Bitcoin ( BTC) may be worth greater than Ethereum ( ETH), however readily available Glassnode information, as assessed by CryptoSlate, reveals that ETH’s optimal prominence has actually outshined BTC’s in the last 2 years.

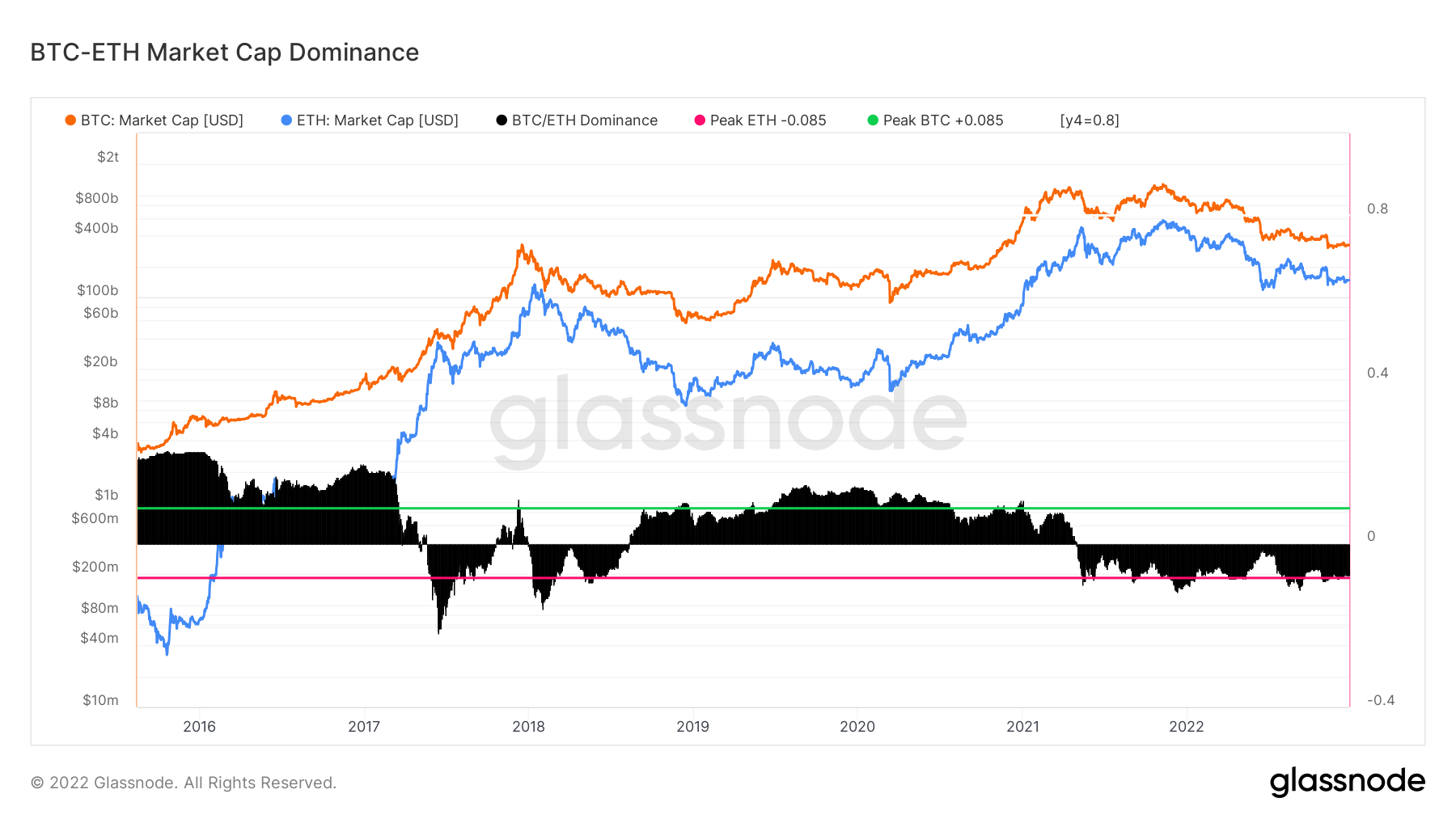

Glassnode’s BTC-ETH Market Dominance statistics is an oscillator that tracks the macro efficiency patterns for the leading 2 cryptocurrencies. The marketplace cap supremacy price cuts shed as well as long-dormant coins, supplying a design that precisely evaluates the resources inflows and also discharges of the properties. This statistics takes into consideration BTC and also ETH’s market cap alone.

