- SushiSwap deserted its financing procedures and will concentrate on other locations for development.

- The activity on the procedure decreased, resulting in plunging earnings.

In a 2 January advancement, SushiSwap’s [SUSHI] CTO specified that they would be deserting their loaning procedure, Kashi, in Q1. They would likewise stop extra advancements on their token launchpad, MISO.

SushiSwap CTO stated that due to create defects and absence of resources, the loaning platform Kashi and the token Launchpad MISO will be deserted in Q1, and the existing focus will be on DEX.

— Wu Blockchain (@WuBlockchain) January 2, 2023

A 780.93 x trek on the cards if SUSHI strikes ETH’s market cap?

Future strategies of SushiSwap

The jobs were deserted mainly due to the platform’s style defects and an absence of resources on SushiSwap. Rather of concentrating on procedures like Kashi, SushiSwap’s focus would be on a tri-pool setup for SushiSwap

SushiSwap’s CTO likewise meant introducing an unidentified swimming pool enter the coming future.

Our objective is to get the Tri swimming pool setup initially (CP, Stable * CL), however a multi-asset balancer-style swimming pool is certainly next in the pipeline!

— I’m Software (@MatthewLilley) January 2, 2023

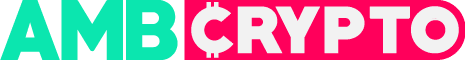

These brand-new updates might assist the decreasing activity on the SushiSwap procedure. According to information offered by Dune Analytics, the variety of brand-new users registering for SushiSwap daily fell materially over the last couple of months. Consequently, the variety of deals being made on the procedure likewise decreased.

Based Upon Dune Analytic’s information, the variety of deals on the SushiSwap procedure reduced from 300,000 to 189,000 in the last 3 months.

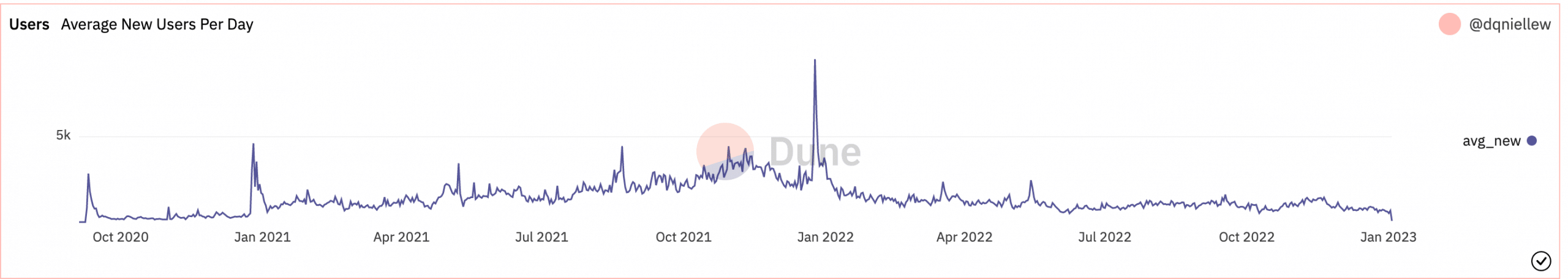

The decrease in activity affected the income gathered by the procedure. Based upon information offered by Token Terminal, it was observed that the income gathered by SushiSwap over the last 30 days reduced by 57.4%. At press time, the total earnings gathered by SushiSwap was $194,547.

SUSHI on your mind?

These unfavorable elements affected the health of the SUSHI token. Based upon information offered by Santiment, SUSHI’s network development fell significantly over the previous month.

A decreasing network development indicated that the variety of brand-new addresses that moved SUSHI for the very first time had actually reduced. Another worrying indication was the decrease in whale interest in SUSHI.

The decreasing quantity of SUSHI that was being held by leading addresses suggested that big addresses were offering their SUSHI. A decrease in SUSHI’s volume accompanied the subsiding whale interest. Throughout the last 30 days, SUSHI’s volume fell from 63.32 million to 40.31 million.

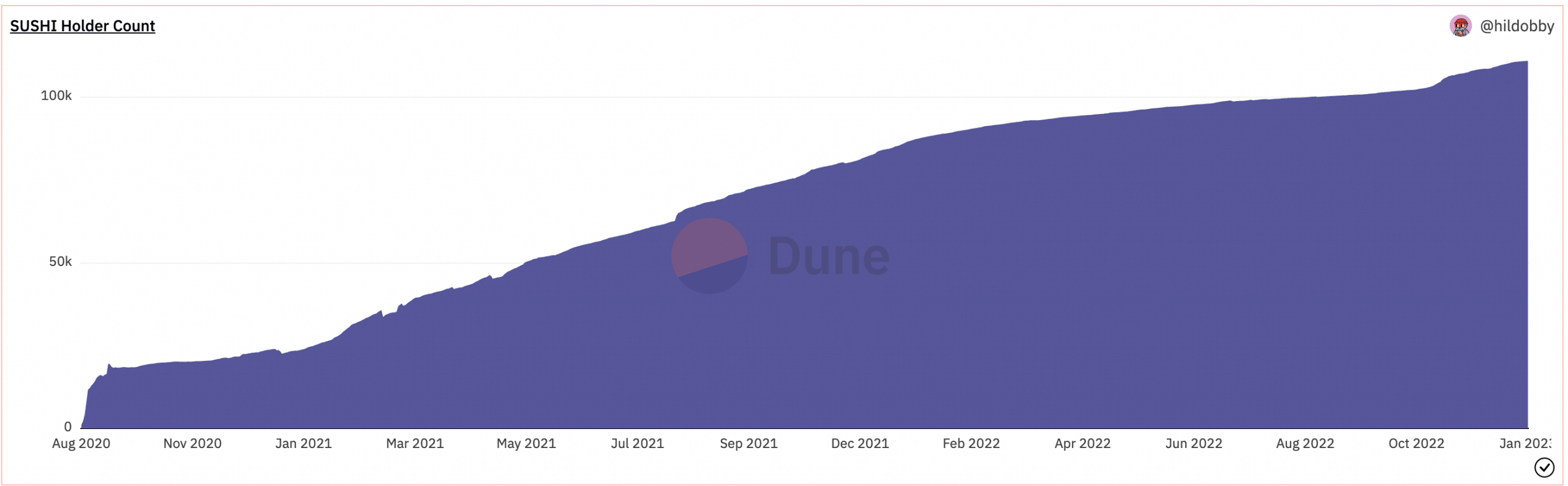

Although the SUSHI token remained in rough shape, the variety of users holding the token continued to grow.

Are your SUSHI holdings flashing green? Examine the earnings calculator

Based upon information supplied by Dune Analytics, since the SUSHI token’s launch, the variety of addresses holding the token has actually continued to grow. Over the last couple of months, the variety of holders went beyond the 100,000 mark and at press time, 111,039 addresses were holding SUSHI.

It stays to be seen whether SUSHI holders will continue to HODL. At press time, SUSHI was trading at $0.979 and its cost increased by 3.04% over the last 24 hours