Amid probably the chilliest winter season in Bitcoin’s background, its p rice has actually dropped by greater than 70% from its Nov. 10, 2021, all-time high of $69,04477, while its market cap is to $318943 billion from the annual high of $90204 billion — a 64.64% decrease.

Let’s have a look at some metrics that can offer even more understanding right into the present Bitcoin bearishness:

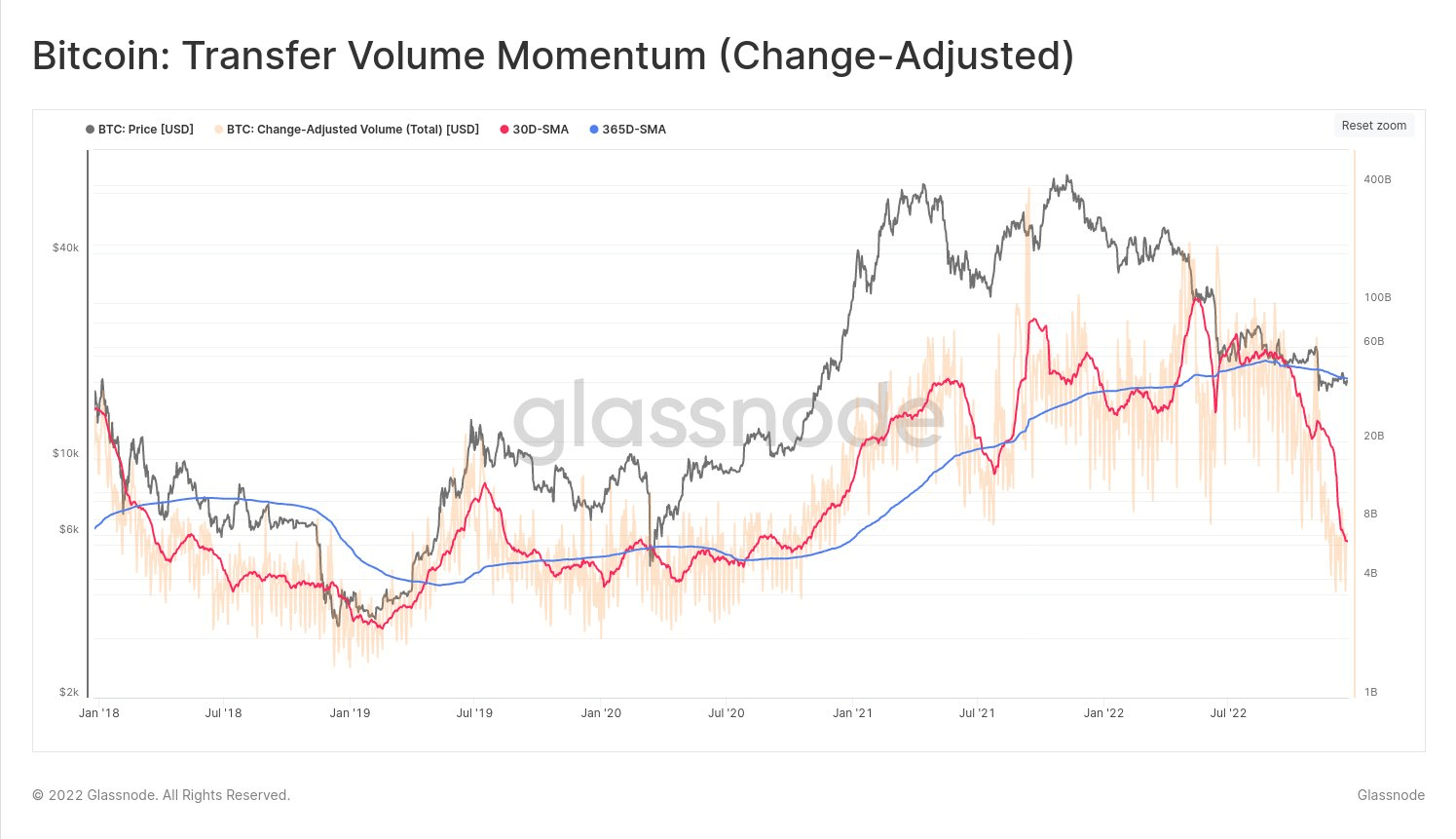

Transfer Volume Momentum

Before June, the 30- day Moving standard (DMA) (red line) transfer quantity in BTC got to brand-new highs, however after the Luna-Terra accident, it swiftly decreased as well as currently stands at brand-new lows.

