withdrawing their properties. A BlockFi agent reached to call BlockFi “the reverse of FTX,” mentioning its fully grown, constant management, skilled personnel, and correct procedures and treatments.

Since composing, all user deposits are locked on the platform.

When we initially released this post in 2019, we spoke with a member of the BlockFi group concerning different circumstances concerning the business’s security and organization design. The actions are kept in their initial type listed below.

What occurs if BlockFi gets hacked?:”Gemini is BlockFi’s main custodian and BlockFi does not hold personal secrets straight. Gemini keeps the large bulk of its possessions in freezer and is guaranteed by AonGemini is a certified custodian and managed by the NYDFS. They just recently got SOC2 Type 1 compliance audit from Deloitte for their custody service. We motivate users to learn more about Gemini’s security.

What takes place if a user account is jeopardized?:”Considering that beginning, BlockFi has actually not lost any consumer funds. In case a user’s account is jeopardized, which our security procedures have actually captured in the past, we freeze the person’s represent one week. We perform a Videoconference with the impacted person to validate their identity. We can then alter their e-mail address and password, so they can gain back control of their account.”

What takes place if all of a sudden everybody defaults on their cryptocurrency loans? ” When we provide crypto possessions to produce yield, we have an incredibly comprehensive danger management and credit analysis procedure. We just mostly provide to big, well-capitalized, institutional customers, or to counter-parties happy to publish security and supply the capability to margin call them on a 24/7 basis.”

“What that suggests is, if we are providing $1M worth of BTC to Firm XYZ, Firm XYZ collateralizes the loan (usually ~ 120%) by providing us ~$ 1.2 M USD. If the loan were to then go into margin call and the customer was not able to offer extra security (default), we would utilize their USD security to purchase crypto.”

“We have actually actively provided given that January of 2018, consisting of throughout several durations of high volatility, with no losses throughout our whole loaning portfolio. BlockFi is bound by NDA’s to go over regards to particular borrowers/rates.”

How do I look for a BlockFi Account?

Registering for BlockFi is relatively uncomplicated and can be performed in under 2 minutes. Please keep in mind that it is not presently using the BlockFi Interest Account.

- You can begin right from this BlockFi evaluation. Go to the BlockFi siteUtilizing this code, you can get as much as $75.

- Go to the “Get Started” in the menu.

- Enter your e-mail and make a password to produce your account.

- Get in the confirmation code sent out to that e-mail.

- As soon as visited, choose “Deposit” to validate your identity and make your very first deposit.

- Enter your individual info for confirmation (part 1)

- Submit a kind of ID such as a passport, chauffeur’s license, or ID card and wait to be authorized.

How do I get in contact with BlockFi Customer Service?

If you ‘d like to call client service, you can reach them at support@blockfi.com

Far, BlockFi assistance has actually been well above typical Let us understand how your experience was any various!

Is BlockFi guaranteed?

Is BlockFi FDIC guaranteed? Well, given that FDIC insurance coverage does not use to digital properties such as cryptocurrencies, your deposits in BlockFi are not covered by FDIC insurance coverage. BlockFi utilizes partner business Gemini as its custodial service, and Gemini does have its own insurance coverage for its deposits. Take this with a grain of salt, as BlockFi has yet to experience a hack for user funds– insurance coverage is just as great as it works, and it has yet to be figured out (and ideally never ever will be!)

BlockFi Interview: How Did BlockFi Work?

The BlockFi Interest Account just exists for previous consumers, who even then aren’t able to include more funds, there are some lessons that can be gotten about the developing cryptocurrency interest account specific nicheExcerpts are from our interview with the BlockFi group, prior to the SEC occasion pointed out above.

How is using a 4.5% on BTC rate of interest sustainable?

“The interest we have the ability to pay is based upon the yield that we have the ability to create from loaning, which straight associates to the marketplace need in the area (I.e. what rate organizations want to pay to obtain particular crypto possessions, as it differs from property to possession). We are bound by NDAs to talk about specifics (organizations, particular rates, and so on).”

How about the 9% rate of interest on Stablecoins like GUSD?

“We have the ability to utilize stablecoin deposits to money our customer loans (typical APR is ~ 10-13%) so we can pay for to pay greater interest to GUSD/ Stablecoin depositors.”

The BlockFi rate of interest undergoes alter on a month-to-month basis, could you discuss why this is?

“Upcoming modifications are revealed normally 1-2 weeks prior to a brand-new month, offering customers sufficient notification and time to prepare. The interest we have the ability to pay is a function of the loaning need.

You can learn more about why our rates vary and how the loaning market works here and here“

What occurs when it comes to a BTC/ETH fork? Will a. user’s balance be credited with the forked coin too?

“Gemini is our custodian and has all of the details about what occurs when it comes to a forked network. Please describe their user contract here where you can find out more about that.”

Last Thoughts: Is BlockFi Legit?

In our preliminary evaluation, all of our indications (history, group, interaction with assistance, and service design assessment) indicated BlockFi being legitimate– suggesting it was a genuine business and not a rip-off.

In spite of not being a straight-out fraud, its users discover themselves at a comparable outcome– with their funds out of reach, possibly gone permanently.

Optimistically, we might see some (or maybe too optimistically, all) of the user’s made whole; this is a continuous occasion, and we will upgrade this short article appropriately.

At any time your cryptocurrency leaves your hard cold walletsit’s exposed to a greater degree of threat. If BlockFi or Gemini were to experience some disastrous occasion, your cryptocurrency would be at threat– and as evidenced above, these things can occur to even the most apparently genuine business.

Editor’s Note/disclaimers: The above short article isn’t financial investment recommendations. This evaluation is composed for instructional and home entertainment functions. Do not invest anything you can not pay for to lose, and talk to a certified monetary consultant if you’re interested in cryptocurrency.

Never Ever Miss Another Opportunity! Get hand chosen news & & information from our Crypto Experts so you can make informed, notified choices that straight impact your crypto revenues Register for CoinCentral complimentary newsletter now.