Polygon (MATIC) has actually been among the handful tasks that have actually accumulated the crypto verse, with its energy and sprawl on the charts. Not to miss-out, Polygon has actually likewise altered the understanding of the crowd around layer-2 procedures. The network has now set-up an example for emerging layer-2 procedures in the crypto market.

When compared to Ethereum cost and Solana rate, Polygon is no doubt carrying out exceptional and has high capacity in the coming days. MATIC is among the greatest valued crypto coin which instantly has actually drawn in numerous financiers. MATIC rate forecast has actually constantly been an issue to the online marketers and financiers.

Tabulation

Its native token MATIC is an ERC-20 token that powers the Polygon Network. MATIC has actually depicted excellent rate runs in the current past. And boasts an amazing ROI of 16915.16%. Wondering if you should think about MATIC for your next shopping spree? This MATIC cost forecast pins the possible targets for 2023– 2025 and the years to come!

Summary

| Cryptocurrency | Polygon |

| Token | MATIC |

| Cost | $ 0.7788 |

| Market cap | $ 0.0000 |

| Flowing Supply | 0.0000 |

| Trading Volume | $ 0.0000 |

| All-time high | $ 0.0000 Jan 1, 1970 |

| All-time low | $ 0.0000 Jan 1, 1970 |

Polygon thinks in Web3 for all. Polygon is a decentralised Ethereum platform that allows its designers to construct much better and easy to use dApps with low deal charges without ever compromising on security. Polygon (MATIC) can hold upto 65,000 per 2nd making it quickly available to its users.

MATIC Price Prediction 2023

Polygon is noted amongst the leading 20 most valued cryptocurrency. MATIC cost forecast plays an essential function as this crypto is highlighted. It has actually worked together with lots of innovations and business to construct a more powerful and more protected network. MATIC has actually assisted to make the deals much faster and more dependable. It has actually just recently minimized its CO2 emission in a high volume. Which has actually assisted the business acquire more trust amongst its users.

The Polygon platform runs utilizing the Ethereum blockchain and links Ethereum-based jobs. If MATIC cost looks for motivation from the growing adoptions and advancements in the procedure. The cost might close the annual trade for 2023, with a prospective high of $1.8351.

That stated, the digital property might trade with a typical cost of $1.4141, if not much motivation is gotten. If the network sees lower adoption and activity owing to ETH 2.0, the cost might be up to closing rate of $0.9588.

| Cost Prediction | Possible Low ($) | Typical Price ($) | Possible High ($) |

| 2023 | 0.958 | 1.414 | 1.835 |

Polygon (MATIC) Price Prediction 2024

If polygon handles to get more financiers and team up with other business for brand-new tasks, then the business will grow in a substantial rate. Which will straight effect the cost of the MATIC coin. Polygon now focuses on minimizing its carbon footprints.

Polygon being among the popular layer-2 procedures, the increase in supremacy of the sector will be worthwhile for the digital possession. It may potentially lead the area at the leading edge, with its basic strengths. In such a situation, the rate of MATIC may skyrocket to an optimum of $2.9886 by the end of 2024.

On the contrary, if layer-2’s are outthrown by layer-1’s, MATIC may sink to the lows of $1.5932. Successively, a balance in trading pressures might land the typical trading rate at $2.2729.

| Rate Prediction | Prospective Low ($) | Typical Price ($) | Prospective High ($) |

| 2024 | 1.593 | 2.272 | 2.988 |

Polygon Price Prediction 2025

By the end, polygon cost forecast 2025 is prepared for to be in the leading 10 cryptocurrencies list. Numerous incoming advancements and collaborations may cause its development. If the network can even more deal with TPS, and offer inspiration to its PoS chain addresses. It may ultimately help ETH holders and move the rate to $5.0678. That stated based on Polyscan, while the active PoS chain addresses has actually come a long method on the greater timespan.

If the bears go on pulling the rates down due to a possible market crash or any external debates. As an outcome, the Matic rate may be up to $2.6285 by the end of 2025. That stated, on a favorable note, with its enhanced scalability and layer-2 blockchain’s long-lasting success, MATIC might be seen trading at $3.8435.

