- BlockFi vs. Crypto.com: Key Information

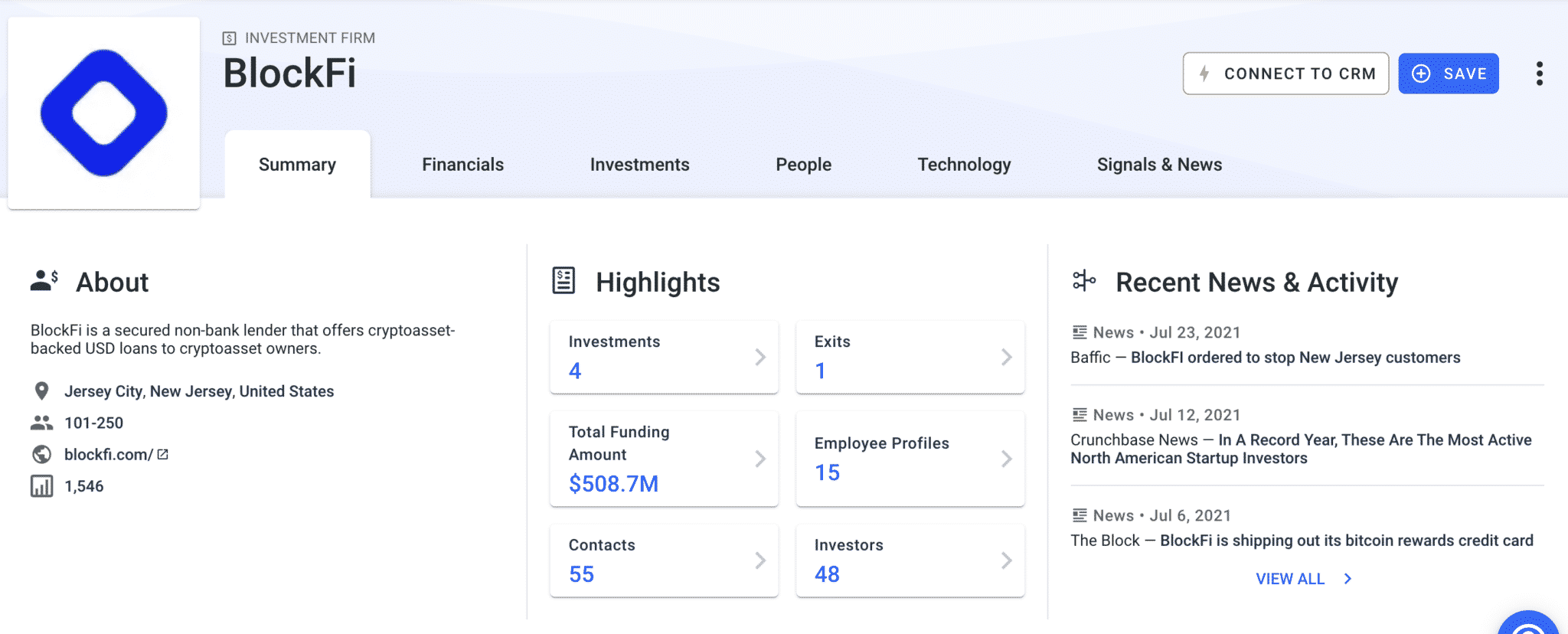

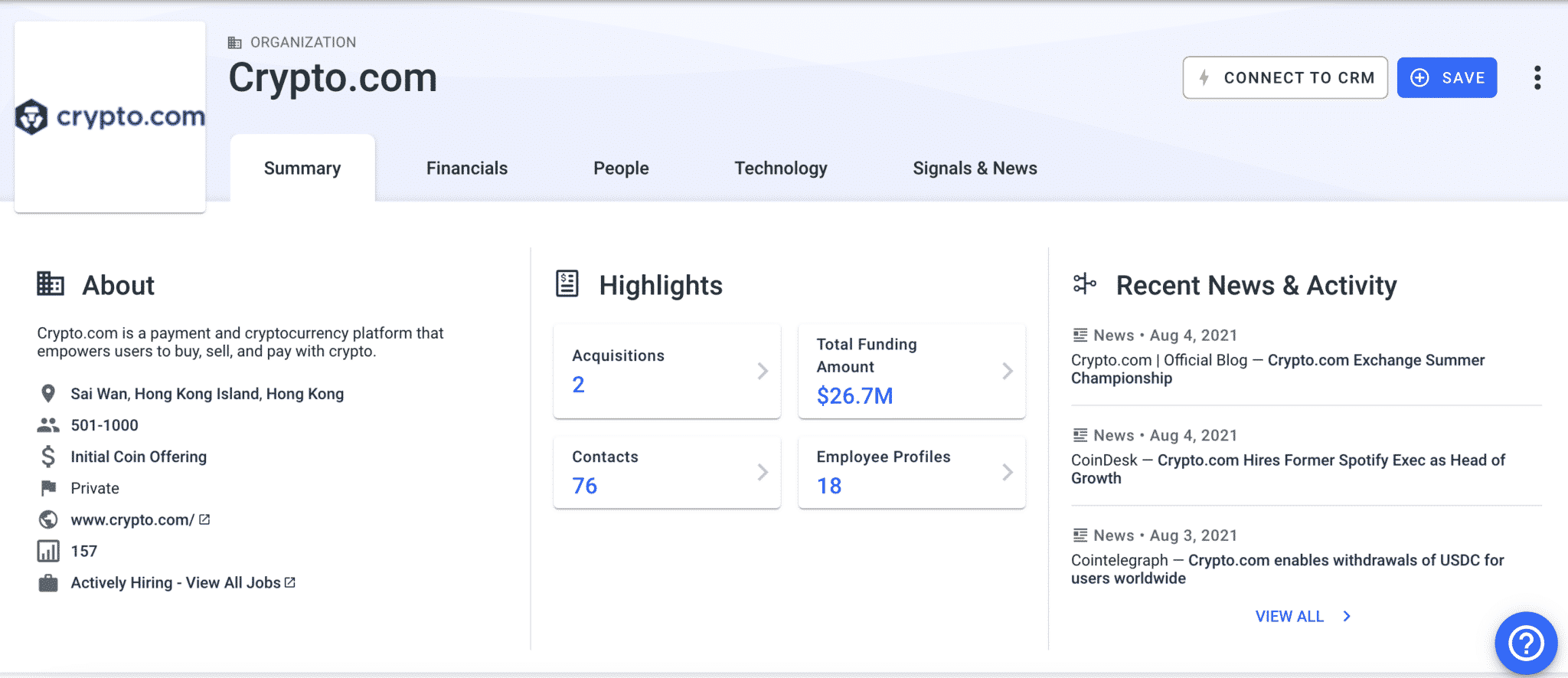

- Business Bios: BlockFi vs. Crypto.com

- Function # 1: Interest Rates: Who Pays More, BlockFi or Crypto.com?

- How Do BlockFi and Crypto.com Make Money?

- Function # 2: Payouts and Withdrawals

- Function # 3: BlockFi vs. Crypto.com Security

- Function # 4: Ease of Use

- BlockFi vs. Crypto.com Standout Features

- The Court of Public Opinion: BlockFi vs. Crypto.com Reddit

- BlockFi vs. Crypto.com Customer Support

- Can You Trust BlockFi and Crypto.com?

- BlockFi vs. Crypto.com: Which is the Better Crypto Interest Account?

Editor’s note: During the bulk of its operations, BlockFi was considered as a top-tier item, a minimum of in the cryptocurrency market; it was thought about to be safe, and its executive group promised to keep user funds safe. By November 2022, BlockFi had no option however to obstruct all consumers from withdrawing their possessions due to its complicated monetary relationship with FTX and FTX affiliate hedge fund Alameda Research.

If you’re weighing your cryptocurrency interest account alternatives, Blockfi vs. Crypto.com is a strong very first contrast.

