- Chainlink exposed its accomplishments of 2022

- The metrics and indications were bearish

Chainlink [LINK] published a brand-new upgrade that highlighted its accomplishments through 2022, which showed how far the network has actually progressed in a year

Among which was Chainlink Oracle Services that supported more designers and tasks than ever previously. The upgrade made it possible for more than $6.9 trillion in deal worth in 2022.

In Addition, Chainlink Data Feeds broadened throughout brand-new blockchains and layer-2s, consisting of assistance for a non-EVM chain such as Solana.

In 2022, #Chainlink reached a number of significant turning points from worth allowed to #LINK staked, assisting the #Web 3 economy scale firmly.

Here’s a take a look at crucial network highlights & & how Chainlink is growing to fulfill international need for #ProofNotPromises pic.twitter.com/fO6pCmvlEo

— Chainlink (@chainlink) December 31, 2022

Read Chainlink’s [LINK] Rate Prediction 2023-24

How can this advantage LINK in 2023?

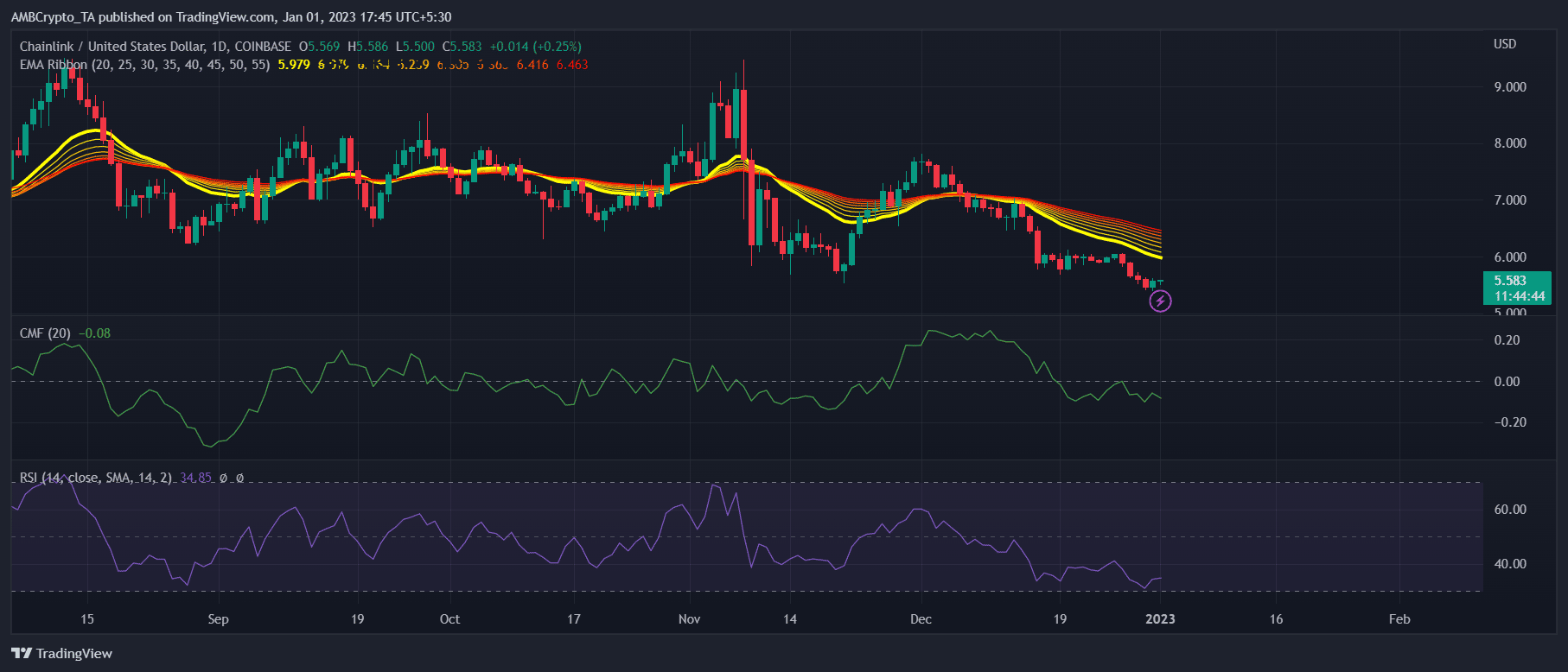

Since January 1, 2023, Chainlink was down by more than 6% in the last 7 days and was trading at $5.57 with a market capitalization of over $2.8 billion. LINK’s stock cost revealed indications of healing throughout the very first days, issues still stay on its metrics front.