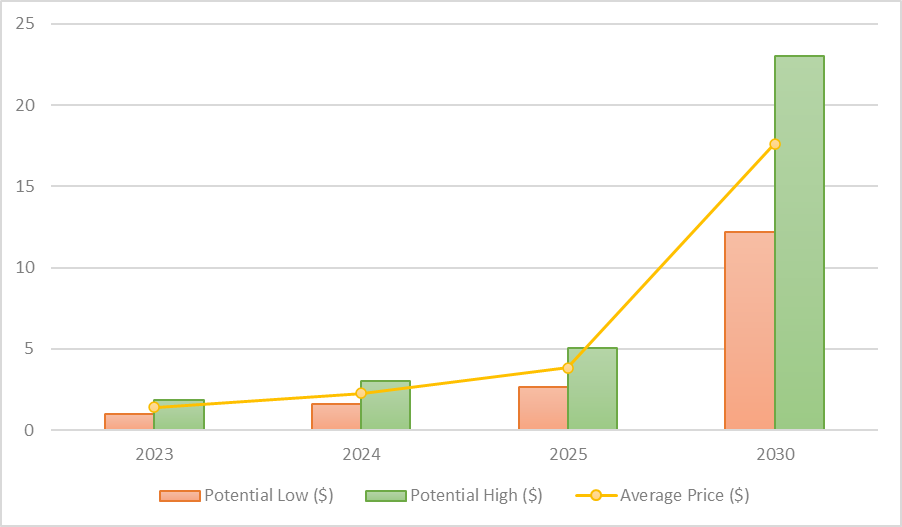

Evaluating the polygon cost for many years, polygon rate to skyrocket to optimal cost of $23.0400. on the contrary, thinking about all the possible cost-effective and non-economical aspects MATIC rate might be traded at $12.1623 by the end of 2030.

| Cost Prediction | Prospective Low ($) | Typical Price ($) | Prospective High ($) |

| 2025 | 2.628 | 3.843 | 5.067 |

Polygon Price Prediction 2026– 2030

| Rate Prediction | Possible Low ($) | Typical Price ($) | Possible High ($) |

| 2026 | 3.812 | 4.969 | 6.254 |

| 2027 | 4.951 | 6.281 | 7.628 |

| 2028 | 7.025 | 9.566 | 13.211 |

| 2029 | 9.216 | 13.718 | 18.635 |

| 2030 | 12.162 | 17.214 | 23.040 |

CoinPedia’s MATIC Price Prediction

The neighborhood may work together with specific other jobs and start-ups for the improvement of the procedure. As Matic consists of special functions such as scalability, and security it might improve its user base. With more interventions the rate can skyrocket throughout the blockage that takes place on Ethereum. The rate forecast of this crypto has actually constantly remained in talks.

According to CoinPedia’s developed MATIC rate forecast. Brand-new financiers change and the preferring market patterns for MATIC can lead to reaching brand-new turning points. The altcoin can strike $1.835 by the end of 2023. If it stops working to keep up and get more financiers the rate might drop and reach $0.958.

Market Analysis

| Company Name | 2022 | 2023 | 2024 | 2025 |

| Priceprediction.net | $0.86 | $1.32 | $1.95 | $2.78 |

| Digital Coin Price | $0.84 | $1.70 | $2.42 | $3.16 |

| Trading Beasts | $1.0427 | $0.8739 | $0.9873 | $1.2716 |

*The abovementioned targets are the typical targets set by the particular companies.

What Is Polygon (MATIC) Token?

An Indian-based crypto platform established by Jaynti Kanani, Sandeep Nailwal, and Anurag Arjun takes on some particular scalability problems. And increases deal speeds in addition to network scalability.

The Matic Network intends to resolve the scalability concerns the Ethereum blockchain innovation handle. In February 2021, the platform rebranded to the Polygon network, with some technological upgrades and a more comprehensive goal.

Even after The Merge, Ethereum will continue to count on Layer 2 scaling options like Polygon. Business such as Meta, Disney and Starbucks have actually picked Polygon for their NFT and Web3 jobs. While the competitors to use scaling services for Ethereum has actually heightened, Polygon is still the clear market leader.