BlockFi is based in the U.S. and is considered as a CeFi staple. It’s simple to begin, highly-trusted within the cryptocurrency neighborhood, and provides above-average yields throughout coins like BTC, ETH, and USDC.

BlockFi has an exchange, interest account, and charge card that all effortlessly set together.

Crypto.com is based in Hong Kong and has actually developed itself as a leader in what it does, which is relatively whatever. Its items consist of an exchange, interest account, staking platform, NFT storage platform, charge card, and more.

While Crypto.com uses a few of the greatest APY for its interest account, it needs its users to leap through lots of hoops and hold substantial quantities of its native token, CRO, to get them.

Our complete BlockFi vs. Crypto.com contrast consists of whatever you require to understand about rates, security, public trust, and more.

Let’s begin.

BlockFi vs. Crypto.com: Key Information

| BlockFi | Crypto.com | |

| Evaluations | BlockFi Review | Crypto.com Review |

| Website Type | Cryptocurrency interest account + fundamental exchange | Crypto exchange + crypto interest account + NFT exchange |

| Novice Friendly | Yes | Yes |

| Mobile App | Yes | Yes |

| Buy/Deposit Methods | ACH, wire transfers, crypto deposits | ACH, wire transfers, PayPal, credit or debit card |

| Sell/Withdrawal Methods | External crypto wallet, checking account | External crypto wallet transfer, ACH |

| Readily available Cryptocurrencies | Bitcoin, Ethereum, Litecoin, Link + stablecoins | Bitcoin, Ethereum, Dogecoin, stablecoins, other altcoins |

| Business Launch | 2017 | 2016 |

| Place | Jersey City, NJ, USA | Hong Kong |

| Neighborhood Trust | Poor | Fantastic |

| Security | Terrific | Fantastic |

| Consumer Support | Great | Excellent |

| Confirmation Required (KYC) | Yes | Yes |

| Charges | Medium | Typical |

| Website + Promo | The business is insolvent | Make as much as $25 on Crypto.com |

Business Bios: BlockFi vs. Crypto.com

BlockFi was established in 2017 by Zac Prince and Flori Marquez. It’s headquartered in New Jersey and has actually gotten financial investments from a number of huge names in the Fintech and cryptocurrency markets, consisting of SoFi, Winklevoss Capital, and Pomp Investments.

BlockFi’s most current round of financing happened in March 2021, in which it raised $350 million at a $3 billion assessment. The business has around $15 billion in possessions under management (AUM).

Crypto.com was introduced in Hong Kong under the name Monaco Technologies in June 2016 however rebranded in July 2018 to its existing name. The business grew rapidly, as it was accepted into a Hong Kong-government-backed cryptocurrency incubation program called SuperCharger in 2017

Crypto.com is led by CEO Kris Marszalek and CFO Rafael Melo. Its group has plenty of alumni from a few of the most significant names in both standard financing and cryptocurrency, consisting of:

