The crypto by-products market has actually expanded so huge in the previous couple of years that it can be utilized as an indication of future rate activities. Bitcoin choices have actually recorded the crypto sector and also have actually rapidly developed into fully grown items whose activities have the power to persuade the remainder of the market.

Just like in the conventional monetary market, Bitcoin alternatives give their owners the right, yet not the commitment, to get BTC at a pre-programmed rate at the agreement’s expiry day. Alternatives are typically valued making use of a statistics called indicated volatility (IV), which reveals the marketplace’s sight of the possibility of adjustments in an offered safety and security’s cost.

Implied volatility (IV) is usually utilized by financiers to approximate future volatility in a protection’s cost. While IV can forecast cost swings, it can not anticipate the instructions in which the rate will certainly go. High indicated volatility indicates there’s a high opportunity of a huge rate swing, while reduced IV implies that the rate of the hidden property more than likely will not alter.

As such, IV is taken into consideration a great proxy of market threat.

Looking at the indicated volatility for Bitcoin reveals that the marketplace sees little danger in BTC.

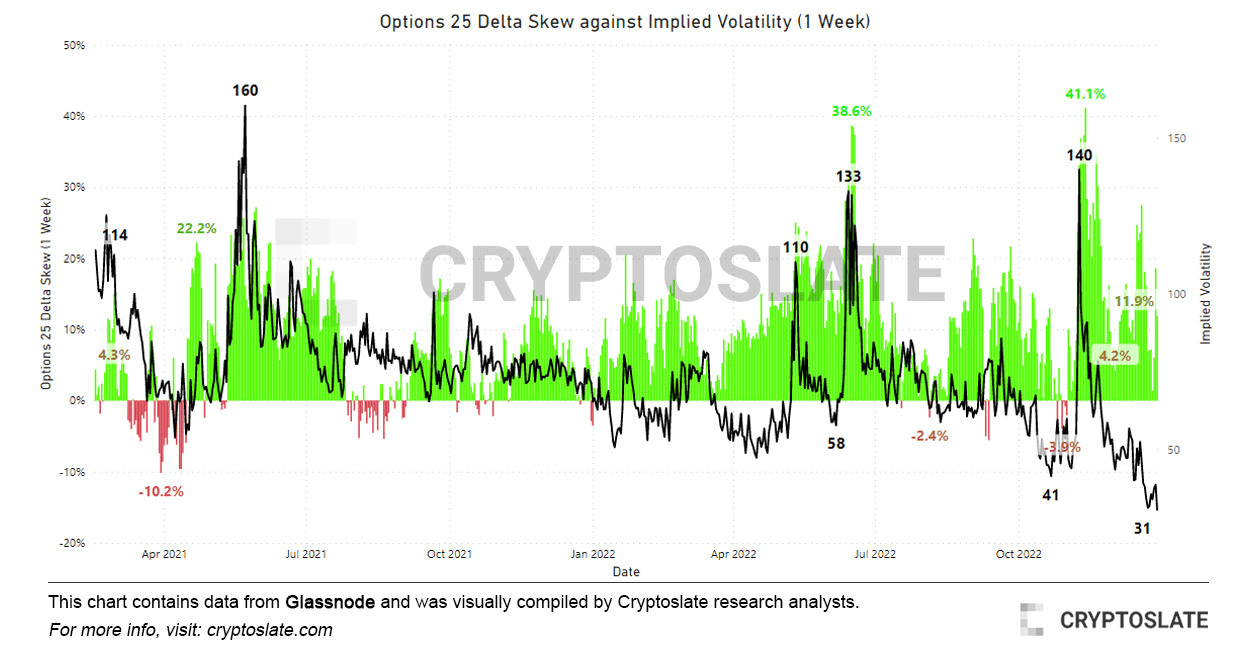

Bitcoin’s indicated volatility presently stands at a two-year reduced. The sharp decrease in IV has actually traditionally adhered to hostile spikes triggered by black swan occasions– spikes were seen throughout the 2021 Defi Summer, the Terra collapse in June 2022, and also the FTX failure in November 2022.

However, the decrease in indicated volatility seen at the end of 2022 reveals that the by-products market sees no significant rate motions in the future.

Comparing Bitcoin’s suggested volatility with the choices 25 delta alter additionally verifies this.

When put on choices agreements, alter actions the suggested volatility in between various strike costs with the very same expiry. In other words, it provides the proportion in between put as well as call alternatives. Delta is a step of adjustment in an alternative’s cost arising from an adjustment in the hidden protection.

The 25 delta alter consider places with a delta of -25% as well as calls with a delta of 25%, netted off to reach an information factor. A 25- delta placed alter of -25% implies that the put alternative prices 25% much less than the place cost of the hidden property, and also the other way around.

The statistics basically gauges just how delicate a choice’s cost is to adjustments in Bitcoin’s area cost. Information evaluated by CryptoSlate reveals that the costs for put choices has actually boiled down from severe degrees taped in November and also June. Spikes in the 25 delta alter are typically a strong scale for bearish market as they associate with severe spells of rate volatility.

December caused a sharp decrease in the 25- delta alter, which saw a mild boost in the very first couple of days of2023 Much like the decrease in suggested volatility, this shows a much calmer market in the days and also weeks to find.