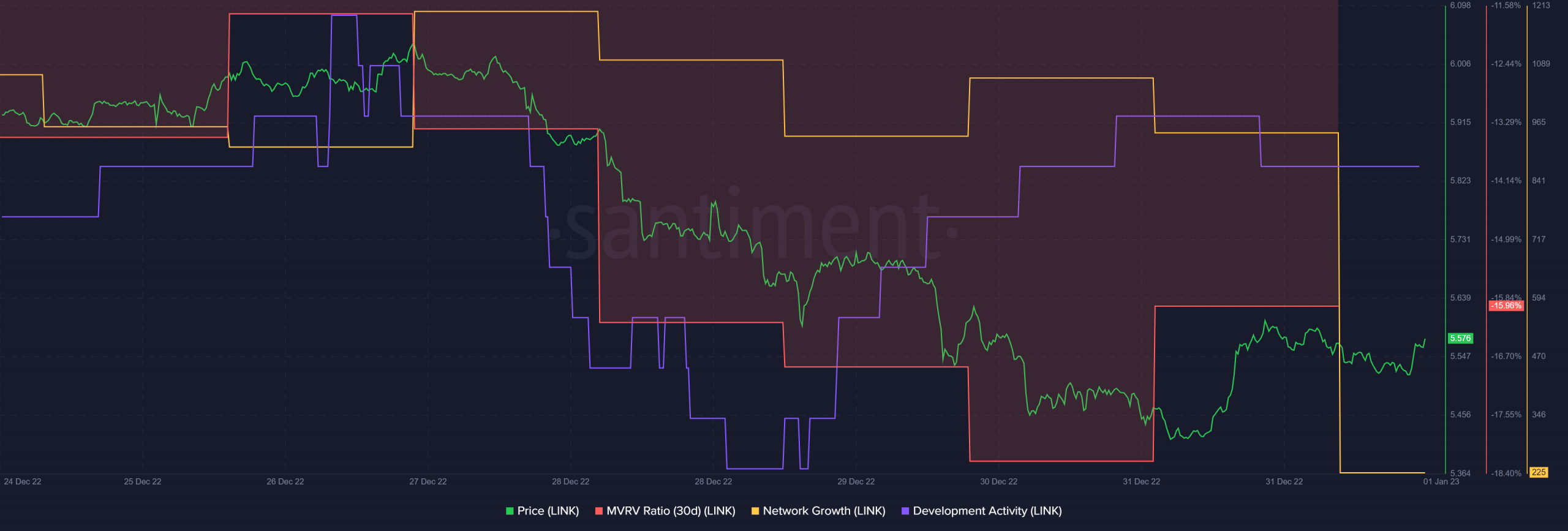

Based on Santiment’s information, LINK’s Market Value to Realized Value (MVRV) Ratio saw a significant low over the previous week. This might be problematic for the future of LINK.

LINK’s network development likewise followed a comparable course and signed up a sharp decrease. CryptoQuant’s information exposed that LINK’s exchange reserve was increasing, representing high selling pressure.

Fortunately was likewise that LINK’s advancement activity increased, which showed the designers’ efforts to enhance the blockchain.

Surprisingly, Chainlink Partnered with numerous other business over the last year. This might assist the network increase its offerings for its users. A few of them consist of the collaboration with the Blueberry Protocol, Magpie XYZ, and Galilio Protocol.

Are your LINK holdings flashing green? Examine the Earnings Calculator

Perseverance is advised, however why?

A take a look at LINK’s market signs represented a bearish photo. A lot of indications didn’t prefer a cost walking. LINK‘s Chaikin Money Flow (CMF) signed up a downtick

Not just that, however the Relative Strength Index (RSI) was likewise rather low. This looked unfavorable for the network. LINK’s Exponential Moving Average (EMA) Ribbon likewise looked quite bearish, which may generate more problem.