The graph over programs that Ethereum had its peak market prominence as much back as 2017, also prior to the property’s recognized market cap height. ETH likewise saw its prominence return in 2018 and also has actually kept it because late 2021.

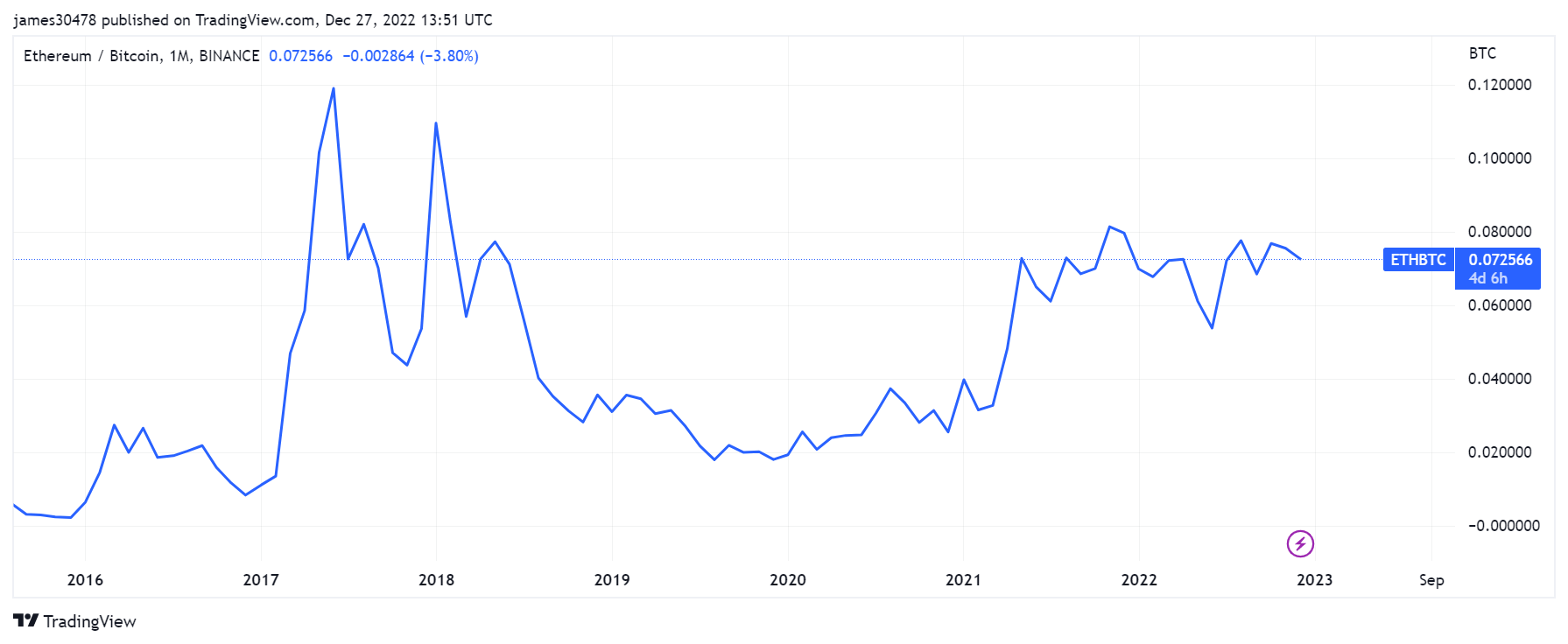

BTC came to a head throughout the bearish market duration in between completion of 2018 as well as very early 2021– revealing that it is a far better possession throughout the risk-off setting.

A risk-off setting explains a bearish market circumstance where capitalists leave high-risk properties like supplies and also hedge their funds in safe-haven financial investments like gold and also bonds. This could describe why several experts and also financiers think about Bitcoin electronic gold.

