Disclaimer The details provided does not make up monetary, financial investment, trading, or other kinds of suggestions and is entirely the author’s viewpoint

- The marketplace structure on the day-to-day timeframe was bearish

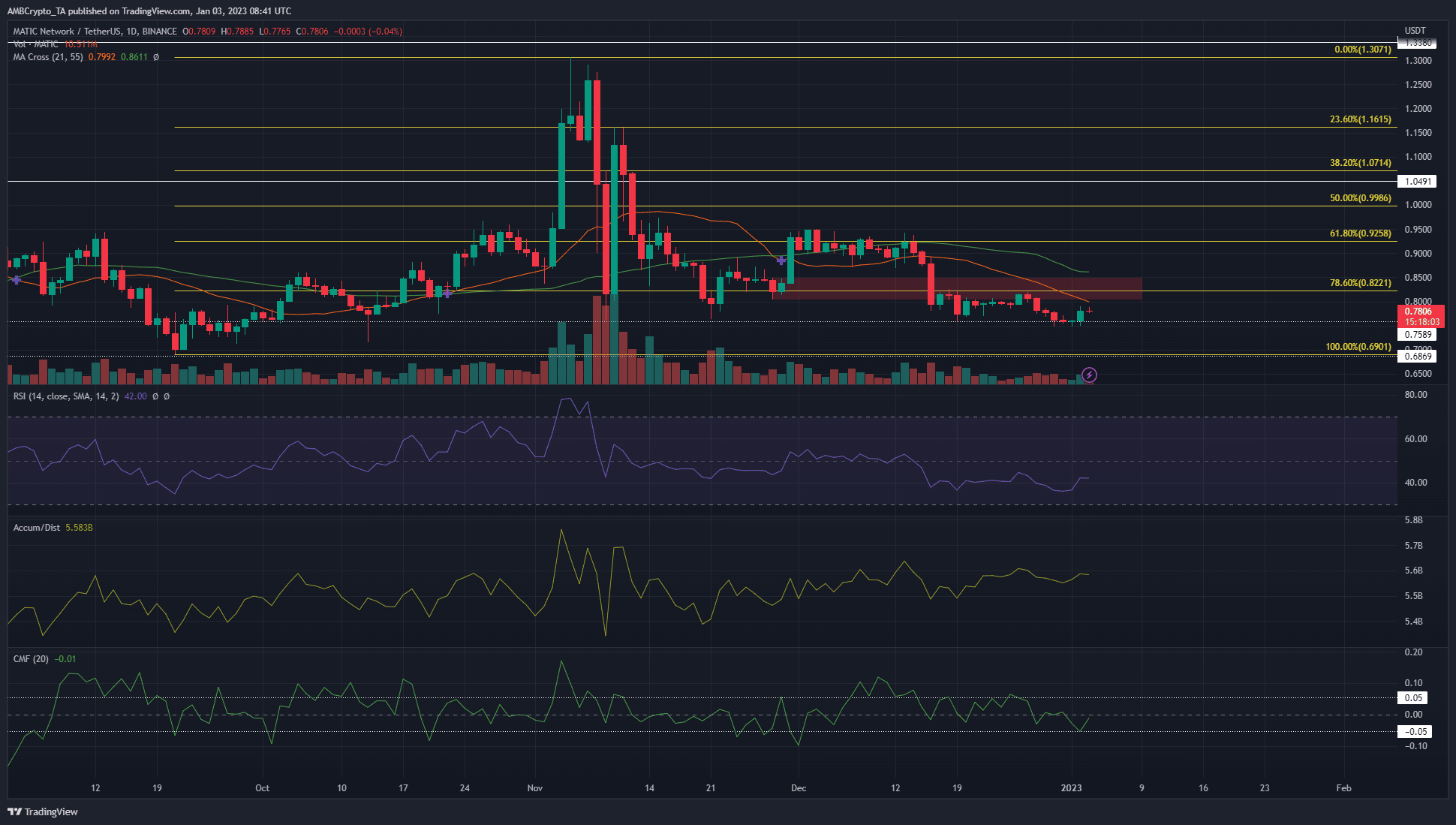

- The existence of the 78.6% retracement level included confluence to the resistance at $0.82

Bitcoin [BTC] has actually not started a big relocation in current weeks Polygon [MATIC] Remained reasonably peaceful on the rate charts. It bounced in between the $0.759 and $0.822 levels of assistance and resistance, however the greater timeframe predisposition was bearish.

The number of MATICs can you get for $1

Appropriately, traders can look for offering chances and trade with the pattern. One such chance can emerge if the token reached the resistance location highlighted on the charts.

The bearish breaker and momentum continued to prefer MATIC sellers

The cost action stayed bearish for MATIC on the greater timeframes. It has actually fallen underneath the 78.6% retracement level of the relocation northward back in October. A bearish breaker on the day-to-day timeframe has actually likewise established right at the 78.6% retracement level (highlighted in red).

The moving averages revealed bearish momentum, and the Relative Strength Index (RSI) likewise moved below neutral 50 to highlight the very same. The Accumulation/Distribution (A/D) sign has actually formed greater lows because late November, however did not yet signal bullishness. The Chaikin Money Flow (CMF) remained in neutral area, and did not indicate substantial capital circulation into or out of the marketplace.

A bullish case can be made as soon as MATIC climbs up above $0.822 and retests it as assistance. This might use a purchasing chance targeting $0.925. As things stand, a more engaging case can be made for the bears.

The bearish breaker extended from $0.8 to $0.85, and just a day-to-day session close above this location would revoke the bearish concept. Brief sellers can look to pack their positions on a relocation up to $0.82-$0.84, and target $0.76 and $0.69 as take-profit levels.

Belief turns unfavorable as soon as again and exchange outflow saw a little boost near the bottom

The weighted belief behind the token has actually been neutral in the previous couple of days. Late December saw belief shoot hugely into favorable area. The rate just handled to increase from $0.795 to $0.816- a 2.92% relocation higher.

The exchange inflow and outflow did not see big spikes in current weeks, although the outflow metric did see a little bump when the costs reached $0.771 to reveal some build-up.

The 30-day Market Value to Realized Value (MVRV) ratio stood in unfavorable area, and has actually been here considering that mid-December. This revealed the token might be underestimated on the lower timescales.

On the other hand, the 365-day MVRV ratio (disappointed here) has actually climbed up greater considering that June and formed greater lows, although it still stayed in unfavorable area.

Are your MATIC holdings flashing green? Inspect the Revenue Calculator

The reasoning was that holders may require to wait on much more months prior to a strong greater timeframe uptrend can be developed.