On Nov. 10, 2021, (BTC) developed an all-time high of over $68,600, according to CryptoSlate information. On the exact same day, Ethereum(ETH) got to an all-time high cost of $4,86411, CryptoSlate information programs.

The optimal in the rate of both biggest cryptocurrencies by market cap would certainly lead capitalists to think that the marketplace was still experiencing a bull run. A close appearance at information on energetic addresses recommends the bear market might have begun in mid-2021, months prior to BTC and also ETH achieved all-time highs.

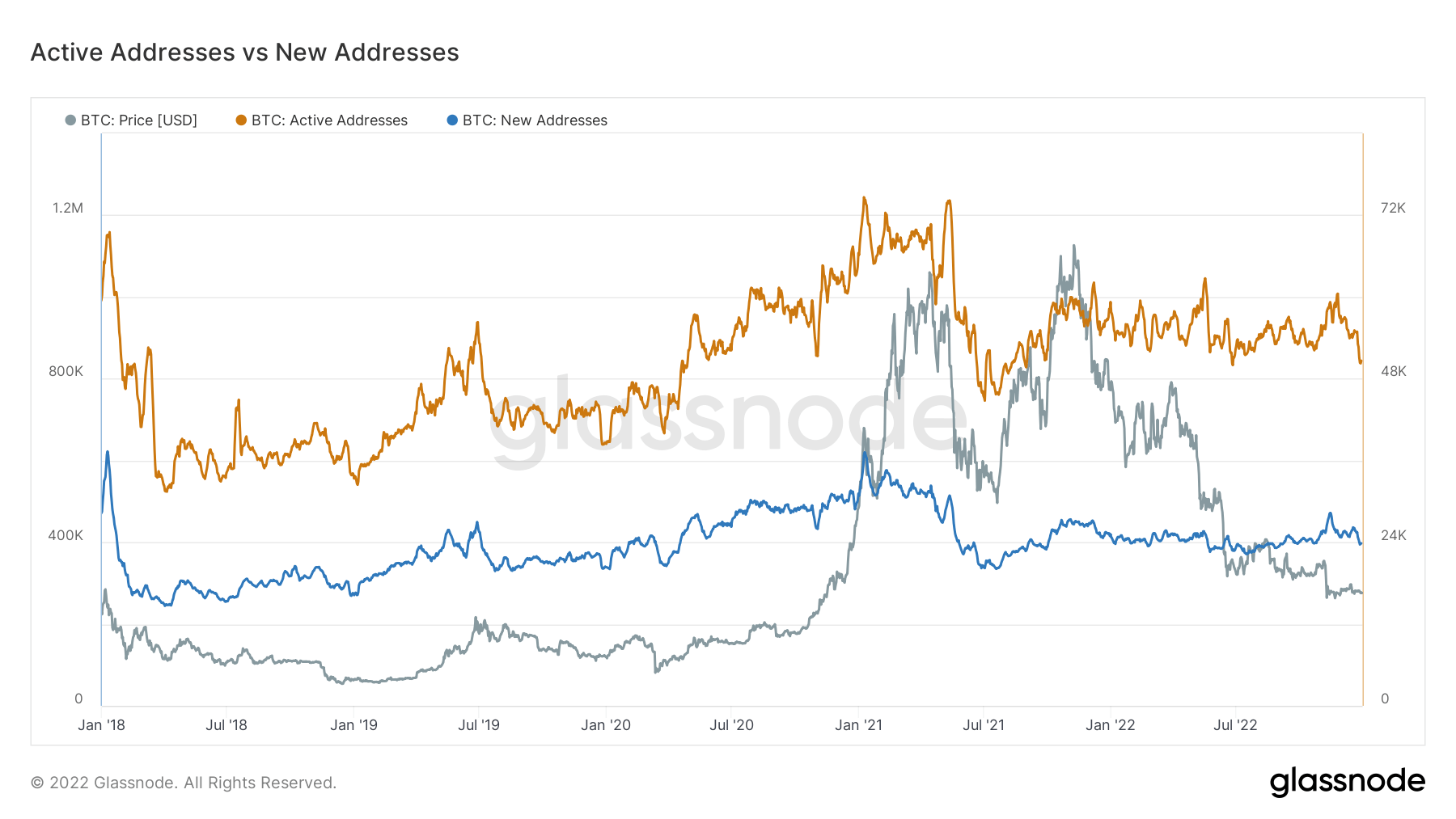

Analyzing addresses is an outstanding means to assess the task in the community or exactly how well the community is being utilized. Throughout the bull run of 2017, energetic BTC addresses exceeded 1 million, according to Glassnode information. As the bull run finished in 2018, energetic BTC addresses decreased by almost 50% to around 500,000, Glassnode information suggests.

Active BTC addresses had a sluggish work upwards in between 2018 as well as2021 In Between January and also May 2021, energetic BTC addresses floated around the 1.2 million mark, breaching it two times in the 5 months and also getting to as high as over 1.3 million, according to Glassnode information.

But in June 2021, energetic Bitcoin addresses got to a reduced of around 500,000, which can have been possibly the beginning of the bearishness. Afterwards, energetic BTC addresses raised a little as BTC got to a brand-new all-time high in November2021 Also with the BTC rate coming to a head, energetic addresses floated around 1 million.