Transfer quantity on the Bitcoin network supplies an indicator of the existing degree of network task and also the worth that is being moved in BTC and also USD. This statistics contrasts the month-to-month standard (red line) transfer quantity versus the annual standard (blue line) to highlight loved one changes in leading view and also assistance determine when the trends are transforming for network task.

It is normal for the 30 DMA to be listed below the 365 DMA throughout bearish market and also the other way around throughout booming market. Presently, the 30 DMA has actually dropped listed below the 365 DMA, a measure of decreasing network basics as well as decreasing network use, according to information evaluated by CryptoSlate.

This shows that energy has actually vaporized in regards to chain transfer, which is worrying. It is additionally the biggest disparity in between the 30 DMA as well as the 365 DMA in over the last 5 years.

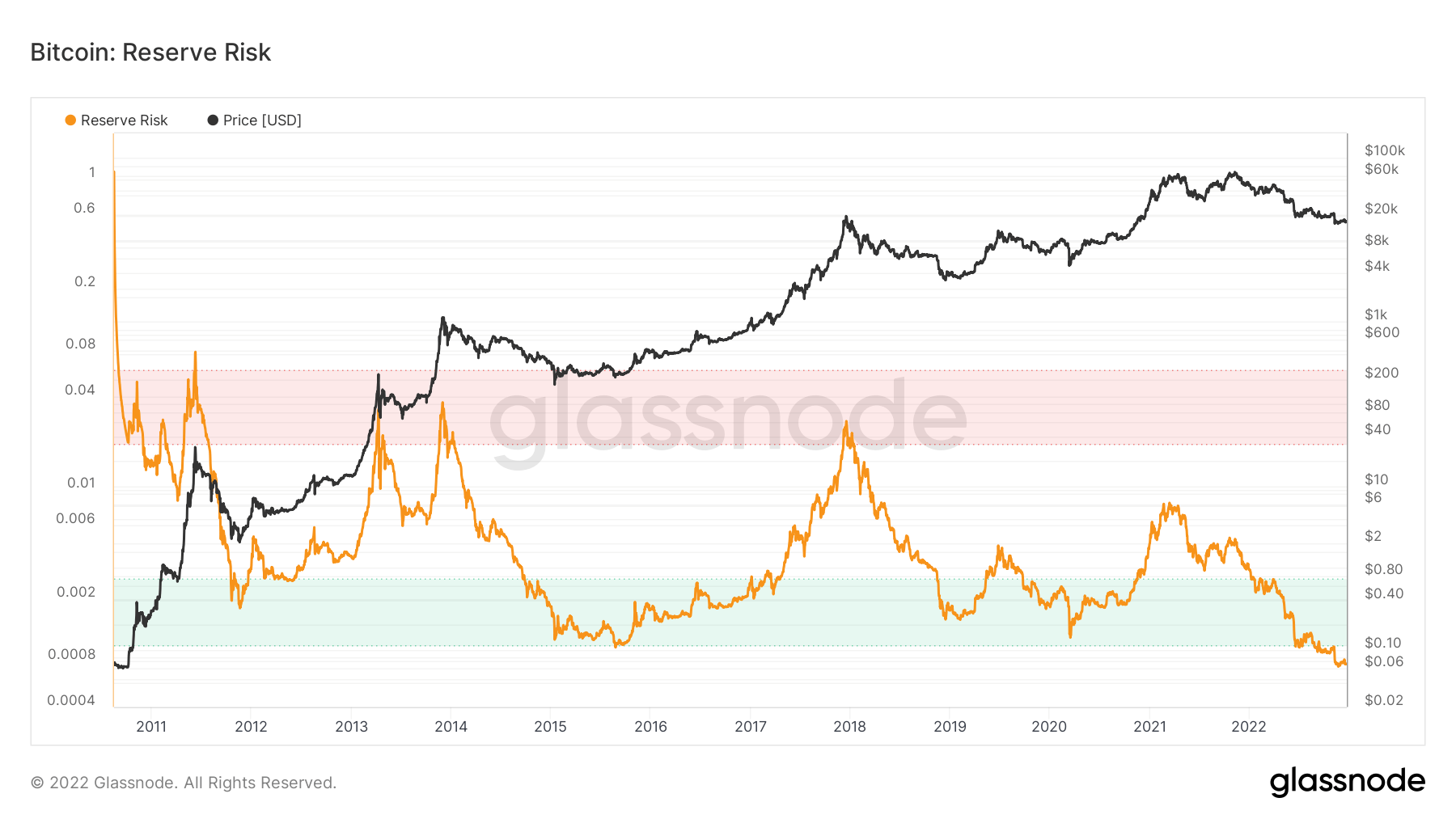

Bitcoin Reserve Risk

CryptoSlate’s on-chain evaluation reveals the Bitcoin Reserve Risk indication has actually decreased to a lowest level.

The Bitcoin Reserve sign assesses the self-confidence degree of lasting owners about the present bitcoin rate. Book Risk is the proportion in between the present rate (reward to market) and also HODL Bank. The HODL Bank statistics stands for the advancing chance expense of holding the possession.

When Bitcoin rates get to document highs, Reserve Risk (the red area) often tends to be greater, mirroring a reduction in financier self-confidence.