- Deutsche Bank

- JP Morgan

- PayPal

- Binance

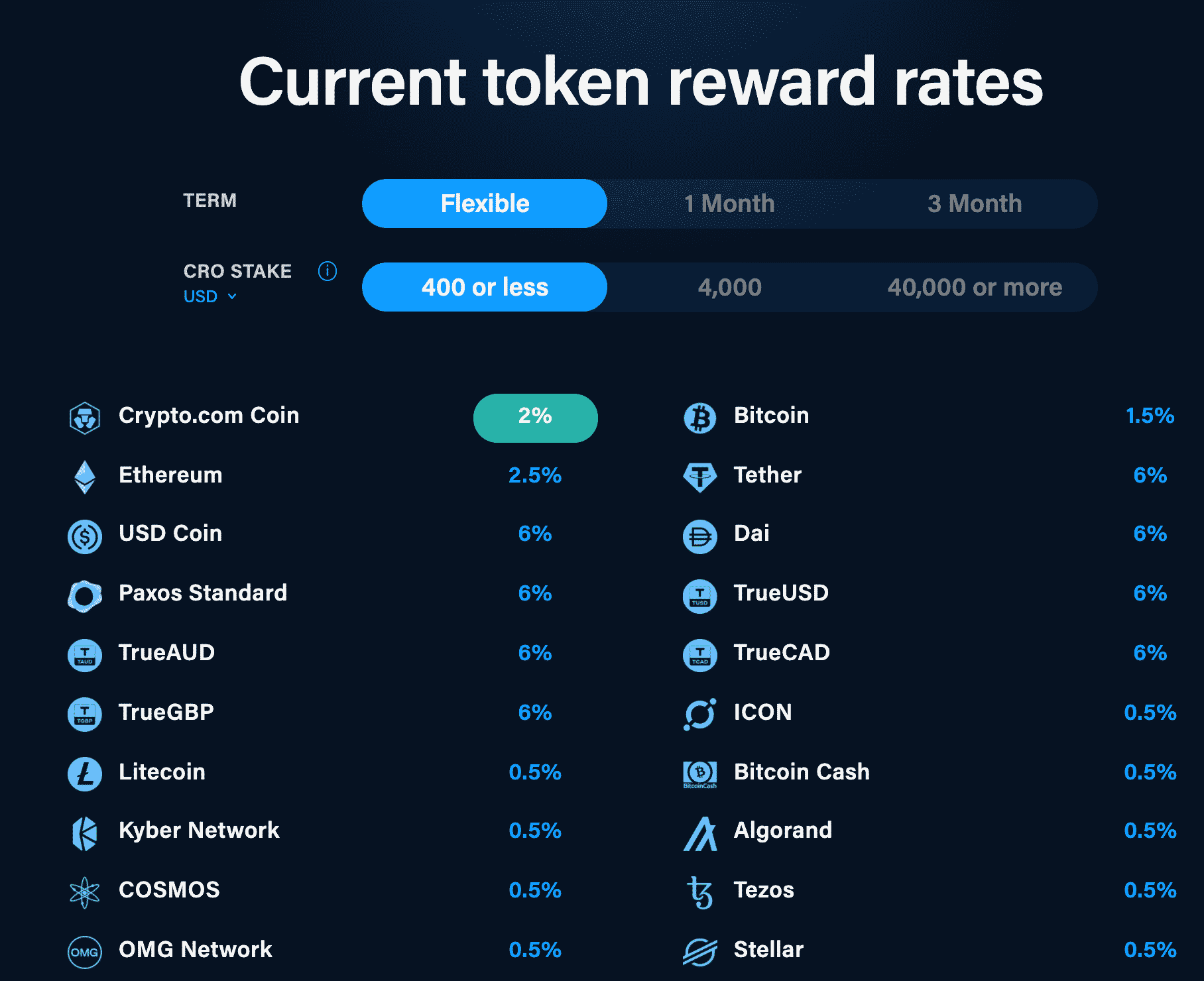

Function # 1: Interest Rates: Who Pays More, BlockFi or Crypto.com?

Both Crypto.com and BlockFi paid users interest on the cryptocurrency properties they save on the platform.

Crypto.com’s system is far more complex, with a lot of chances to get puzzled. Crypto.com Rates differ based upon whether a user picks a versatile, 1-month, or 3-month term. Even more, users require to own Crypto.com’s token (CRO) to make the optimum interest. Rates scale up based upon the tiers of CRO holdings:

- $400 or less in CRO

- $401 to $4,000 in CRO

- $4,001 to $40,000 or more in CRO

- $40,001 to $400,000 in CRO

These CRO quantities are in dollar quantities– as in you will require to purchase $400,000 worth of CRO to open the greatest tier.

Let’s see how this plays out with some examples.

Bitcoin

- BlockFi utilizes a tiered interest-rate system for Bitcoin; APY scales based upon just how much BTC you save on the platform Rates are around 4% for 0– 0.25 BTC, 1.5% for 0.25– 5 BTC, and 0.25% for>> 5 BTChowever go through alter.