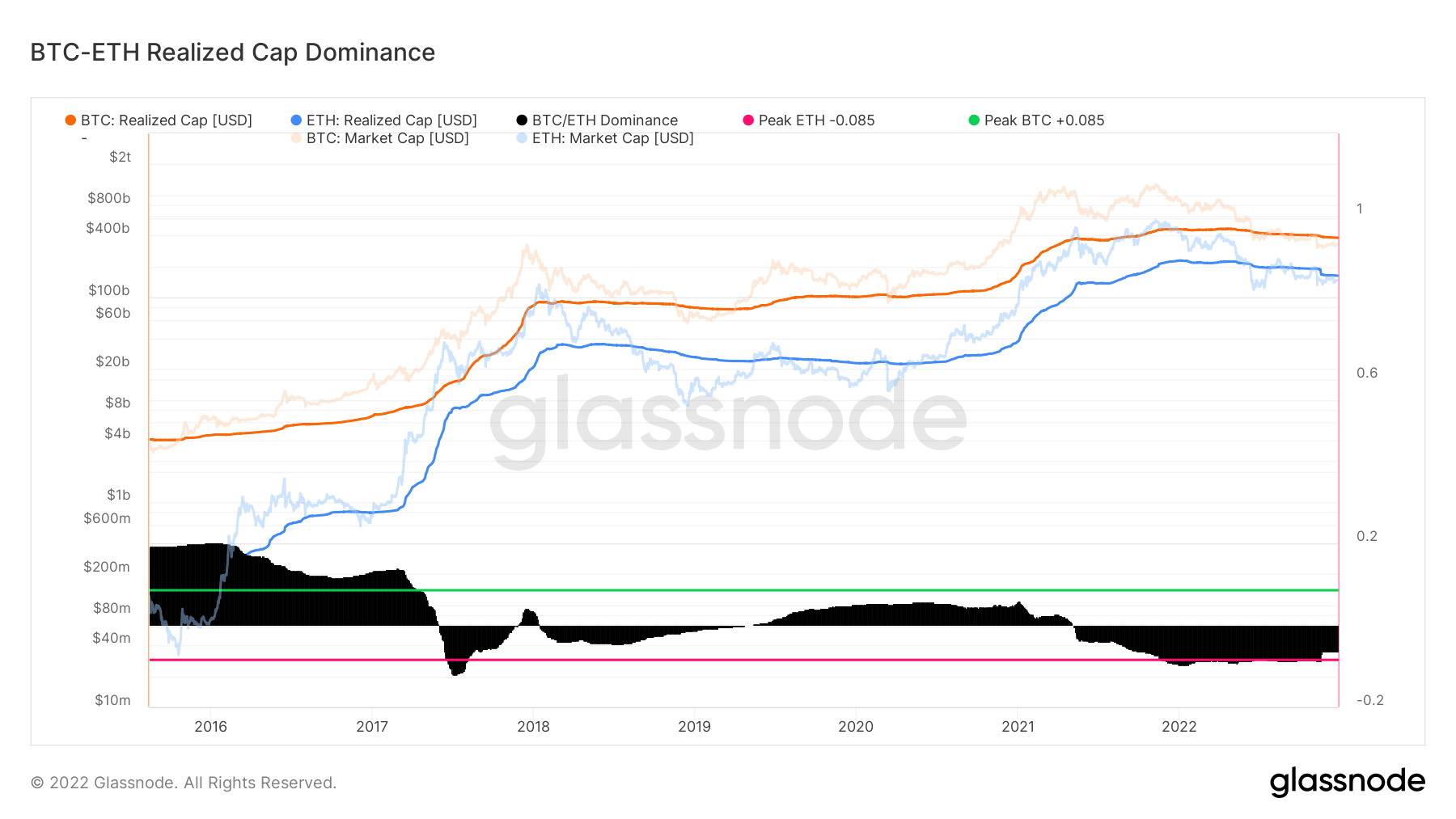

On the various other hand, ETH professions much better in a risk-on setting when financiers are a lot more going to place their funds right into dangerous properties. This is why ETH’s supremacy turned that of BTC given that the very early bull run of 2021 as well as has actually kept that efficiency previously. Ethereum’s supremacy over BTC in regards to understood market cap came to a head at over 0.765, according to the Glassnode graph below.

However, ETH’s prominence over the previous 2 years has actually not equated right into much better efficiency for the possession. Its supremacy has actually progressively decreased because 2017, with all various other optimals in 2021 and also 2022 falling short to defeat the previous highs. The factor behind this decrease continues to be unidentified.

However, the success of the Ethereum Merge has actually seen the possession turn deflationary a couple of times, as well as its issuance price has actually considerably decreased. Records have recommended that the property may be slowly developing into a shop of worth based upon the sentence of long-lasting owners.

With the marketplaces coming to be a lot more bearish once more, BTC is currently revealing indications that it might exceed ETH in a risk-off atmosphere. It has actually gone beyond Ethereum in the last 60 days.

Several information as well as market experts are forecasting an economic downturn in 2023; this can remain to play right into BTC’s toughness of being a much safer property in a risk-off atmosphere.