Throughout 2022, energetic BTC addresses mostly continued to be listed below 1 million, according to Glassnode information. New BTC addresses stayed fairly level with 2022, around the 400,000 mark. New BTC addresses have actually floated around the 400,000 mark over the previous 5 years. In very early 2021, brand-new BTC addresses came to a head somewhat to go beyond 600,000, Glassnode information shows.

Therefore, although the rate of Bitcoin touched brand-new elevations in November 2021, principles recommend that the bearish market embeded in months prior.

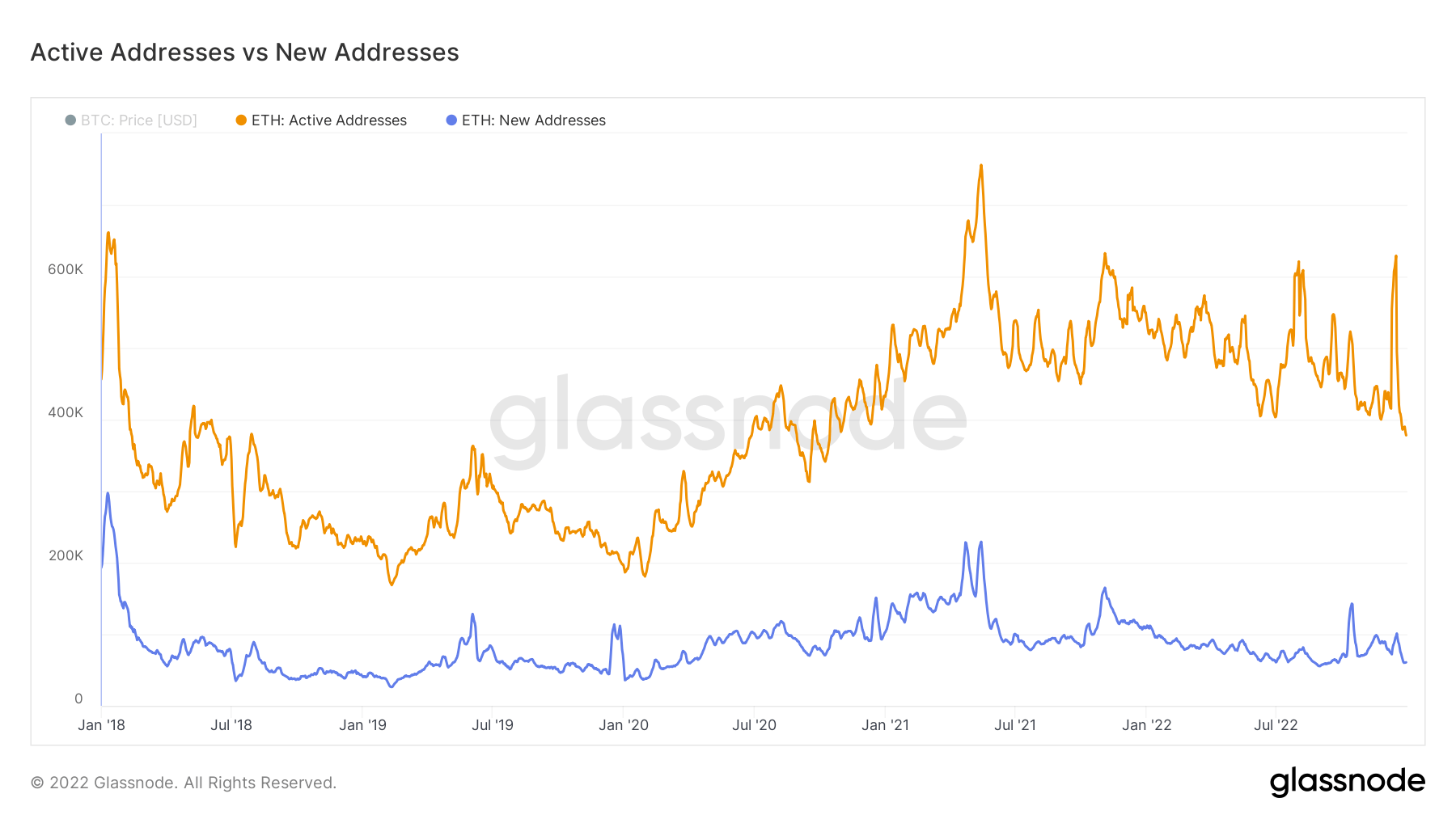

ETH energetic addresses comply with a comparable tale to Bitcoin– coming to a head throughout bull runs as well as dropping and also going stale melting bearish market.

It deserves keeping in mind that ETH energetic addresses saw one of the most substantial 2022 spikes throughout market capitulations, such as the Terra-Luna farce and also the personal bankruptcy of FTX and also Alameda Research. This might show numerous points, such as opportunistic financiers purchasing the dip or brand-new capitalists stress offering, and even merely engaging with the ecological community.

New ETH addresses, like BTC, stayed almost level listed below 200,000 over the previous 5 years, just breaching the mark two times– when in very early 2018 and also once more around May 2021.