- Crypto.com’s BTC rates vary from as low as 1.5% for a versatile account with less than $400 in CRO to as high as 8.5% for a user with $40,000 or more in CRO with a 3-month account.

Ethereum

- BlockFi likewise utilizes a tiered interest-rate system for Ethereum Existing rates are 4% for 0 to 5 ETH, 1.5% for 5 to 50 ETH, and 0.25% for>> 50 ETH.

- Crypto.com’s Ethereum rates begin at 3.5% for a versatile user with $400 or less in CRO and increase to 8.5% for a 3-month user with more than $40,000 in CRO.

Alts

| Coin Name | BlockFi | Crypto.com |

| Chainlink | 3% (0– 750 LINK), 0.5% (>> 750 LINK) | 0.5%– 5% |

| Bitcoin Cash | N/A | 0.5%– 5% |

| Substance | N/A | 0.5%– 5% |

| Universe | N/A | 0.5%– 5% |

| UNI | 3.75% (0– 750 UNI), 1.5% (>> 750 UNI) | 0.5%– 5% |

| Dogecoin | N/A | 0.5%– 5% |

| Litecoin | 4.5% (0– 100 LTC), 2% (>> 100 LTC) | 0.5%– 5% |

| Polkadot | N/A | 6%– 14.5% |

Stablecoins

| Coin | BlockFi | Crypto.com |

| Tether | 7.5% (0– 50,000), 5% (>> 50,000) | 6%– 8.5% |

| GUSD | 7.5% (0– 50,000), 5% (>> 50,000) | N/A |

| USDC | 7.5% (0– 50,000), 5% (>> 50,000) | 6%– 14% |

Winner: BlockFi BlockFi’s simpleness and competitive rates win.

Crypto.com provides greater top-end rates than BlockFi on a lot of coins, it’s asking a lot from its users. Holding $40,000 to $400,000 worth of a perhaps suspicious token like CRO might appear impractical and unneeded for a lot of users. To put it simply, Crypto.com’s juice isn’t worth the capture, especially when a platform like BlockFi (or Celsiusdeals comparably high rates without the intricacy.

CoinCentral readers can make as much as $250 by registering for BlockFi

How Do BlockFi and Crypto.com Make Money?

BlockFi makes its cash by providing out the possessions it holds for less than it pays its users for them. It may provide 7.5% on Tether (USDT) however provide it out for 12%. These loans are over-collateralized so the threat of default is reasonably low.

Crypto.com makes its cash through both loans and exchange costs. The business’s lending system works likewise to BlockFi’s. It utilizes a complicated maker/taker cost structure for crypto trading, with maker rates varying from 0.036% to 0.1% and taker rates varying from 0.090% to 0.16%

Function # 2: Payouts and Withdrawals

BlockFi interest accumulates day-to-day and is paid on a regular monthly basis. A lot of its rivals pay interest daily. BlockFi users are entitled to one totally free crypto withdrawal and one complimentary stablecoin withdrawal every month. Extra withdrawals sustain a cost.

Crypto.com charges for all withdrawals that are finished on-chain. Users can prevent these charges by utilizing the business’s withdraw to app functionThat being stated, there is no charge to send out cryptocurrency to other Crypto.com users.

Crypto.com pays its interest out daily, nevertheless, this interest does not substance.

Winner: BlockFi BlockFi wins this one due to its complimentary withdrawal choices and intensifying interest. Crypto.com is a much better option for individuals who desire their interest paid right away instead of regular monthly– nevertheless, be careful the charges.

Function # 3: BlockFi vs. Crypto.com Security

Crypto.com and BlockFi appear to take users’ security seriously and neither has actually suffered a significant breach that affected customers’ funds.

BlockFi holds 95% of the funds it shops in freezer. This is handled by Gemini, which holds a SOC accreditation from Deloitte.

Crypto.com is routinely examined by Bureau Veritas and has actually partnered with Ledger to cold shop the large bulk of its users’ funds. It likewise utilizes hardware security modules and multi-signature innovations to keep possessions protect.

Both business have various user-facing security functions such as 2-factor authentication.