Business Details

Polygon is a secondary Ethereum scaling option and a layer-2 option that runs in parallel to a mainnet however procedures deals beyond it. This results in greater deal throughput and more affordable gas rates. Over 19k+ dapps have actually been utilized by Polygon to scale their efficiency. The network was formerly called Matic Network, and was released in October 2017. The task was co-founded by Jayanti Kanani, Sandeep Nailwal, and Anurag Arjun. The network utilized a plasma-driven scaling method and Proof-of-Stake (PoS) sidechains to assist Ethereum scale as user need rose. The procedure has actually developed into a popular scaling option for numerous applications. Polygon’s native digital possession is MATIC, which is an Ethereum-based ERC-20 token. The Matic tokens are utilized for settlements in between users and services on the network. The scaling options supplied by the platform are polygon POS, polygon zkEVM, polygon obtain, polygon edge, polygon nightfall, polygon miden, and polygon absolutely no. With almost 130 million distinct users and 3 million day-to-day deals, the platform is bringing dApps to conclusion quicker, more secure, and without the requirement for gas.

Essential Analysis

The network deals with a Proof-of-Stake agreement and has a sidechain of the system and a group of validators. These validators guarantee to increase the “TPS”, therefore likewise minimizing deal chargesThe network deals with a Plasma structure that remarkably solves scalability problems, therefore avoiding network blockage.

Matic Network is a layer-2 scaling platform that assists in quickly and protects off-chain deals for payments and generalized off-chain smartcontractsIt is a scaling service for the Ethereum network. It enables Ethereum based deals to be processed rapidly utilizing ingenious procedures.

It uses the plasma frame to establish decentralized applications (DApps). Contributing to it, the network is likewise eagerly anticipating developing desktop wallets and internet browser extensions. Plasma is a particular structure for quickly producing DApps that can connect effortlessly with each other. The PoS checkpoints help numerous deals taking place on a single side chain.

Historic Market Sentiments 2019– 2021

- Polygon network had actually started its journey in the crypto area on the 29th of April with MATIC’s rate at $0.004. MATIC rate increased to $0.04 by early December, however slipped down to close the year at $0.014.

- Matic continued to trade at $0.014 up until the dawn of January 2020. Post variations the rate increased to $0.02 in February, however sank to $0.006 by mid-March in the middle of the Covid-19 crash. Following healing, the altcoin struck the $0.031 by mid-August, however slipped down to $0.017 by the end of the year.

- The trade for 2021 was begun with a price of $0.018, and rose to $0.043 by the end of January. MATIC remarkably reached an all-time high of $2.45 on the 12th of March. The bliss was short-term, as the notorious crash from May. Dragged the rate to $0.69 by the 20th of July.

- The rate of MATIC increased to $1.669 by the 23rd of August. And exceeded the resistance at $1.79 by September 5th. After a downswing, the month of October was closed at $1.953. The altcoin struck its ATH of $2.92 on December 27th, however closed the year at $2.479.

Frequently asked questions

What cost can Polygon reach by the end of 2023?

MATIC cost might perhaps close its trade for 2023, with a more expensive tag of $1.835.

Is MATIC an excellent financial investment?

Yes, MATIC is a rewarding financial investment, the digital possession ought to be under due factor to consider for the long term.

How high can Polygon (MATIC) pass completion of 2025?

According to our MATIC cost forecast, the altcoin might perhaps reach an optimum of $5.0678 by the end of 2025. With a prospective rise the rate might go as high as $23.040 by the end of 2030.

Is Polygon (MATIC) much better than Solana?

While it is not a direct apples-to-apples contrast, as one is a layer-2 and the other is a layer-1. Polygon presently stands stout with its robust network.

How high can polygon MATIC go?

At its finest, Polygon can process 65,000 deals per second.

Why Polygon is much faster than Ethereum?

The significant performance of Polygon is to make it possible for the multichain Ethereum community. It supplies a network that uses interoperability in between previous and present facilities situations of Ethereum.

Can polygon strike $100?

Matic Price Prediction $100, It is possible for Polygon Matic to reach $100 over the next 18 years.