Alternatively, a reduced Bitcoin rate and also greater self-confidence imply reduced Reserve Risk (the environment-friendly area) or a boosted risk/reward proportion.

However, at present times, BTC get danger has actually befalled of the eco-friendly box for the very first time in its background, revealing an uncertainty amongst capitalists.

Nevertheless, reduced Reserve Risk can signal family member undervaluation, which can be a prolonged and also long term procedure.

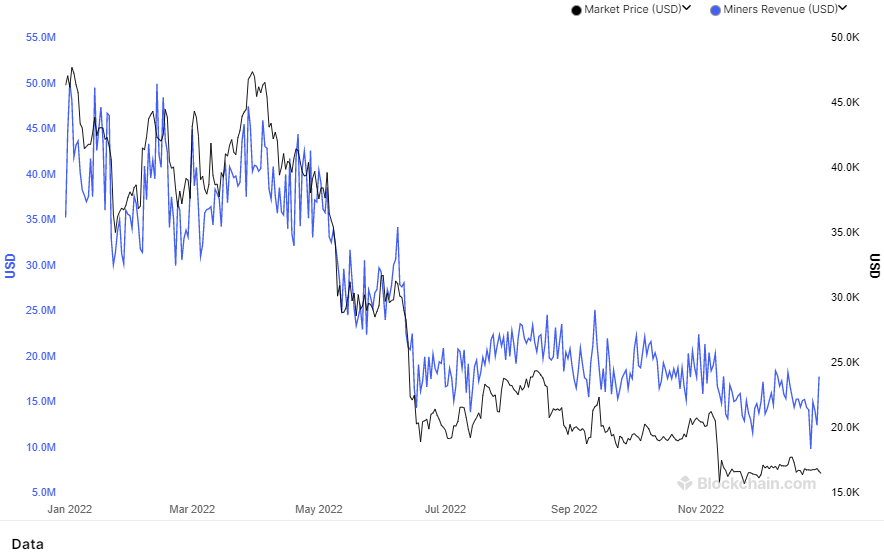

Bitcoin Miner’s Revenue

Bitcoin miners’ earnings daily decreased over one year as well as was up to brand-new lows as a result of a weak market and also boosting computational needs.

As an outcome, mining companies such as Core Scientific have actually declared insolvency, as well as numerous miners are additionally experiencing. Additionally, according to a previous record by CryptoSlate, miners are offering their coins at the greatest price in the last 2 years, causing problem being readjusted adversely progressing.

Meanwhile, BTC miner purse equilibriums have went down to degrees seen in January 2022, according to information examined by CryptoSlate.

Mark Mobius, the founder of Mobius Capital Partners, that appropriately anticipated the decrease to $20,000 this year, thinks bitcoin is not much from $10,000 having actually damaged the technological assistance degrees of $17,000 and also $18,000

If Mobius’ $10,000 telephone call happens, it will certainly include even more suffering to the cryptocurrency market.

However, Bitcoin view is not totally bearish in2022 The number of long-lasting Bitcoin owners struck an all-time high this year.