Each deals FDIC insurance coverage for as much as $250,000 of its users’ money funds– this is just for fiat, not stablecoins or cryptocurrency.

Winner: Crypto.com It’s tough to differentiate a winner here, however Crypto.com gets approval due to the fact that it declares to save 100% of its users’ funds in freezer, vanquishing BlockFi’s 95%.

Function # 4: Ease of Use

BlockFi is without a doubt the much easier of the 2 platforms to utilize; users just require to move funds to BlockFi and kick back while the interest begins accumulating.

Approved, Crypto.com users can do that too, however they will not get the very best rates unless they likewise acquire a non-insignificant amount of CRO tokens. This presents a brand-new aspect of danger into the formula that BlockFi does not require upon its users. Even more, Crypto.com users require to secure their funds to get the very best rates.

Celsius resembles Crypto.com because it likewise has its own cryptocurrency (CEL). It does not need users to lock their funds or hold a specific quantity of CEL to make the finest rates.

CoinCentral readers can get $25 by registering for Crypto.com and staking for the Ruby Card, and likewise take house approximately a $50 BTC reward by transferring $400 or more on Celsius for 1 month.

BlockFi vs. Crypto.com Standout Features

Crypto.com and BlockFi have a comparable standout function: a cryptocurrency charge card.

Both the BlockFi charge card and Crypto.com charge card enable users to make interest in crypto on daily purchases.

As one might presume based on other points throughout this BlockFi. vs. Crypto.com evaluation, BlockFi’s charge card is much easier to utilize.

BlockFi’s card is complimentary to obtain, it has no yearly costand it does not need leaping through hoops to get its optimum benefit.

Crypto.com uses a number of variations of its charge card at various tiers, with benefits that vary from 1% to 8% based upon the quantity of CRO a user holds. A private requirements to hold a minimum of $400,000 in CRO to get approved for the greatest rates of interest.

The Court of Public Opinion: BlockFi vs. Crypto.com Reddit

Individuals on Reddit are typically complimentary of both BlockFi and Crypto.com. The basic agreement is that each platform is safe to utilize and provides outstanding yield-earning chances.

Some individuals on Reddit have actually recommended spreading your funds throughout both of these platforms and Celsius. That method, if something were to occur to among the platforms, you would not be affected as adversely.

BlockFi vs. Crypto.com Customer Support

BlockFi has live phone assistance readily available from 9:30 AM– 5 PM EST. The business likewise has an online FAQ page users can check out to get the answer to commonly-asked concerns.

Crypto.com has a aid center with responses to typical concerns. The business likewise has e-mail assistance readily available at [email protected]

Can You Trust BlockFi and Crypto.com?

The typical agreement is that both BlockFi and Crypto.com are both trustworthy. Each business declares to utilize freezer for user funds, which keeps them far from internet-based security threats.

That being stated, crypto interest accounts aren’t safe and must not be deemed if they were cost savings accounts. Digital possessions like BTC and USDC aren’t FDIC guaranteed.

Even more, these business provide your cryptocurrency to 3rd parties. They take preventative measures to over-collateralize their loans, there is still a threat included when you do not have custody of your digital asset.s

BlockFi has actually gotten acknowledgment for its security practices from relied on names like Deloitte and the New York Department of Financial Services.

Crypto.com has actually made an ISO/IEC 27001:3013 accreditation and is routinely investigated by Bureau Veritas.

Crypto.com is still in service, whereas BlockFi was required to lock individuals’s funds on its platform. Crypto.com power users wanting accept the dangers that include holding big quantities of CRO tokens, Crypto.com might be a noise choice. When the token quantities and lock-up durations are maxed out, Crypto.com’s yields are a few of the greatest in the CeFi crypto interest account market.

CoinCentral readers can make approximately$25 when staking for the Ruby Card

Never Ever Miss Another Opportunity! Get hand chosen news & & information from our Crypto Experts so you can make informed, notified choices that straight impact your crypto revenues Sign up for CoinCentral totally free newsletter now.